Much of my career to date has been in town centres and retail planning. I have amassed extensive experience in completing retail evidence base studies for local planning authorities and project managing planning applications for major town centre, mixed-use proposals. As such, I have a keen interest in the future of our town centres.

Lichfields was recently commissioned by Harborough District Council to update its retail evidence base. This was an update to a retail study that Lichfields had completed in 2013. This update, alongside the many other retail studies that Lichfields completes year-on-year, provides clear evidence that nationally, the composition of our town centres is changing over time. I have taken this analysis further and considered how our town centres have changed over the past decade, based on data set out in Experian Goad category reports, which cover UK town centres.

A number of key trends emerge from this research:

Convenience (food retail)

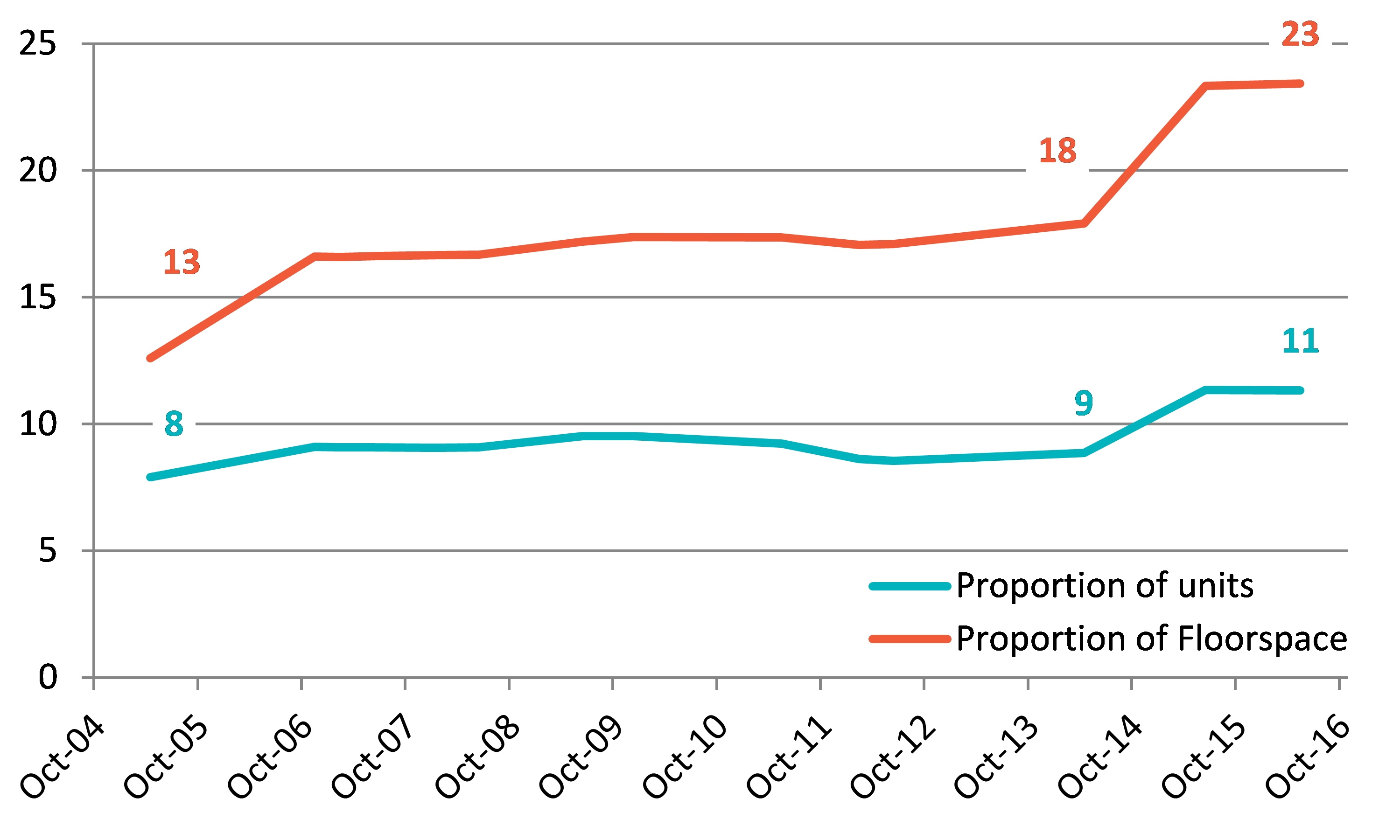

There has been a recent increase in the proportion of town centre units occupied by convenience retailers on a national average basis. Between 2005 and 2014, the proportion of convenience units has stayed constant at around 8-9%. However, more recently there has been an increase of 2 percentage points to 11% in 2016.

