After a wait of nearly a year since the release of the Strategic Options Consultation, the draft Greater Manchester Spatial Framework (GMSF) was finally released on 20

th October 2016. It will be presented to the Greater Manchester Combined Authority’s (GMCA’s) Executive Board for approval (and, unusually, amendments) ahead of a formal consultation process beginning on 31

st October.

The report has been awaited with great anticipation amongst the local development community as it will set out the approach to housing and employment land across all ten Greater Manchester (GM) authorities for the next 20 years. In recent weeks leaked documents, local newspaper headlines and e-newsletters have built up expectations, suggesting that the GMSF will be ‘ambitious’, create 200,000 new jobs and result in a radical re-drawing of GM’s Green Belt boundaries, with substantial new releases for housing and employment development as a consequence.

Given the Government’s devolution agenda and continued supported for the Northern Powerhouse initiative, the GMSF has a key role to play in making GM a financially self-sustaining city, sitting at the heart of (and driving forward) the Northern Powerhouse. Many industry observers had expressed disappointment at the level of housing delivery set out in the 2015 Strategic Options Consultation. Indeed, NLP produced a

report on behalf of a housing consortium analysing GM’s potential role as a driving force behind Osborne’s Initiative, and what this was likely to mean in terms of housing and economic growth. The work suggested that a step change in housing provision was required in the order of 16,640 dwellings per annum [dpa] compared to 10,350 dpa in the 2015 draft.

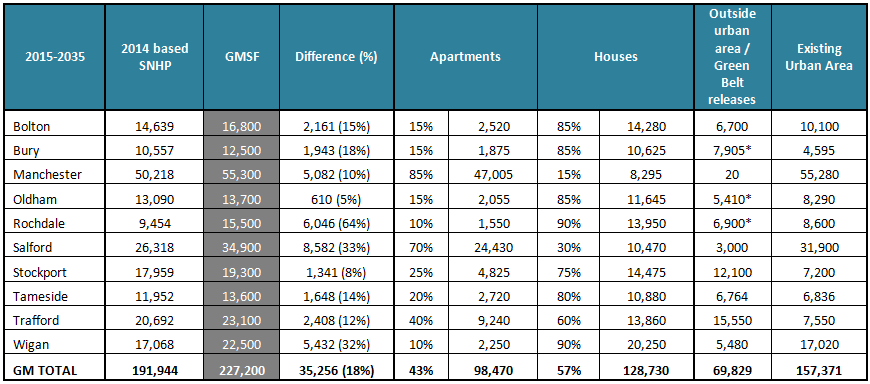

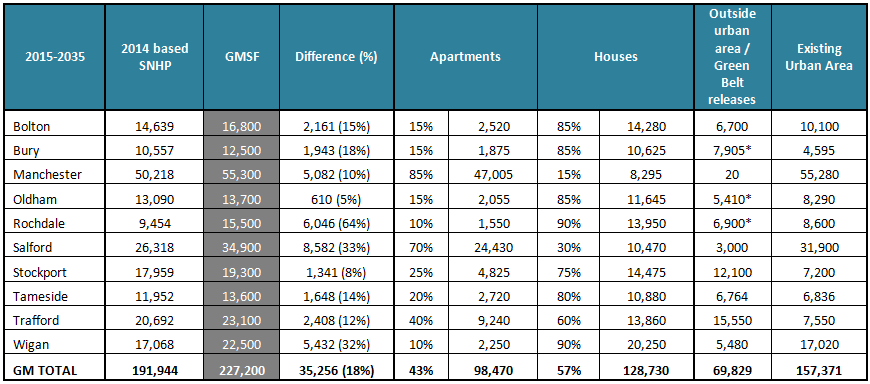

It is fair to say that the newly released draft GMSF has been met with a mixed reception by the development industry so far. The document seeks to accommodate land for 200,000 jobs and provide 227,200 new homes over the 20-year period 2015-2035 (at a rate of 11,360 dpa), with a strong emphasis towards directing new development to brownfield land in urban locations. This represents a 10% uplift on the housing target that was previously put forward, and as we can see from the Figure below, represents an 18% uplift on the latest household projections. However it still remains well below the level of housing many observers (ourselves included) feel is necessary to address years of under-delivery in GM and to effectively drive forward the Northern Powerhouse agenda.

Furthermore the level of job growth, at just 0.7% annually, is lower than the 1% job growth that has been achieved in recent years - hardly the level of growth necessary to allow Greater Manchester to drive forward the Northern Powerhouse and act as the counter-weight to London that George Osborne originally envisaged.

There are also concerns that there is a strong reliance on high density apartment schemes to help make up the numbers. The Table below indicates that 98,470 apartments are envisaged to come forward, or 43% out of a total housing requirement of 227,200. We might expect some particularly high contributions in Manchester City and Salford. However, identifying 43% of the overall housing target as high density apartments puts the overall housing and economic strategy at risk as there is a particular need for family accommodation and aspirational housing more generally.

It is also unclear from the evidence that has been released to date why Rochdale’s contribution towards the housing target should be a figure almost two-thirds higher than the starting point demographic projections, whilst Stockport’s figure is only 8% higher (despite being an area with some of the highest house prices and development pressure in the sub-region). Perhaps the justification for this will become clearer once the detailed evidence base documents are released in the weeks ahead.

However, even at this relatively modest level of housing delivery, the GMCA accepts that it cannot accommodate all the homes within the existing settlement boundaries and has therefore accepted that exceptional circumstances exist to amend the existing Green Belt boundaries. The draft GMSF has identified 55 potential new allocations for residential, industrial and commercial development in the Green Belt, which would result in a net reduction in the total area of designated Green Belt of 4,900 ha, or 8.2% of the total. This would reduce the total land area of GM covered by Green Belt from 47% to 43%.

The GMSF has also added three large sites to the Green Belt, at West Salford Greenway; Rectory Lane, Standish (Wigan) and land within the Roch Valley in Rochdale.

*Note: includes some sites that straddle two local authority administrative areas – the housing allocation has been split 50:50 in these instances.

*Note: includes some sites that straddle two local authority administrative areas – the housing allocation has been split 50:50 in these instances.In total, we estimate that the draft GMSF makes provision for almost 70,000 new homes from Green Belt/greenfield releases, 30.7% of the total; although the pattern is distinctly uneven. Whilst many of these Green Belt releases appear logical and are likely to have considerable support amongst the development industry, there is also a concern that many of the releases are not located in those parts of the sub-region where housing need is strongest. This could mean that sites either take longer to come forward or do not materialise at all. Furthermore, it is unclear for the time being how the GMCA has justified the scale of Green Belt release in each district, given that it has not undertaken a comprehensive urban capacity study. It has instead relied upon existing SHLAAs and 5-year land capacity studies undertaken by each LPA independently (each presumably having different approaches and assumptions). This could present consistency problems further down the line.

Many of these Green Belt releases are also intended to stimulate economic growth. This is part of a strategy of planning for over 2.4 million sqm of new office floorspace and 4 million sqm of industrial and warehousing floorspace, with the latter representing a 40% increase in development rates compared to the average achieved since 2004. Whilst the GMSF suggests that these site allocations deliberately allow for a significant level of choice and flexibility (which is to be welcomed), it is curious that such considerations have not been applied to the housing and commercial office allocations.

Hence whilst there is much to be welcomed in this latest draft of the GMSF, it still seems to be pursuing conservative levels of housing and employment growth levels well below many cities elsewhere in the UK. A re-booted, pro-development, GMSF would be beneficial for Greater Manchester, sustain the Northern Powerhouse and act as a healthy counterweight to London and the Greater South East.