Whilst not unexpected, the recently published

ONS figures that reveal a 20.4% contraction in the UK economy in April are still shocking. This decline – which relates to a single month and adds to the decline of 5.8% experienced in March 2020 – is three times greater than the total reduction experienced during the last recession and equates to a fall of approximately £30 billion in Gross Value Added (GVA).

The ONS analysis splits the economy into 14 sectors and shows that all of these, except for Public Administration and Defence (which remained stagnant), contracted in April 2020, with 10 sectors experiencing a more than 20% decline in GVA, and 11 experiencing their largest falls since records began in January 1997.

In providing an overall figure for the UK economy, this data obscures regional variations.

Analysis by Lichfields has shown that South East Wales is at particular risk of short-term economic contraction because of its strong reliance upon hospitality, manufacturing and education sectors. Given that South East Wales accounts for 52% of Wales’ total GVA

[1], a severe regional shock will have a negative impact on the wider Welsh economy.

Looking to the future

The economic impacts of Covid-19 will inevitably be felt for a considerable period of time but many commentators have pointed out that April may be the worst month as there was a partial relaxation of lockdown in England in May. However, a stricter lockdown continued in Wales into June, potentially resulting in a further divergence between the economic performance of Wales and England.

As detailed in our

Covid-19 Economic Recovery Framework, planning for the longer term recovery is critical to mitigating a risk of continued economic decline. History has taught us that a period of recession can result in opportunities for specific sectors to both lead the recovery and reshape the profile of the local economy. Although the circumstances that have promoted the current downturn are very different to anything that has gone before, and the scale of decline is unparalleled, there are already clear signs of the sectors that are likely to emerge stronger than before.

Health / life-sciences

As a health crisis, Covid-19 has been fought by front-line health workers and its resolution lies in a health solution. The manufacturing of pharmaceuticals was the only manufacturing subsector that displayed upward growth in April (+4.7%), following on from strong performance over recent months. This growth would undoubtedly have been boosted by the investment and increased activity that has been focused on Covid-19 treatment, vaccines and testing but ONS also reports higher demand for general pharmaceutical products, with strong growth in domestic facing output in April 2020. We anticipate that there will be a greater focus on this sector in the future in terms of both public and private sector investment.

Logistics

The logistics sector has been instrumental in keeping the country going through the pandemic. Be it through the supply and distribution of PPE to front line staff, delivery of food and other essential items to stores, or the increase in online shopping, the logistics sector has stepped up to the challenge and played a critical role in supporting and protecting people. Globally there was a 25% increase in airfreight volume in March 2020 compared to March 2019

[2], whilst increased levels of road and rail freight have been the backbone of domestic logistics during the pandemic. The improved efficiencies that have been forced upon the sector put it in a strong position to continue to meet growing demands as consumption patterns change for good, particularly if a decentralisation in population and economic activity does occur.

Energy/environmental

More than 200 top UK firms and investors have called on the government to deliver a Covid-19 recovery plan that prioritises the environment

[3]. There is an increasing argument that Covid-19 should be viewed as a pivotal moment in the shift to a green economy. Specific proposals that have been put forward include:

- Increased investment in low carbon innovation and industries;

- Focusing on those sectors that can support the environment; and,

- Ensuring that companies that receive government support are operating in a manner that is consistent with climate goals.

A growth in the green economy would align very closely with the Welsh Government’s sustainability objectives and its aspirations for green growth to be fuelled by an increased reliance on green energy.

IT / Communications

The UK-wide lockdown forced us all to look to technology for work, entertainment and social contact. Reflecting the importance that we are all placing on video communications, the share price of Zoom has doubled since the start of March

[4] and ONS has noted that telecommunication and programming and broadcasting activities have also been resilient to falls in output. It is likely that some of the practices that we have adopted out of necessity will remain commonplace after Covid-19 has passed and that such platforms will continue to enjoy significant growth. In addition, expected increased future levels of home working (compared to the pre-Covid-19 baseline) and growth in key sectors such as life-sciences, green energy and logistics will all rely on continued advances in IT.

Tourism / hospitality

This sector suffered the most significant contraction in April 2020 (-88.1%) and remains shut-down. Although there are very real concerns about the survival of many tourism businesses, there is the potential that it will grow significantly in the future. This will particularly be the case if restrictions on international travel remain and if people remain nervous about international travel – both of which may encourage them to choose to holiday in Britain instead of travelling to overseas destinations.