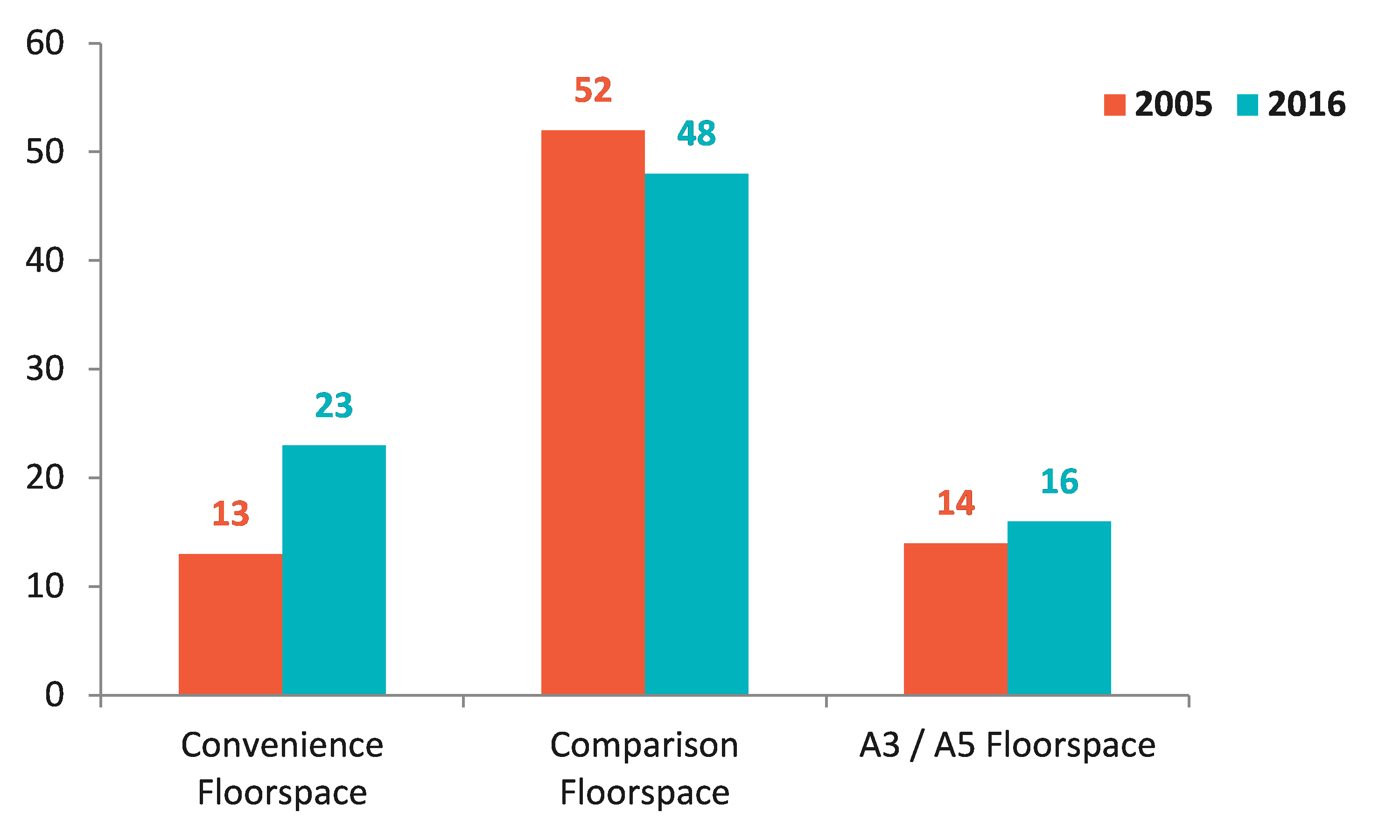

This general trend is replicated in the proportion of town centre floorspace occupied by convenience retailers, albeit there has been a greater increase in the proportion of convenience floorspace. In fact, between 2005 and 2016, the proportion of convenience floorspace has almost doubled, increasing by 10 percentage points. It is expected that the proportion of convenience floorspace may fall in the future as foodstore operators continue to consolidate their position and focus their requirements on key strategic locations, albeit this may not be reflected in the proportion of convenience units, as these might increase as the focus on quality fresh food leads to more independent convenience shops returning to many areas.

Comparison (non-food retail)

