Implications

Typically, a new Government's first budget often provides an opportunity to re-evaluate policy directions and make difficult or bold decisions that mark a departure from the previous administration. In many ways, the months of briefings on the ‘bad news’ had already gone some way to set that tone. Yet, on the day, the Chancellor maintained a relatively balanced approach, alongside new policy detail, committing where she could to maintaining many of the funding and other initiatives that the Conservatives had introduced. That certainty will be welcomed by many given the long period of hiatus.

The changes to the fiscal rules that the Chancellor announced have given the Government some additional headroom to make some reasonably significant capital spending commitments, particularly towards the NHS, schools, defence and energy. In making these choices, the Chancellor has largely been able to avoid significant austerity measures (i.e. finding savings elsewhere to pay for them). However with those ‘big ticket’ commitments now made, and limited capacity to invest further public money, the medium term challenge to boost growth becomes even more apparent.

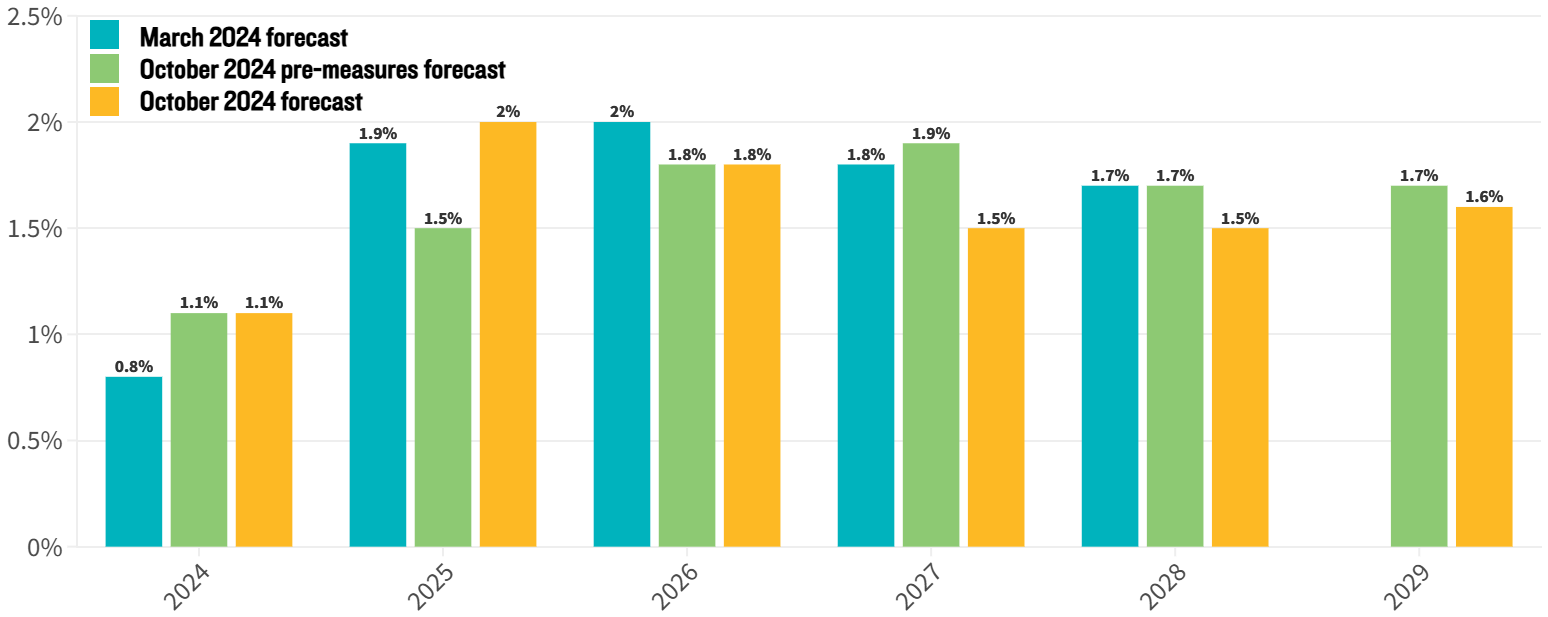

The OBR forecasts indicate that the Chancellor’s measures are expected to deliver a short term stimulus to the economy, increasing real GDP growth to 2.0% in 2025, well above their October 2024 pre-measures forecast of 1.5% as shown in Figure 4. In effect, the Chancellor used every public investment lever almost as a ‘bridging loan’ to, what the Government hopes will be a period of growth driven by the private sector. The importance of crowding in private sector investment was underlined by the OBR’s forecast as the initial boost to growth is moderated in the medium term – with GDP growth expected to slow to around 1.5% from 2027 to 2029. Significantly, this is a lower rate of growth than is forecast in the OBR's October 2024 pre-measures forecast, and much lower than the ambition previously expressed by the Prime Minister to target annual GDP growth of 2.5%.

