To declare that building homes is complicated would be an obvious understatement. Markets for raw materials, land, labour and finance are entwined so tightly that the Gordian Knot can seem impossible to untangle. But attempts are being made to do just that, by a variety of businesses, research teams and charities (and, of course, by the Government in the new Housing White Paper). They all share a common goal: to build more homes.

Before the publication of the

Housing White Paper, Lichfields published

Stock and Flow a research report that highlighted the business models of firms involved in bringing land forward - and building homes - that advanced a pragmatic view on the complexities regarding lapse rates and incentives. We concluded that the evidence did not support the allegation of systemic, widespread land banking, and that the focus should be on increasing land supply. It seems the Government has agreed with us; the White Paper puts forward some measured approaches intended to tackle stalled sites and increase the pace of building but it focuses most on driving land supply though Local Plans.

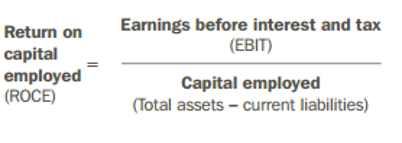

In our analysis of developers’ business models, we highlighted one – of many – financial indicator that shareholders use to determine house builder profitability – return of capital employed (ROCE).

Figure 1 Return on capital employed

Source: Lichfields analysis

To demonstrate the mechanism, we stated:

When a housebuilder buys land, it increases their total asset value; all things being equal, if this land (or the properties built on it) are not sold, this will decrease its ROCE. A reduction in its ROCE may affect how investors view the house builder’s long-term profitability, so the housebuilder is incentivised to maintain (or improve) its ROCE.

Interestingly, housing charity Shelter, through a guest blogger, took umbrage at this, deriding its “simple static model”. They were of course right to highlight that indicators operate over more than a single time period, and they are also right to highlight snapshots can distort metrics – something investors know only too well. However, the blog went on to claim:

In year 1 land values rise and the firm decides not to use its land, so its ROCE falls. However, in year 2 the firm does decide to build and sell houses – so its earnings will increase and its total assets fall (because it no longer owns the land or homes), leading to a much larger increase in ROCE. What matters in the real world is the rate of change of returns through time – not just in year 1.

Unfortunately, even within its own simple model, the blog’s approach has difficulties.

First, house builders are funded by shareholders who will want an annual return – to glibly claim that returns may be higher if everyone holds off and waits for their returns later on is a risk investors frequently won’t want to take.

Secondly, the point about rising values is an important one - albeit noting that values are not rising fast everywhere[1] - but again, there is a temporal issue. Taking the given example, Year 2 will require more land to be bought (at a potentially higher price) in order to demonstrate to shareholders that there is a pipeline of development to maintain business longevity over subsequent years. This lag will require revenues to increase as capital employed has also increased.

Thirdly, the high level approach is fraught with difficulty because house building is a site-by-site business and internal business metrics show how some sites have to perform better to cover unforeseen issues (cost overruns or delays) across the portfolio . The business is about mitigating risks in an uncertain and complicated type of activity.

Fourthly, it is important to combine theoretical concepts with engagement with those who work in the sector to understand business behaviours. At Lichfields, we do this day in day out. But further, the work of Dr. Sarah Payne (looking at the situation in 2015) provides an excellent example of an academic approach seeking to understand the perspectives, incentives and pressures of those involved in this sector[2].

Yes, there are clearly frictions in the land and residential market that hold up site delivery and limit the rate at which many sites build out, but one needs a practical understanding of market behaviours and their causes before one draws conclusions about how best to intervene. In this context, Shelter is right to highlight the relationship between house building and the risk of credit and market cycles. Indeed, our report flags how time and risk in the planning process is often a barrier which takes time to overcome. If it takes, say, six to eight years to get a site allocated in a Local Plan, secure planning permission and start building homes, the probability of building when a recession hits is high – this risk has to be priced in.

Given we all want the same thing - namely more sites allocated; faster and more positive planning; greater assurance; less risk; greater investment in infrastructure and a high quality built environment; and obviously more homes – perhaps any disagreement actually centres on the age-old debate of ‘pragmatism or idealism’.

Recognising the world as it is, there are changes to the planning system that would help achieve many of our shared goals with relative ease and speed – ‘low hanging fruit’, if you will. A more proactive Local Plan process that provides incentives to cooperate and agree on housing numbers in an expedited manner would help bring more land forward and more homes to be built in areas - particularly outside the London bubble - where planning issues (not “hoarding landowners”) often restrict development. The starting point for homes being built in most areas is allocating land for housing so stopping local areas choking off land supply (which increases planning risk and creates barriers to entry for SME and specialist housing developers) should be the first barrier to overcome. The increases in permissions and housing output over recent years - coinciding with changes to the NPPF - despite deficiencies in local plan coverage shows we are closer to achieving this than some might perceive.

Of course, many economists would struggle to disagree with some of the ideal proposals set out in skeleton terms in Shelter’s – and others’ – articles. If we were to create a system from scratch, many of the examples relating to land assembly within European municipalities or land value capture in Asian countries would come to the fore. If this were combined with a positive change in a domestic local political culture that can often be hostile to development, it would be transformational. But there is a difference between debating the merits of two alternative systems and debating how to get from one to another.

UK history is full of examples of well-meaning, but failed Government attempts to intervene in the land market, and in particular, to fail to anticipate the unintended consequences of policy and fiscal measures in light of market behaviours. This is why I feel more confident than some other commentators in the Government’s White Paper: it takes a more holistic approach to housing; it moves away from the singular focus on ownership; it understands that – outside London - Local Plan- making is the most important first step to planning and building homes; it promotes a standardised approach for assessing housing need, calculating housing requirements and allocating more land; it encourages different models of delivery including Development Corporations; it leaves enough flexibility in the process to reflect spatial variation; and it stops short of gimmicks. Sure, there are things one might like to be different – such as, perhaps, the proposed policy approach to Green Belt – but it is a world away from where we were in 2015.

To be strong on criticism demands an author to be strong on solution. As practitioners rather than theorists, we are most interested in the solutions that can be implemented quickly and avoid a market shock effect that creates a hiatus in supply (as did planning changes in 2010-12). The housing knot is being pulled in many directions but simply cutting through it has its own systemic risks that are rarely explored. Let’s loosen it, with focused tweaks to the existing system before we risk something bolder.

[1] Savills Land Index - http://pdf.euro.savills.co.uk/uk/market-in-minute-reports/uk-residential-development-land---jan-2017.pdf

[2] Examining Housebuilder Behaviour in a Recovering Housing Market - https://www.sheffield.ac.uk/polopoly_fs/1.544813!/file/1.pdf

Image credit: Google Earth