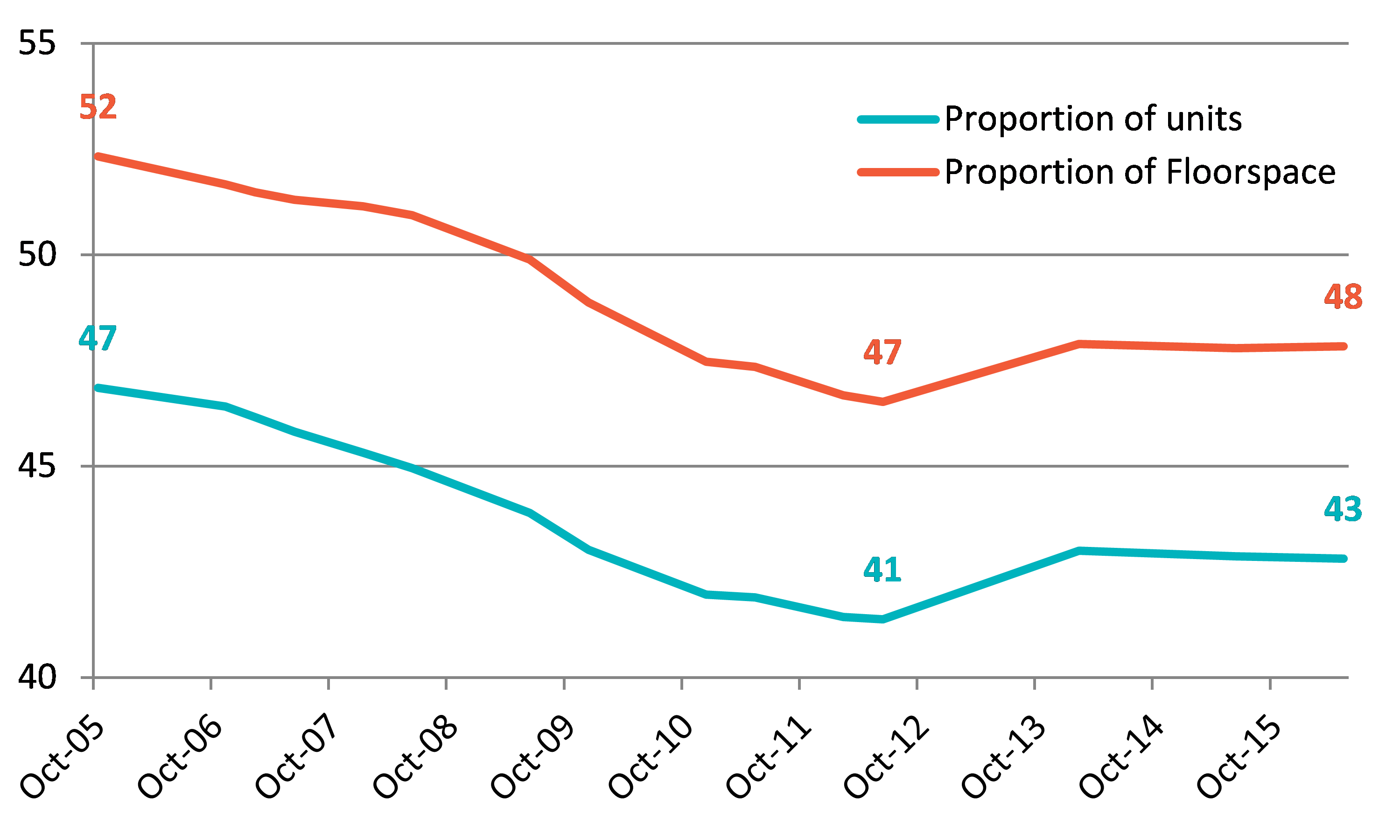

On a national average basis, the proportion of town centre units occupied by comparison retailers has reduced. In 2005, the national average proportion of town centre units used by comparison retailers was 47%. This proportion reached a low of 41% in 2012, during the global financial crisis. Whilst there has been a small increase in this proportion as the economy has improved, over the eleven years from 2005 to 2006, the proportion of comparison units has reduced to 43% (a fall of 4%).

This change is significant and is mirrored in the proportion of comparison floorspace, with the proportion falling by 4% over this eleven year period. Based on current and likely future retail and leisure trends, Lichfields considers that this overall trend is unlikely to be reversed, with department stores and high street retailers generally seeking less floorspace, but maintaining or seeking a presence in larger town and city centres.

