A fundamental role of planning is to provide land of the right type in the right location to balance the need for new development with the interests of local communities and the wider public. The key challenge though is to recognise current and emerging growth opportunities and ensure that local plans are sufficiently flexible to be able to accommodate the full spectrum of opportunities, from small scale extensions and change of use through to identifying strategic sites capable of accommodating inward investment from external sources.

The recent chain of events triggered by the UK’s decision to leave the EU has placed a renewed focus on how localities position themselves for economic growth and ensuring that the various planning systems across the UK are ‘fit-for-purpose’ to secure future prosperity.

Inward investment represents just one source of growth and development, yet it remains one of the more challenging to quantify and plan for, given its ‘footloose’ nature. The extent to which local areas can actively plan for – and successfully capture – inward investment can also vary considerably across the country.

To explore how planning for inward investment works in local areas and how local partners can be more pro-active in securing these opportunities, NLP recently carried out a survey of local planning authorities (LPAs) and local enterprise partnerships (LEPs) across England. The key messages are presented in our new research report

Invest to Grow and are summarised below:

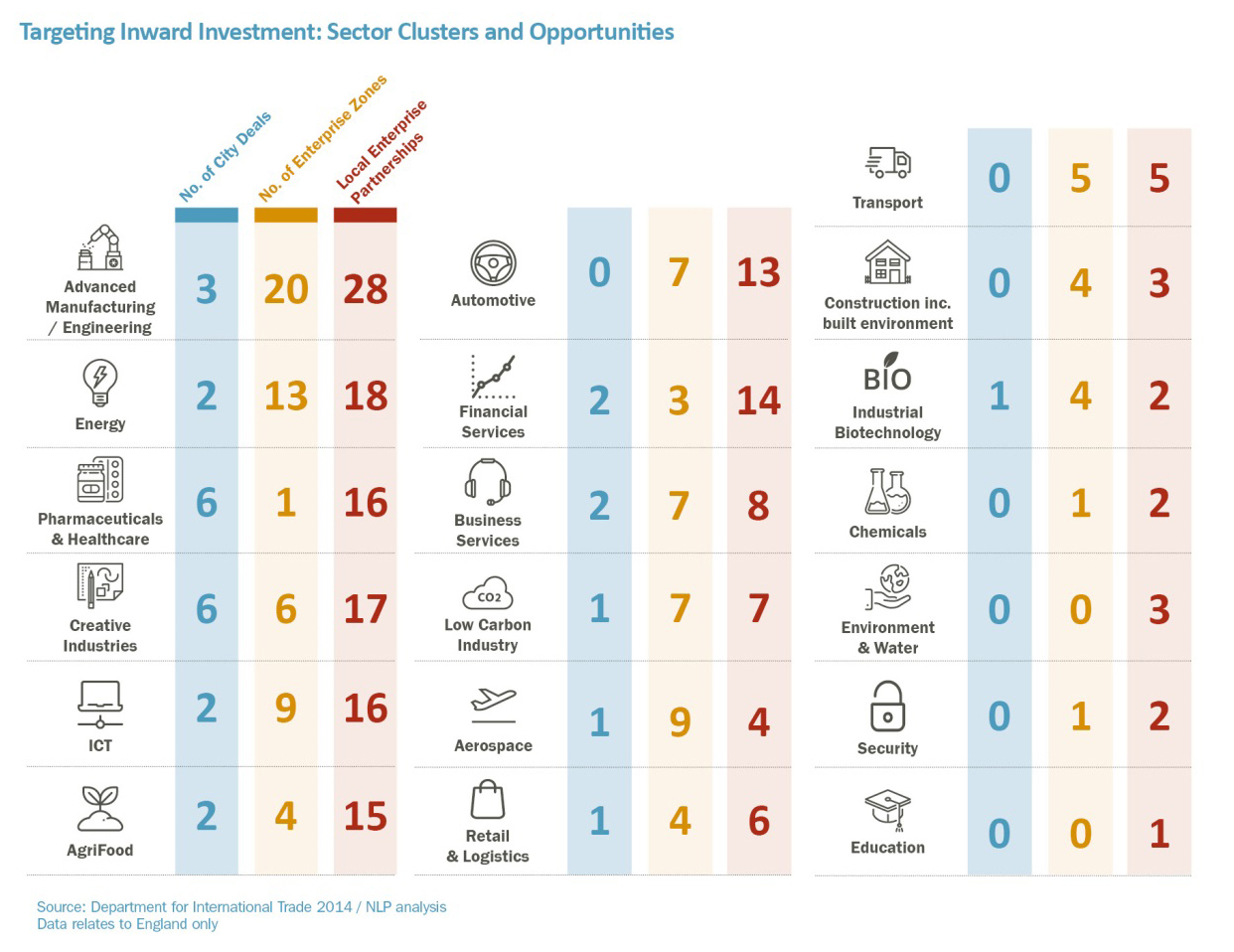

Drawing on best practice examples, we have identified a series of critical success factors that local partners could use to shape appropriate planning policy responses to inward investment opportunities in their area. This distils the opportunity into three broad typologies (described below) and provides a useful way of thinking about how the planning system can more pro-actively target and help capture inward investment within the overall ambit of planning for growth.

