Is the West of England ready for Build to Rent Investment?

Grant Swan

17 Mar 2016

Build to Rent, the concept of developing to retain and lease housing stock as a long-term investment, is not a difficult development model to grasp. It is not entirely dissimilar to privately-managed student accommodation, but compared to the seemingly indefatigable market for privately-managed student accommodation, investment from the Build to Rent sector has historically been less prolific.

Let’s put the scale of this into context: the Department for Communities and Local Government’s Private Landlords Survey in 2010 found that only 5 per cent of landlords in the Private Rented Sector (PRS) were company landlords, being responsible for just 15 per cent of stock. More pointedly just 8 per cent of all PRS properties had been built for this purpose, the remaining majority having been acquired through inheritance or the open market.

The previous coalition government sought to jump-start the sector with the announcement of the £200m Build-to-Rent fund in 2012, which was later increased to £1bn in the 2013 budget. However, activity in the sector has generally been more limited than anticipated. The greatest level of interest activity has been, with little surprise, across Greater London. Of the last round of allocations from the Build-to-Rent fund, announced in July 2015, just two were located outside of London and the South East.

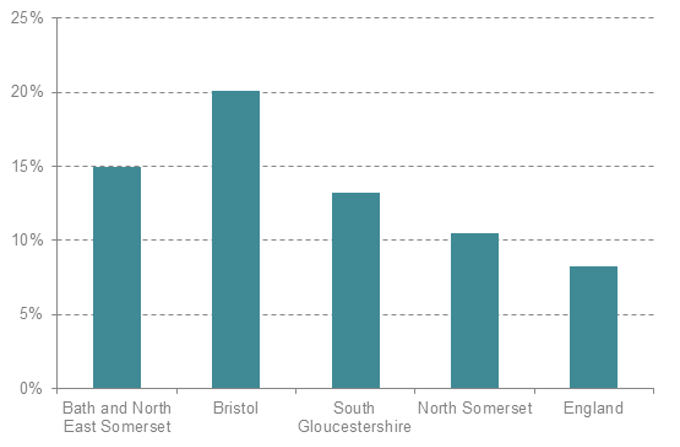

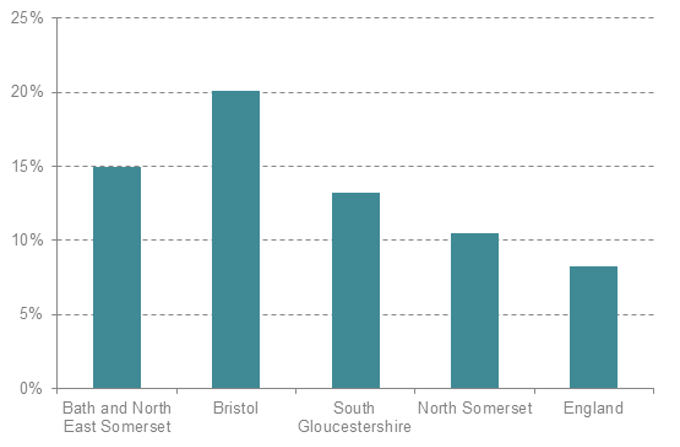

So where does this leave Bristol and the West of England? The key indicators suggest that the market in the West of England is suitable to accommodate investment by the Build to Rent sector, and in particular within Bristol city itself. In the four year period to 2015, Bristol saw a 20 per cent growth in rents for the average 2 bedroom property (5 per cent annual average change), compared to the English national average of 8.3 per cent.

Chart 1: Rent Change for a 2 Bed (2011-15) | Source: VOA

The demographic portrait of Bristol also indicates a strong market to support Build to Rent development. It is an overwhelmingly young city with 35 per cent of the total population aged between 15 and 34. It will come as little surprise to those familiar with the vibrancy and increasing cultural offer of the city, that this is reflected within the demographics of the PRS itself. The 2011 census indicates that approximately 57 per cent of PRS households in Bristol fall within the 16-34 age range. Bath and North East Somerset is similar at 54 per cent. This underscores the role the West of England already plays as an economic and academic centre of international significance and the challenges that are posed by high house prices and affordability constraints. However, the figures also bear out that geography impacts the composition of the PRS across the West of England, and these characteristics are particularly less prevalent in North Somerset.