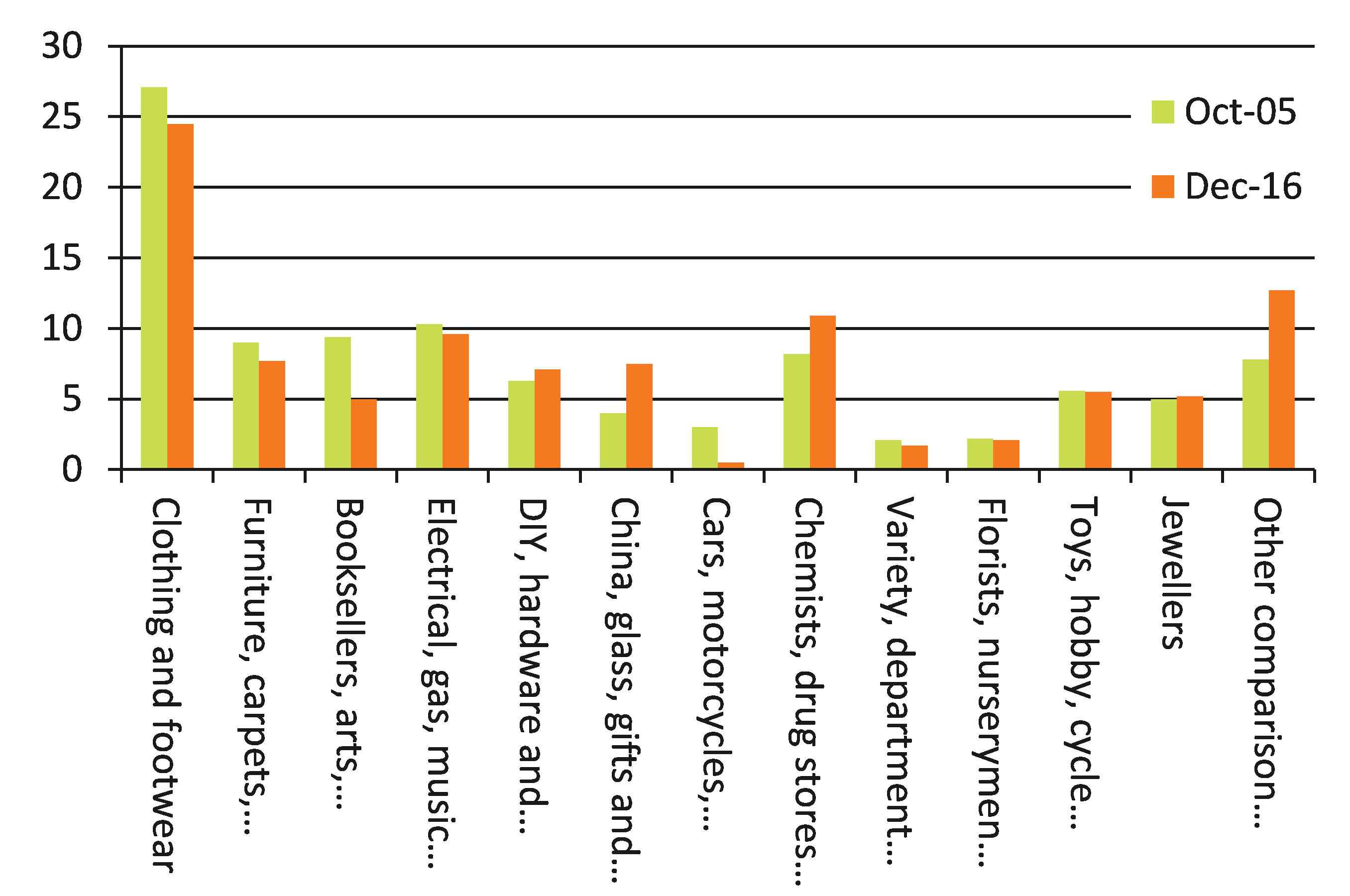

With this change in mind, Lichfields has looked deeper into changes in the composition of comparison retail units, and there are some that are key. In 2005, ‘clothing & footwear’ accounted for 27% of all comparison goods retail units nationally. By 2016, this figure had fallen to 25%. The traditional sector of ‘booksellers, arts, crafts, stationers’ also fell sharply, by 4% over the same period.

