The Mayor of London, Sadiq Khan, has now issued the version of the London Plan he intends to publish to the Secretary of State for Housing, Communities and Local Government, Robert Jenrick (Secretary of State), for final approval.

This latest amended version of the Plan includes a number of changes made following the release of the Panel of Inspectors’ Draft New London Plan Report, published in October, and is accompanied by a number of other documents, including a schedule setting out his response to the recommendations put forward by the Panel.

Of the Panel’s 55 recommendations, the Mayor has decided to take forward 30 in full. Ten of the Panel’s recommendations have been accepted either in part or with amendment, whilst the Mayor has decided not to accept any element of 15 of the recommendations.

Ahead of our upcoming Insight looking at what we should expect from the final London Plan, we’ve picked out six key points that stand out in the version of the Plan that the Mayor intends to publish.

1. Overall housing target reduced

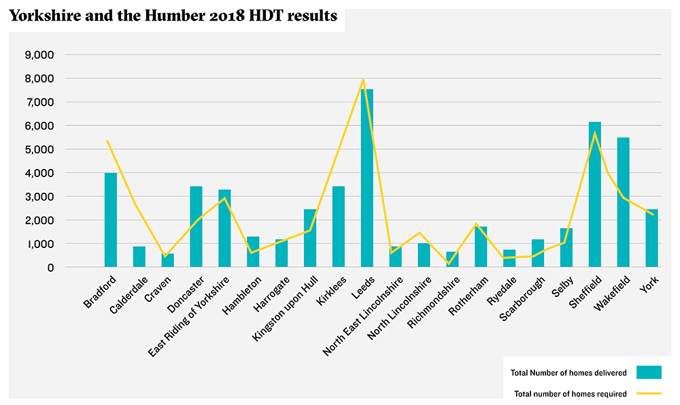

Whilst the Panel’s report found the 2017 SHMA provided a reliable starting point for the housing needs of London, in terms of how boroughs should address this need, it was sceptical over the heavily theoretical small site capacity modelling contained within the SHLAA.

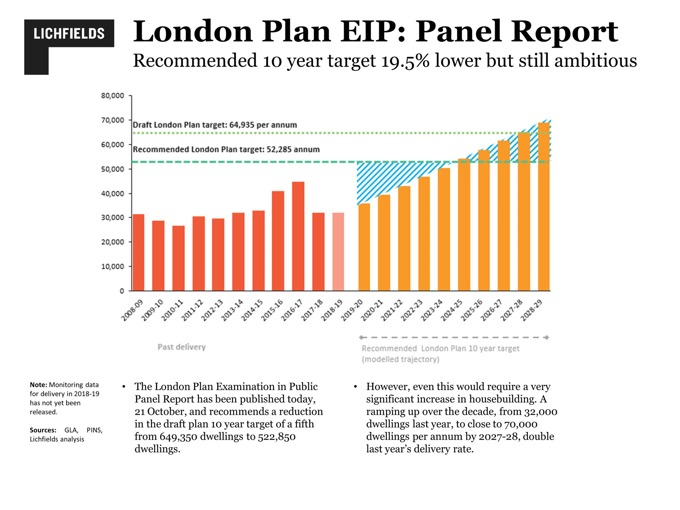

As such, the Panel recommended the removal of policy H2A (see point 3 below) and the adjustment of the small site housing target, effectively forcing a 19.5% reduction in the Plan’s overall housing target (see Figure 1).

Consequently, the Panel also recommended that the Mayor amend the total housing numbers for the capital in line with this figure.

The Mayor has agreed to make this change and has now modified the Plan’s ten-year housing target for London from 649,350 homes down to 522,850.

Interestingly, the Mayor has now also published a note setting out other planned interventions to increase housing delivery in London. The note states that the Plan should be read alongside the London Housing Strategy, which provides further detail on the wider measures the Mayor is bringing forward to deliver against the Plan’s housing policies and Good Growth objectives.