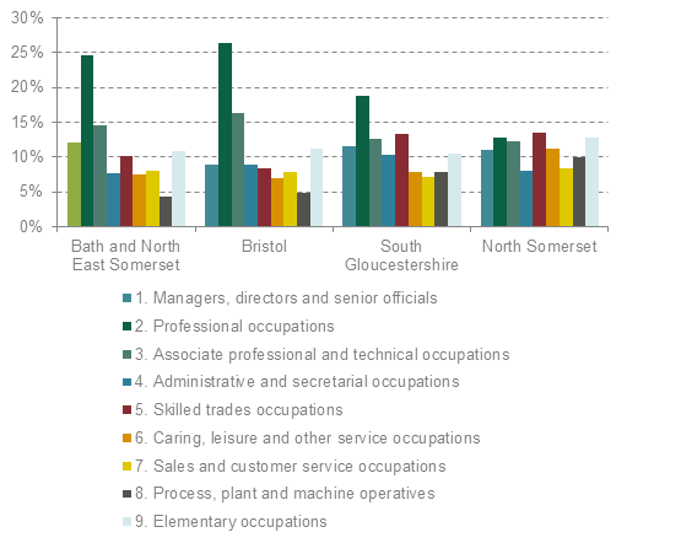

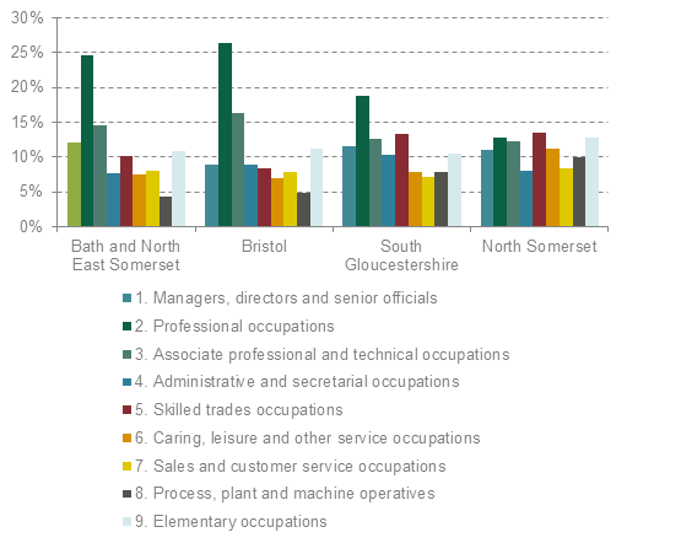

The occupational profile also has a bearing on the strength of the PRS sector. In 2011, 42 per cent of the overall PRS population in Bristol fell within the ‘professional’ and ‘technical and associate’ occupation sectors, both of which have a strong representation in Bristol. Bath and North East Somerset is similarly strong with 40 per cent of its PRS population in the same categories, shown in the chart below.

Chart 2: Occupation of PRS Renters (2011) | Source: Census 2011 ONS

Understanding the demographics of the market is an important factor. Few individuals among what is now termed ‘the Millennials’ or ‘Generation Y’ (roughly those born between 1980-2000) come straight from education to owner-occupied housing. It has to be acknowledged that some young adults have limited aspiration to purchase a home, though this should not be confused with a wish that, as and when they choose to ‘settle down’ and form a household, that affordable market housing is available. Affordability and mortgage availability also continue to represent significant barriers for those that do want to own their own home. In other words, it remains as important now to ensure that we have a supply of affordable, decent quality privately rented homes for those who are unable or unwilling to seek owner-occupied housing.

The previous boom in the PRS was generated almost wholly through investment by private individual landlords, though since few of these built premises to let, this served to strip existing and new housing stock away from the owner-occupier market. With the Government’s changes to stamp duty for buy-to-let purchases about to kick in, we can expect a cooling in the market for private individual landlords, and without the delivery of new homes to the PRS through Build to Rent, it could have the unanticipated impact of exacerbating unaffordable rents and housing market exclusion.

So has the time now come for Build to Rent investment to flourish in Bristol and the West of England? There are signs that Bristol city centre at least is now being recognised as a viable location for investment. Last month saw the announcement that Legal & General and PGGM would be purchasing a site in Temple Quarter with planning permission for 168 homes to bring forward as a Build to Rent scheme. Bouygues Development and the Homes and Communities Agency are also bringing forward the former ambulance depot site on Castle Street as a Build to Rent development.

The main emphasis will undoubtedly remain on the need to provide sufficient land for new open market housing, though Build to Rent will also have its own role in resolving the nation’s housing crisis. With its suitable demographic and socio-economic profile, it could very be that the time has come for the PRS in Bristol to see new investment and development.