Class A3 (restaurants and cafes) and A5 (hot food / take-away) uses

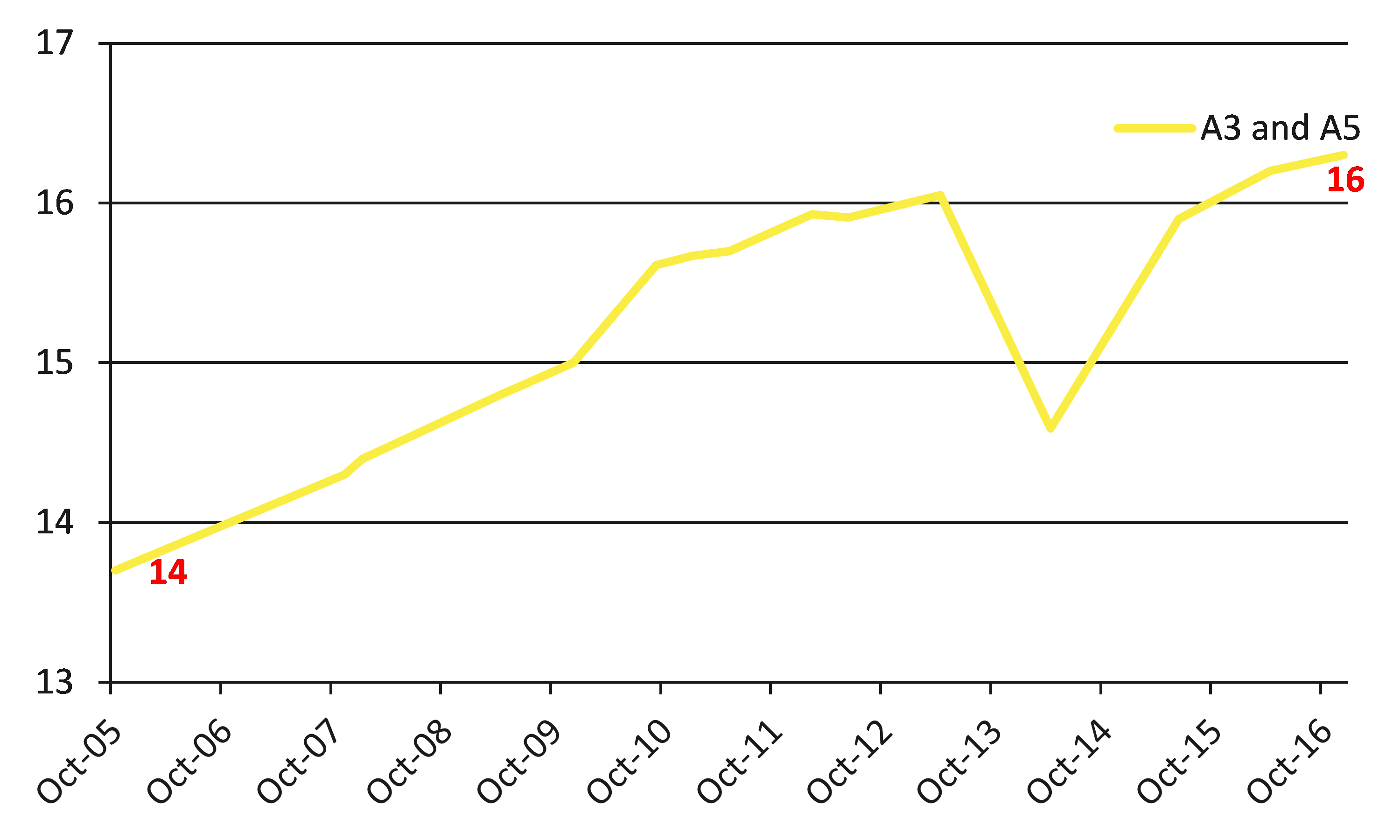

The converse to the decline in comparison retail businesses is that the proportion of food and drink uses in town centres has increased nationally. The proportion of food and drink units accounted for 14% of town centre units in 2005. In 2016, this proportion had grown by 2 percentage points to 16%. The general trend for an increase in the proportion of food and beverage uses in town centres has been well-documented and is likely to continue.