Figure 4: The effects of measures announced in the Autumn statement on real GDP Growth

The OBR’s downgrade in its GDP growth projections in the medium term is both due to the impact of tax rises on real incomes acting to temper consumption across the economy, as well as Government spending crowding out and displacing private investment in an economy which is close to its productive capacity. However, the Chancellor is gambling that her call to “invest, invest, invest” allied to the pro-growth policy changes already made, will start to have an impact in time for the private sector to capitalise on forecast lower interest rates.

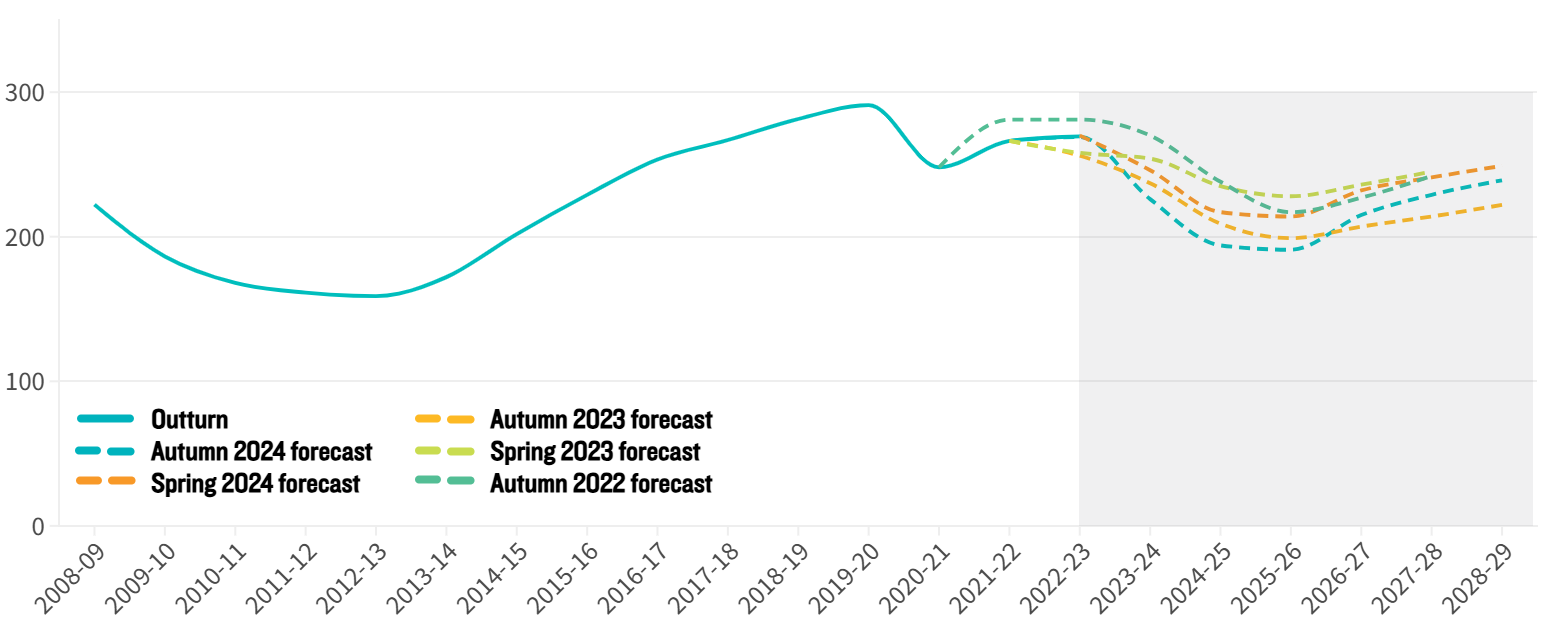

One clear example where the Government are looking to drive growth in the medium term will be through housebuilding. The OBR is forecasting a ‘steeper uptick’ in housebuilding in the medium term than was assumed in previous analysis (see Figure 5) – largely reflecting lower interest rates and a more buoyant housing market – but are not yet factoring in the impact of the forthcoming Planning and Infrastructure Bill or the new NPPF (which the OBR acknowledge will have an impact, and

analysis by Lichfields has shown could be significant from 2028 onwards).