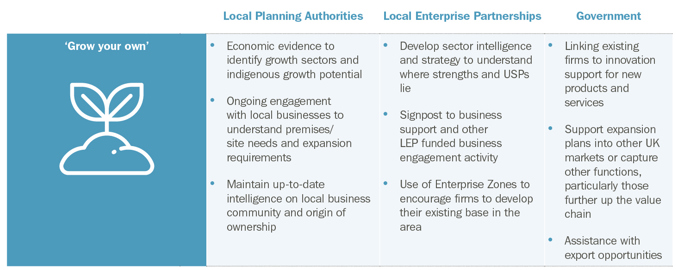

‘Grow your own’ – the first typology - refers to companies that already have a UK base and have scope to expand their operations either in the same location and/or elsewhere across the country. Responding to this opportunity is all about taking the time to understand and nurture an existing business base, ensuring they have the support they need to become more embedded within a local economy and being responsive to expansion and development plans to ensure that their growth can be accommodated.

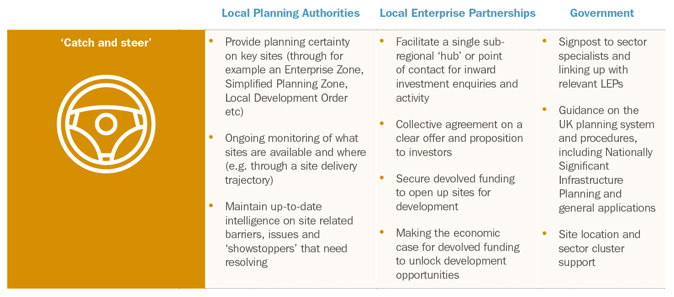

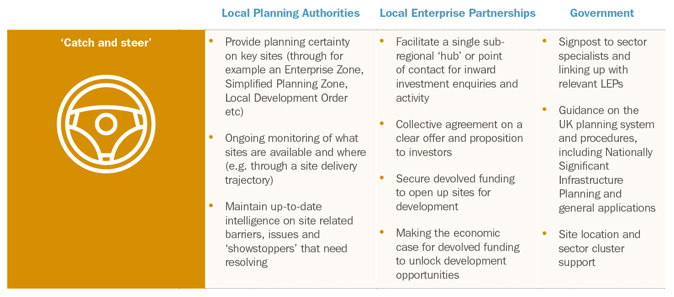

‘Catch and steer’ – the second typology - describes firms that have already decided to bring their investment to the UK or a particular region and are exploring their location, site and premises options. Planning has a role to play here in establishing a clear and competitive sector offer, by providing planning certainty that key sites are available and deliverable, and contributing to making the economic case for public funding to unlock development opportunities.

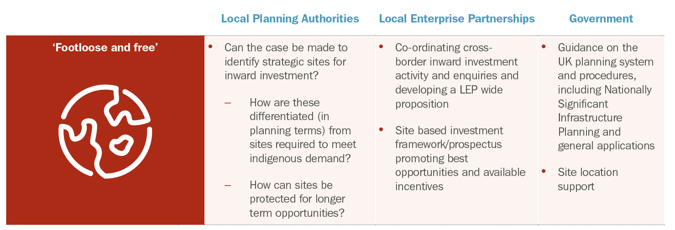

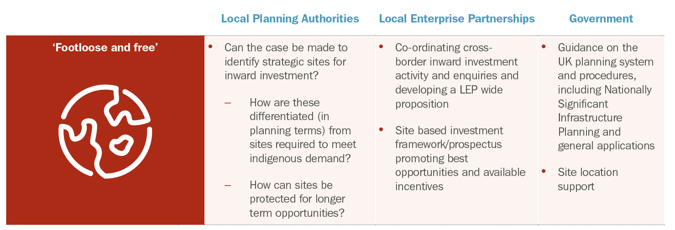

‘Footloose and free’ - the final typology - relates to firms that are not tied to any particular location or country but operate within a global marketplace. This arguably represents the most difficult opportunity to plan for, so maintaining a flexible and responsive planning system that anticipates (rather than accurately predicts) where opportunities might derive from is key, alongside promoting a positive message to the global marketplace that a local area is ‘open for business’. This will help an area to respond effectively if, or as and when the time comes.

Our research shows that planning for inward investment inevitably looks different in different places, but with the EU Referendum result already impacting on business decisions to invest and trade with the UK, it also indicates that the ability of local areas to make themselves attractive to inward investment - and the opportunities that this can bring - is now more important than ever.

Download a copy of

Invest to Grow here.