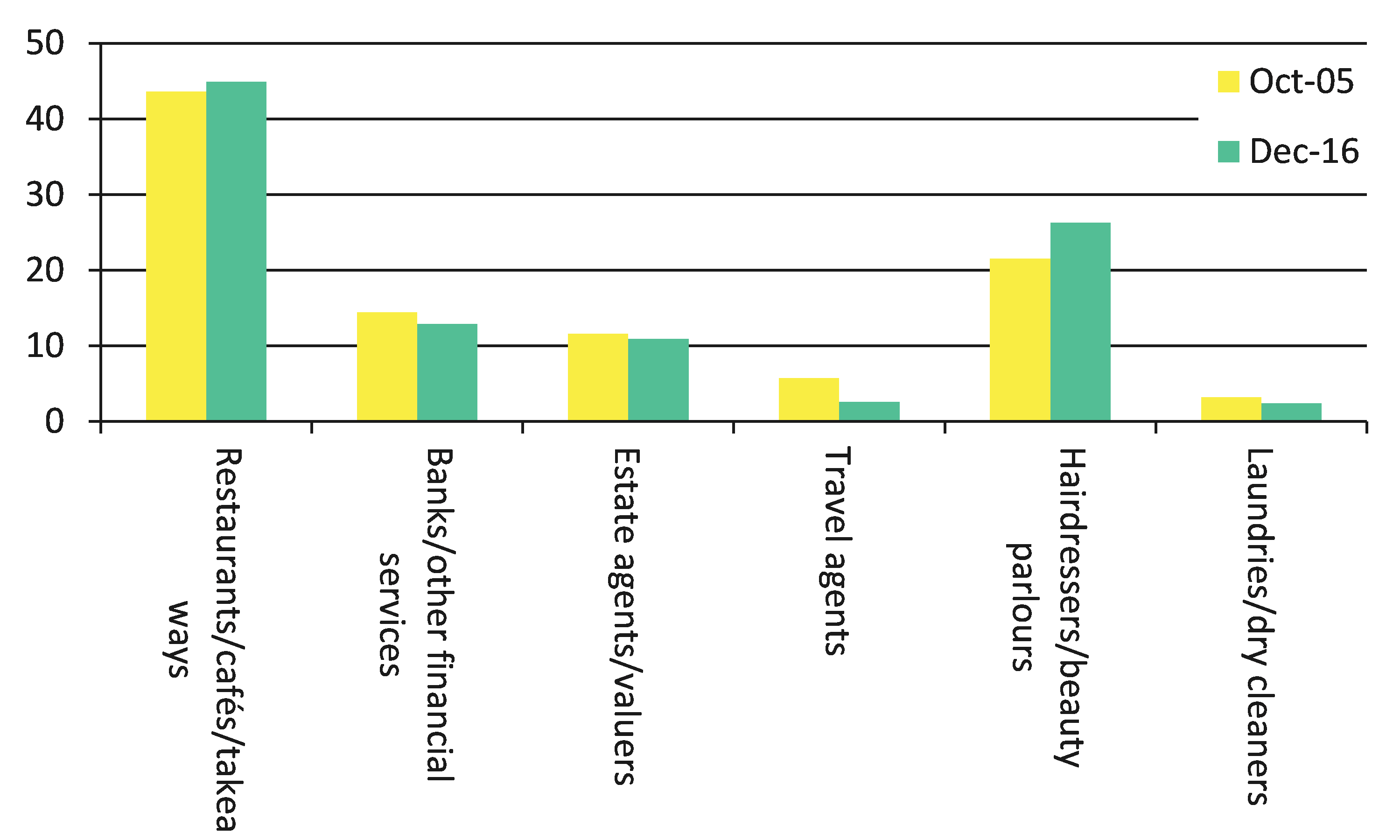

Looking into this further, it can also be seen that ‘hairdressers/ beauty parlours’ now account for 26% of all units occupied by service uses in town centres nationally, up from 22% in 2005. Likewise, the proportion of ‘restaurants/ cafes/ takeaways’ has increased over the same period, albeit by a lesser amount.

Composition summary

Why the changes?

This confirms what everyone perceives - that town centres have fewer clothing and book retailers and more leisure and service- orientated uses such as restaurants and health and beauty parlours. There are many reasons for this trend in the UK, such as:

-

People choosing to spend more on eating out and other ‘experiences’ rather than on traditional goods;

-

The continuing increase in online shopping which affects clothing and book retailers in particular. According to Experian, in 2016 the proportion of sales in special forms of trading (i.e. non-store retail activity such as mail order sales, some internet sales and so on) as a proportion of comparison sales was 13% and this is projected to rise to 17% by 2035;

-

Although there has been a recent resurgence in book sales, overall, the popularity of electronic books (or ebooks) has led to less demand for town centre floorspace for booksellers, whilst many booksellers with a physical presence in town centres have sub-let part of their floorspace to cafes and coffee shops, further reducing the amount of town centre floorspace occupied by booksellers.

-

The concentration of national multiple clothing & footwear retailers in larger town centres, rather than seeking a presence in all town centres. The general trend is for clothing & footwear retailers to occupy larger units, however, the amount of floorspace occupied by clothing & footwear retailers overall in town centres is down;

-

The pre-recession rise in disposable income and the ongoing popularity of eating out; and

-

Vacant floorspace being filled by lower value uses such as takeaways, charity shops and pay day loan shops.

Why Choose Lichfields?

Lichfields is at the forefront of advising on town centre and retail development. We are town centre and retail experts and act for numerous clients with an interest in retail, leisure and town centre development, including developers, investors, operators and councils. We understand the changing town centre environment and the increase in popularity of leisure uses within town centres. Lichfields has a track record in assisting in the delivery of town centre re-developments and regeneration. We are keen to assist both new and existing clients further. To discuss any town centre planning-related requirements,

please contact us.

Image credit: Joe Okpako