Update 22.07.20: The Community Infrastructure Levy (Coronavirus) (Amendment) (England) Regulations 2020 are now in force

Proposed amendments to the Community Infrastructure Levy regulations have been laid before Parliament. Once in force, the regulations are intended to go some way to addressing concerns regarding developers’ ability to pay CIL during the pandemic and over the coming year - but only for certain smaller-scale developers and where there are already signs of financial difficulty linked to the coronavirus.

Background

Some had hoped that the coronavirus-related amendments to the CIL Regulations would apply to all kinds of developer and might include delaying when CIL payments are due and suspending demands for any pending payments, but it soon became apparent that this would not be the case.

In May, the Government announced that the CIL Regulations would be temporarily amended to provide flexibility for SMEs with a turnover of less than £45 million and produced interim guidance. New draft guidance also considers what is meant by turnover.

Guidance suggesting alternative options for authorities that might benefit other developers was published and has been updated to reflect the draft Regulations.

According to the Communities Secretary, the emphasis on SME developers rather than all developers is to provide them with “a bit of breathing space in the weeks and months ahead, which is a critical lesson learnt from the last downturn in the market”. The draft Explanatory Memorandum to the draft regulations also explains that it is intended to help SME developers with short-term cash flow problems resulting from the coronavirus outbreak.

The requirement to show financial difficulty was not announced by the Government in May. It is onerous and open to interpretation, but arguably it has made the amendments a more even-handed (and less attractive) proposition for all developers.

The regulations, as laid

The draft Community Infrastructure Levy (Coronavirus) (Amendment) (England) Regulations 2020 were laid before Parliament on the 30 June. They are anticipated to come into force during the summer and are proposed to remain in force until 31 July 2021.

The amended regulations give additional discretionary powers to collecting authority to defer a CIL payment by up to a maximum of 6 months and to disapply late payment interest and surcharge payments. New Reg. 72A details the process for seeking to defer payments (‘deferral request’), which is only available to a developer that:

- Has an annual turnover less than £45 million;

- Has been served with a demand notice under Reg. 69;

- Is required to pay the charge within the period from when the Regulations come in force to 31 July 2021 (which may include payments that became due before this time and remain outstanding); and

- “Is experiencing financial difficulty for reasons connected to the effects of Coronavirus resulting in difficulty paying that amount”. This must be evidenced (discussed below).

The Government has published draft step by step guidance which will be updated once the new regulations come in to force.

The draft guidance explains what turnover is, for the purpose of checking eligibility:

“If it is a sole enterprise it is the turnover of the applicant only, as shown in the latest set of accounts. For applicants acting as part of a group, that have partners or linked enterprises, the turnover assessment should take the latest turnover of the applicant, as shown in their accounts, together with the turnover of any linked enterprises, any partners of any linked enterprises, any enterprises linked to any of the applicant’s partners and any enterprise linked to the applicant’s linked companies”.