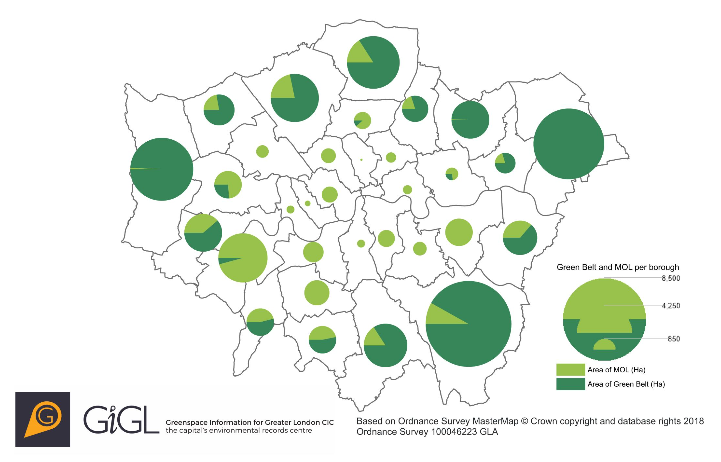

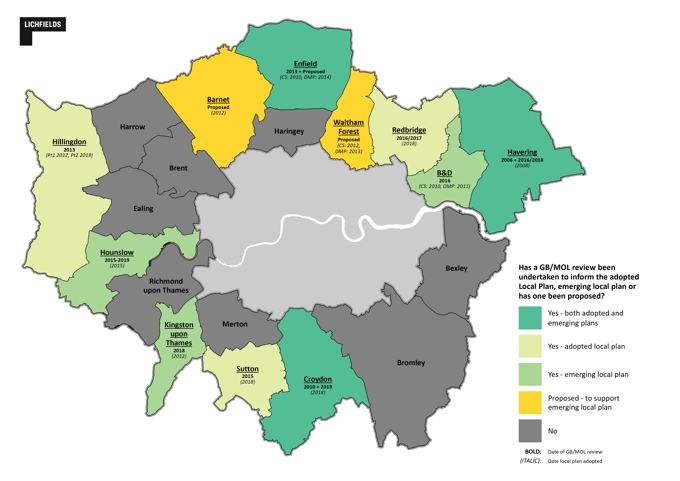

2. Position on Green Belt remains inconsistent with national policy

Throughout the Plan’s Examination in Public, the Mayor defended his manifesto pledge of protecting London’s Green Belt and Metropolitan Open Land, opting to accommodate all of London’s growth within the capital’s existing boundaries.

With proposed amendments to the housing requirements (

see our previous blog), the gap between housing need and housing target will be c. 14,000 dwellings per annum (dpa). To help address the ever-increasing backlog, the panel recommends a comprehensive Green Belt review.

However, to avoid the Plan being delayed, the Panel recommended that the Mayor leads a “strategic and comprehensive review of the Green Belt in London as part of the next review of the London Plan” (PR35).

The Panel suggested (para 596), the earliest date for a draft Plan would be at the end of 2022 (albeit noting the Mayor suggests summer 2023), concluding “…there would be little to be gained from requiring an immediate review until such time as a full review of London’s Green Belt has been undertaken as recommended to assess the potential for sustainable development there and whether and how the growth of London might be accommodated. Therefore we make no recommendation that an early or immediate review of the London Plan should be carried out” (para 599).

The Mayor however, has declined to accept either of the recommendations, stating that a “commitment to review Green Belt in this plan potentially prejudges any future spatial strategy and risks undermining the objectives and delivery of this plan.”

The Mayor considers that any review of London’s Green Belt must be as part of a comprehensive strategic appraisal of London’s spatial development options that focuses on the most sustainable outcomes.

3. Small sites policy watered down

The delivery of new homes on small sites (equal to/smaller than 0.25ha) was a key component of the Mayor’s housing strategy, with the draft Plan setting out that 38% of the overall annual housing target for the Capital would be met through delivering on such sites.

However, the Panel’s report concluded that the small-sites policy was neither effective or justified, stating they were

“sceptical about the delivery”from small sites and that the policies objectives were not

“realistically achievable”. The implications of this were

examined in further detail in our recent blog.

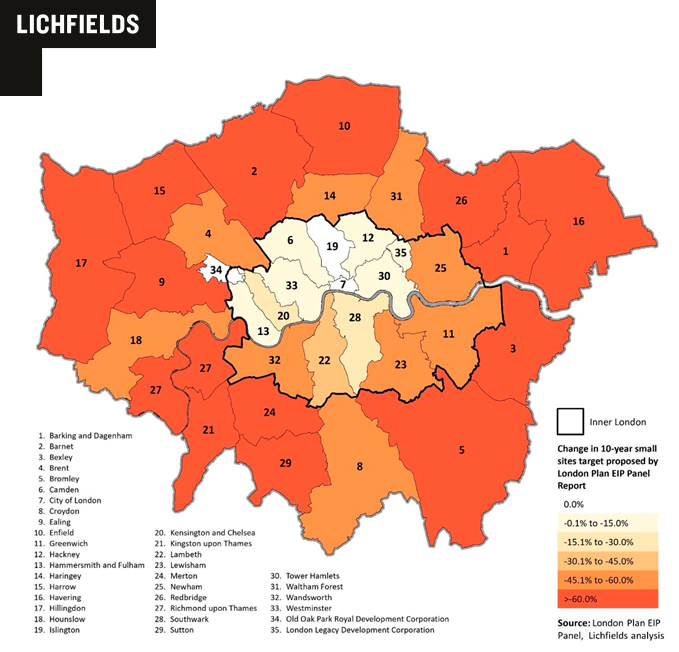

As such the Panel recommended that the Mayor should delete policy H2A regarding small housing developments and amend the small site ten-year housing targets from 245,730 to 119,250 over the plan period.