Figure 5: OBR forecasts of Housebuilding over the last five fiscal events (Net Additional Dwellings)

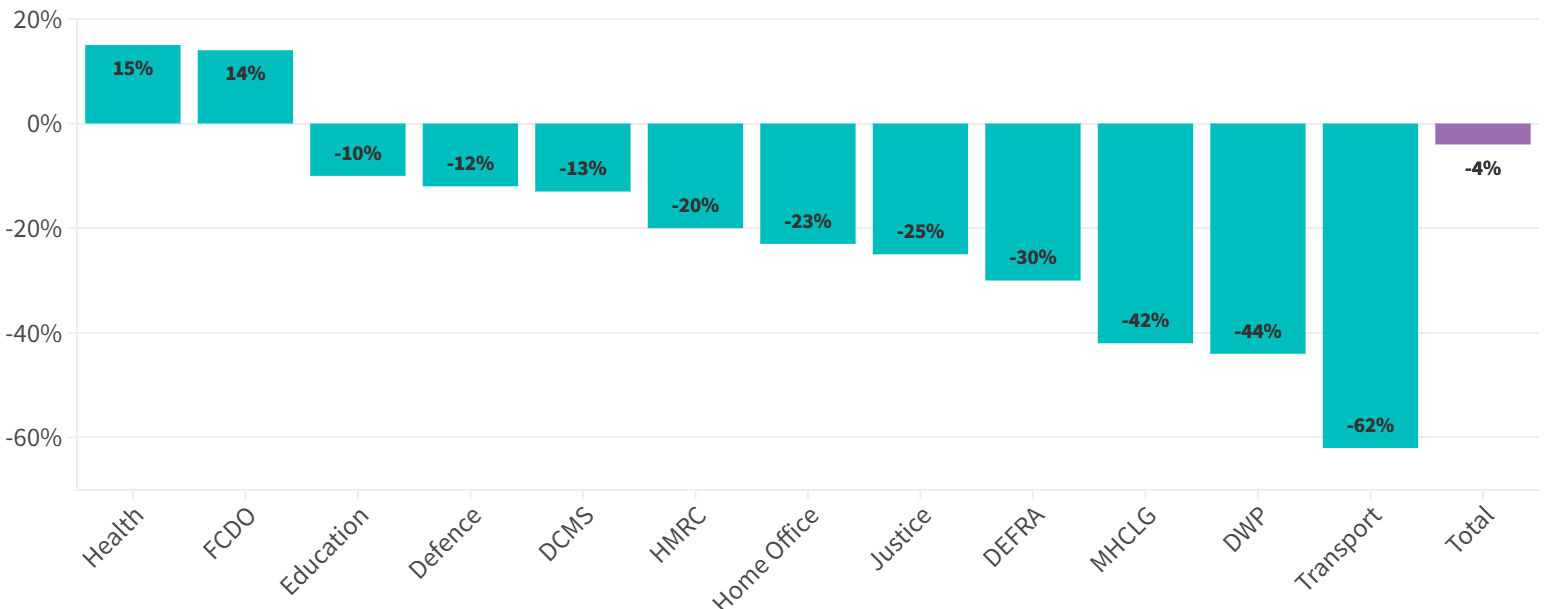

The focus of much of the Budget was to provide clarity and spending priorities over the next few years rather than in the long term, most clearly departmental spending limits set to 2025/26. While this stability will be welcome, not least for MHCLG civil servants whose budget is set to increase around 10% compared with 4.3% across all departments and the recipients of the UK Shared Prosperity Fund, for which a continuation (at a reduced level) of funding is committed to for at least another year.

However, there is a lot of work to be done within Whitehall to take the tough decisions and spending choices ahead of Phase 2 of the Spending Review which will complete by next spring (referenced some 29 times in the Budget report). This means we are now entering a critical period for different sectors and industries to put their case forward as further consultations emerge and conclude, and the detail of the Spending Review is decided.

If we thought the first 100 days of this Government had been busy, the next 100 could be even busier.