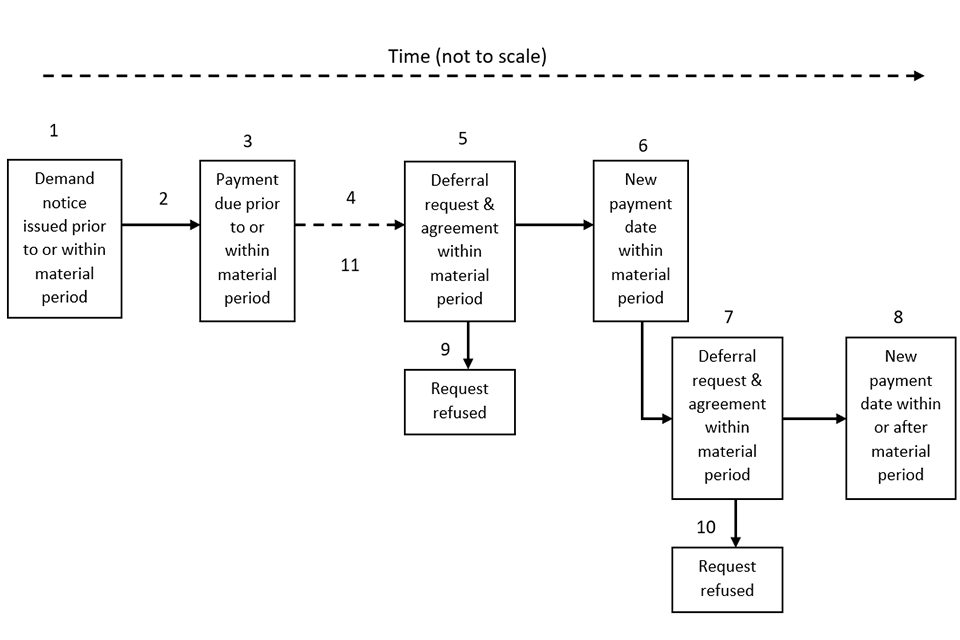

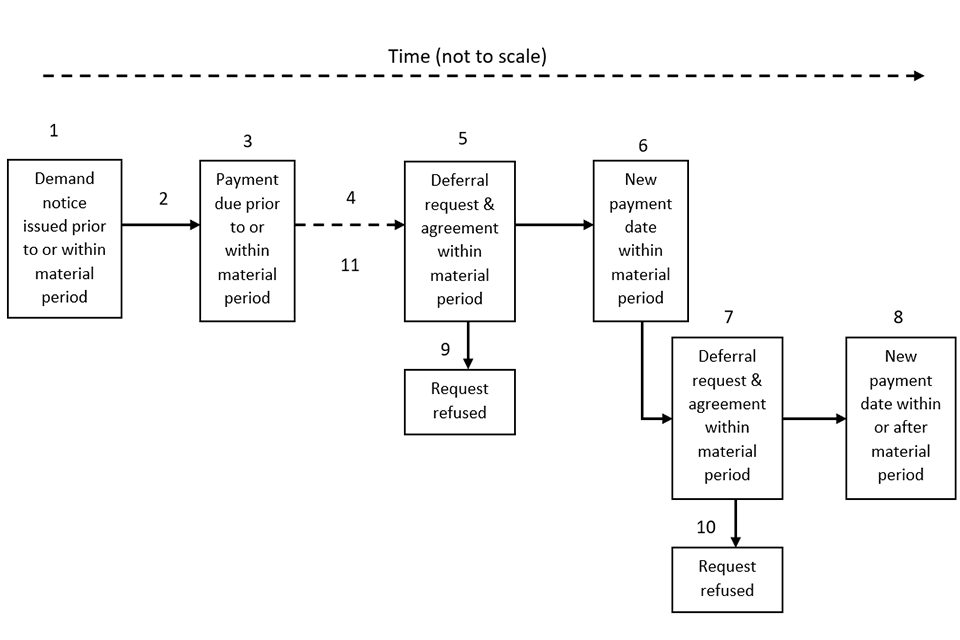

The flowchart below is Figure 1 in the draft guidance; the numbers in the flowchart refer to stages described in the draft guidance.

Key matters to note are as follows:

- Timescales: All deferral requests must be submitted no more than 14 days before any payment is due, when it is due, or as soon as practicable after. The collecting authority should consider the application as quickly as possible and within 40 days. If a deferral is granted the collecting authority must issue a revised demand notice as soon as practicable. The collecting authority is permitted to signal its intent to grant deferral, prior to a decision being made.

- The deferral begins from the date of the request is made not the date the deferral is granted: As aforementioned, the deferral can only be for a maximum 6-month extension.

- This is very much a discretionary process: The charging authority must consider it appropriate to defer the payment and there is no appeal process should the authority refuse a request. In London, this means the Mayor and the local charging authority will separately consider the application as it relates to the Mayoral CIL and the local charging schedule, respectively. It seems likely that TfL would make this decision as they lead on Mayoral CIL.