The cut has a disproportionate impact on outer London where the SHLAA assumed most of the small site capacity could be found. While the reduction to London’s total small sites target is 51%, this corresponds to a 61% reduction to the small sites housing targets in outer London compared to a 26% reduction in inner London (see Figure 2).

Whilst the Mayor still encourages development on small sites, he has agreed to take on the Panel’s recommendations and has amended the Plan to reflect this, although some of the supporting text has been moved to other parts of the Plan. For example, policy H2 now highlights different ways in which boroughs can encourage development of small sites, particularly through proactive use of design codes.

4. Mayor defends the Plan’s approach Industrial Land supply

The Mayor has largely rejected the Panel’s recommendations in respect of Policy E4 land for industry, logistics and services to support London’s economic function, arguing that provision has been part of a balanced and robust approach to managing industrial land in London.

Further to the rejection of a strategic Green Belt review for housing land, the Mayor has rejected the recommendations to identify industrial land as part of a Green Belt review and to note within the reasoned justification to policy E4 the potential for local level Green Belt reviews in order to provide additional industrial land. The Mayor considers that the draft Plan offers a positive and justified strategic framework to meet current and future demands for industrial uses. This includes a “no net loss approach” which ensures the retention of industrial floorspace. Additionally, it is argued that the Mayor does not want to encourage a major shift of industrial activity to the outskirts of London.

Our recent blog discusses the likely future demand for industrial land in city centre locations due to the growth in logistics and e-fulfilment centres.

5. Good Growth: objectives rather than policies

The Panel stated that presenting the Mayor’s vision for Good Growth as a set of policies introduced undue complexity in terms of how the Plan should inform decisions about the content of development plan documents and individual development proposals.

The Mayor has decided to accept this recommendation.

This will come as a relief to many in the development sector. Whilst the EiP revealed a broad level of support for the overarching principles of Good Growth, concerns were raised that the breadth and degree of ambiguity within the draft policies would have made them difficult to apply in planning terms, when determining whether development proposals are policy compliant.

6. Mayor’s position on airports broadly unchanged

The Panel found that the Plan’s approach to aviation set out in Policy T8 were inconsistent with national policy, whilst also expressing concerns that parts A and B were essentially objectives rather than policies, and inappropriate in the context of the proper role of the Plan as a spatial development strategy.

As such it recommended that Policy T8 and its reasoned justification should be deleted in their entirety.

Despite this, the Mayor has declined to accept the Panel’s recommendation, reasoning that in the absence of T8, “there would be no London-wide strategic planning policy for other airports in London, or other schemes coming forward at Heathrow” .

However, Policy T8 has been amended. Part A of the Policy, which supported the case for additional aviation capacity in the south east of England, has now been deleted. Perhaps of most significance for London in the short term, Part C (formerly part D) remains, with the Mayor continuing to oppose expansion at Heathrow Airport “unless it can be shown that no additional noise or air quality harm would result” .

What to expect next?

Now that the Mayor has notified the Secretary of State of his intention to publish, the Secretary of State has up to six weeks to decide whether or not to direct amendments.

The Greater London Authority Act 1999 states that this may happen where the Plan still fails to comply with national policy, or that the plan would be to the detriment of areas outside of London.

As previously discussed, this latest version of the Plan continues to diverge from national policy in a number of key policy areas, so it seems highly unlikely that this will be the final version yet, especially given the Secretary of State’s

previous warnings to the Mayor on this matter.

If unsatisfied, the Secretary of State has powers to issue a holding direction which would stop the Plan from being adopted, unless the Mayor were to make the necessary amendments.

Either way, if and when the Plan is finally adopted, it seems highly likely that the Government will expect the Mayor to review the new London Plan to reflect the 2019 National Planning Policy Framework without hesitation.

There is a nod to this in a new paragraph added to this iteration of the draft Plan, perhaps with a view to discouraging the Secretary of State from insisting on changes now:

“The Plan does not meet all of London’s identified development needs. Work will need to be undertaken to explore the potential options for meeting this need sustainably in London and beyond. This is a matter for a future Plan, and requires close collaboration with local and strategic authorities and partners. Clear commitment from the Government is essential to support the consideration of these options and the significant strategic infrastructure investment requirements associated with them”.

For now at least, the Examination in Public webpage still states that the Mayor intends to publish the final London Plan in February or March 2020.

Mayor's letter to the Secretary of State, Notice of intention to publishIntend to Publish London Plan 2019Inspectors' Report and Panel Recommendations

Click here to see our other blogs in this series

Lichfields will publish further analysis on the draft New London Plan and its future direction in due course.

Click here to subscribe for updates