As the aviation industry reacts to the result of the Brexit Referendum, one area of uncertainty is how leaving the EU will affect the current aviation regulatory structure, including the UK’s access to the European Single Aviation Market and the operational and economic freedoms and policy that stem from it.

What is the Single Aviation Market and the ECAA?

The UK, as a member of the EU, is party to the European Common Aviation Area (ECAA) and the European Single Aviation Market.

The ECAA includes the 27 EU States as well as Iceland, Norway, Switzerland and several Balkan countries.

The principles of the Single Aviation Market provide free market access including the movement of people and cargo; freedom of establishment; equal conditions of competition; and common rules in the areas of safety, security, air traffic management, social and environment.

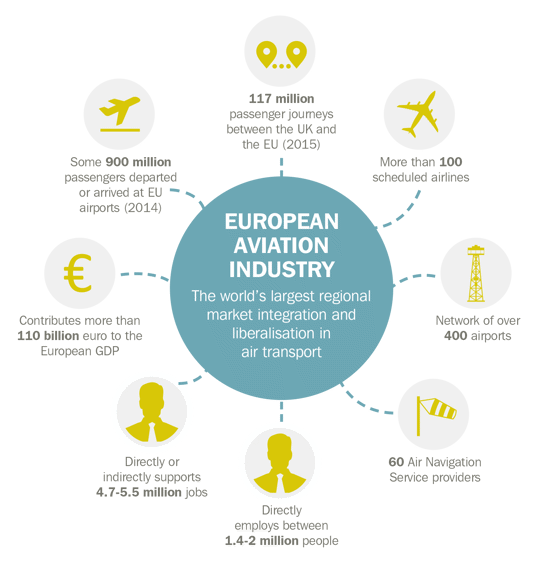

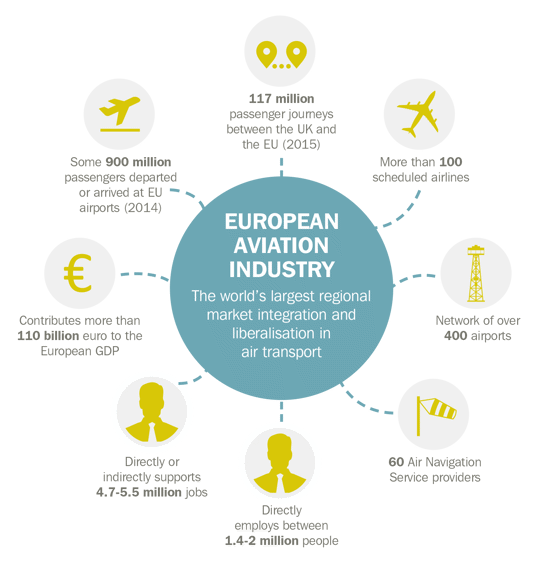

Source: European Commission - Aviation

How has the UK Aviation industry benefited from this?

Aviation has traditionally been a highly regulated industry, governed by bilateral agreements between individual countries and dominated by national flag carriers and state-owned airports. Restrictions in the past were placed on the routes airlines could fly as well as the number of flights and the setting of fares. For example, a German airline established in France could not benefit from the traffic rights accorded in the agreement between France and the United States. These rights were only available to French airlines.

In the 1990s, steps commenced to deregulate the industry. This included the creation of a single European market for aviation.

Fast forward to 2016 and the UK is part of a liberalised European Single Aviation Market and horizontal agreements are in place between the EU and external ‘third party’ states – these promote environmental protection, competition law, safety and security.

Establishing an internal European market has seen the removal of all commercial restrictions for airlines flying within the EU, creating conditions for competitiveness, quality of service and improved levels of safety and security. This in turn has led to more activity, new routes and airports, greater choice, and lower prices – for the benefit of consumers, airlines, airports and employees in the industry.

Beyond the EU, external horizontal agreements with third party states allow access to new markets, promote a high standard of safety and security in international air transport, as well as work to more effectively address the impact of aviation on the environment and to safeguard fair competition in an increasingly globalised and liberalised aviation market.

Post-Brexit

Whilst there may be possible benefits of policy freedoms for the UK in setting its own aviation regulations, leaving the EU raises questions on continued access for airlines and customers to the European Single Aviation Market and the horizontal agreements in place with third party states, such as the US and Canada – and the benefits they currently provide.

Following notification of the intention to leave the EU under Article 50 of the Treaty on the European Union, various new aviation agreements will need to be agreed in order to continue UK-EU co-operation, and with other third party states. These will need to be agreed within a two year window, in what will inevitably be a time and resource-pressured environment.

The International Air Transport Association (

IATA) has suggested that possible options for UK-EU aviation co-operation, post Brexit could include:

- ECAA membership, where membership will be likely to require acceptance of EU aviation law, including for example EU local air quality rules which are seen as a strong legal impediment to airport expansion;

- A bespoke UK-EU horizontal agreement, similar to that in place between EU-US; and

- No formal arrangement where any bilateral air services arrangements between the UK and the EU would likely be limited to market access only.

The aviation industry has been vocal about the need to prioritise all aviation-related negotiations, agreements and decisions during any EU withdrawal process.

IATA has also highlighted that it is possible that if agreements are not reached within the two year Article 50 period, regulation provisions could revert back to the last agreements in place, such as the Bermuda II horizontal agreement between the UK and the US – potentially shifting the industry backwards towards the previous, more constrained environment.

Such uncertainty and potential reduction of activities by airlines, particularly the low cost operators, has already started to impact on airline share prices as well as decision-making on runway expansion, highlighting further the need for early certainty in this vitally important sector of the UK economy.