- Surcharges and interest do not apply when the authority is considering a request: New Reg. 72B protects developers from having a late payment charge imposed (under Reg. 85) and from being required to pay/accrue interest (Reg. 86) normally required when a request is made. Even if a deferral is refused, the developer still has a further 7 days (from refusal) to make the payment without any surcharge or interest being applied/accrued (assuming none were accrued before).

- Payments can be deferred more than once: but only where the earlier deferred payment date now sought to be deferred again falls before 31 July 2021; the final deferral request on a development or phase may grant a deferred payment date beyond 31 July 2021. The authority may refuse further deferral requests.

Where a deferral request is granted, new Reg. 72B also gives collecting authorities the discretion to credit interest already charged to a developer since 21 March 2020 (the date of lockdown). Interest requests cannot be made if a deferral request is refused. The Mayor must agree to an interest credit on Mayoral CIL.

In terms of documents required for a deferral request, as a minimum, developers should submit the relevant demand notice and (where there is likely to be any doubt) evidence to demonstrate the company’s annual turnover is below £45 million, and evidence of financial difficulty related to coronavirus.

The collecting authority can also request additional information from the developer to demonstrate its turnover and its financial difficulties. These requests must be responded to within 14 days or the authority may refuse the request. Developers must therefore be prepared to be open with their financial predicament to the collecting authority’s satisfaction and engaging with them prior to submitting a request is advised. Collecting authorities are expected to be positive in their approach.

Prior to the amendments coming into force and for developers not benefiting from the amendments

For developers who cannot benefit from the new regulations there are some existing flexibilities around the pursuit of payments by collecting authorities, but developers should assume that they must follow and comply all CIL-related requirements in order to avoid surcharges or the loss of exemptions or reliefs.

The interim guidance suggests that until the amending regulations take effect later this summer, collecting authorities should note the draft legislation and use their discretion in considering what, if any, enforcement action is appropriate in respect of unpaid CIL liabilities. It also encourages CIL charging authorities to consider introducing an instalment policy (or amending an existing one).

Developers of developments not commenced, or phases of development not commenced, can benefit from any new instalment policies (or amendments to an existing instalment policy). There are also discretions around issuing of CIL stop notices (requiring development to stop where CIL has not be paid) and issuing surcharges to people who have not paid CIL. However, late payment interest accrues automatically.

As the draft Explanatory Memorandum says:

“The [May 2020] guidance was clear that the terms of an instalment policy would only apply to development that commences while that policy is in effect. A charging authority would not be able to apply a new instalment policy to development that had already commenced. The guidance also made clear that while a collecting authority had discretion over whether to start enforcement proceedings for late CIL payments, and could choose not to charge a surcharge for late payments (see regulation 85 of the 2010 Regulations), they are required to charge late payment interest under regulation 87 of the 2010 Regulations”.

S106 planning obligations

The Government is not proposing any legislation to allow for applications to amend s106 agreements. The draft CIL guidance considers deeds of variation to be a sufficient mechanism to agree amendments to the timing of payments or deliverables. It encourages LPAs “to consider whether it would be appropriate to allow the developer to defer delivery. Deferral periods could be time-limited, or linked to the government’s wider legislative approach and the lifting of CIL easements (although in this case we would encourage the use of a back-stop date)”. There would be no right of appeal if the LPA does not agree to change the timescales in the s106 agreement.

There is no encouragement to review the obligations within s106 agreements, but LPAs are asked to take a pragmatic and proportionate approach to the enforcement of section 106 planning obligations during this period. Reviewing the scope and nature of obligations might be considered premature (particularly when the ability to conduct viability appraisals to understand the valuation implications of the crisis is so difficult); this might follow if the economy does not recover swiftly and the market does not spring back into shape.

Community Infrastructure Levy (Coronavirus) (Amendment) (England) Regulations 2020