Implications for South East Wales

The objective of the Cardiff Capital Region (CCR) City Deal is to

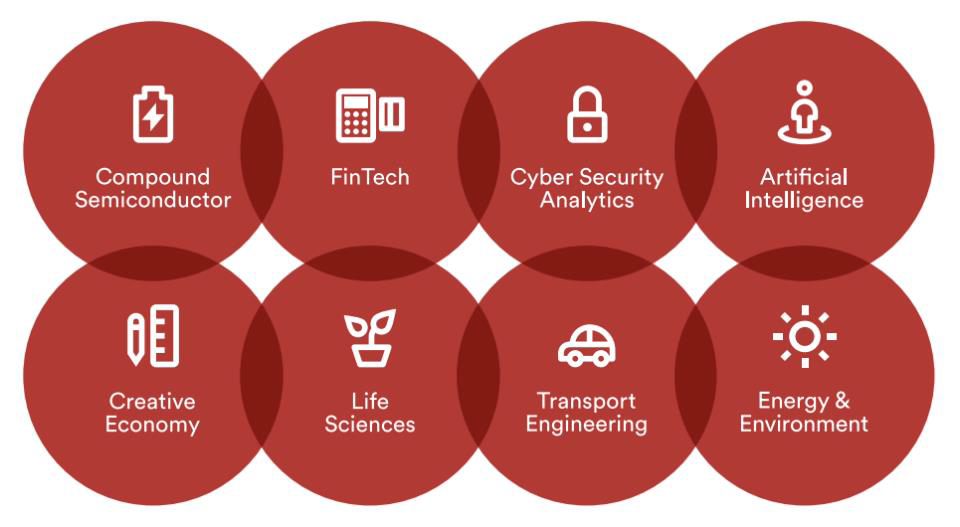

“bring about significant economic growth in the region through investment, upskilling and improved physical and digital connectivity.”[5] The City Deal Investment Framework seeks to

“improve the business environment within the CCR, creating rich ecosystems that stretch and support the development of [the following]

key sectors in the economy, improving comparative performance against other cities and regions in the UK and internationally.”[6]

There are close parallels between these sectors and those that I have identified above:

- Life sciences and energy & environment are specifically identified by the CCR;

- The wider energy and environment sector also incorporates transport engineering activities that relate to electric and other ultra-low emission vehicles;

- Britishvolt has identified St Athan as its ‘preferred’ location for the UK’s first battery Gigafactory, with the first stage of the plant expected to be fully functional by Q3 2023[7]; and,

- The broad IT sector incorporates compound semiconductors, fintech, cyber security and AI.

This synergy gives confidence that these sectors will experience growth and spearhead the much-needed recovery of the Welsh economy. As to the two remaining sectors that I have identified:

- The strategic location and accessibility of South East Wales, and the scale of its population and strength of its economy presents significant logistics opportunities; and,

- The region accounts for 41% of total GVA for Wales in the accommodation and food service sector[8] which means that it is well placed to welcome visitors back when restrictions are lifted.

The takeaway

At a time of ongoing crisis, there are reasons to have some optimism about the future recovery. The latest economic headlines make for grim reading but we must look to the future with renewed vigour. Although the timing and rate of this recovery remain uncertain, its speed and strength will depend on the extent to which close collaboration can be forged between the Welsh Government, CCR, local authorities, business interest groups and individual businesses. Work should start now on ensuring a favourable environment to investment – through the creation of a positive planning regime, support for investment, training to ensure that the necessary skills are available, and a positive approach to residential development as a driving sector of the economy and essential to supporting a growing workforce.

We will be considering these individual sectors in more detail in a series of more detailed blogs and Insight pieces, and will also be looking at the direction of the economy in different parts of Wales.

[1] Source: StatsWales GVA by area and component[2] Source: https://www.statista.com/statistics/1112254/air-freight-volume-worldwide-covid-19/ Accessed 16 June 2020.[3] Source: https://www.bbc.co.uk/news/business-52851185 Accessed 16 June 2020.[4] Source: https://www.marketwatch.com Figure based on share price on at 1500 BST on 12 June 2020 ($230.39)[5] Source: https://www.cardiffcapitalregion.wales/[6] Source: https://www.cardiffcapitalregion.wales/wp-content/uploads/2019/06/ccr-investment-framework.pdf[7] Source: https://www.insidermedia.com/news/wales/south-wales-preferred-location-for-landmark-battery-gigafactory?utm_source=wales_newsletter&utm_campaign=wales_news_tracker&utm_medium=top_story_article Accessed 16 June 2020.[8] Source: Experian business strategies forecasts March 2020