The reach of COVID-19 knows no boundaries. It has affected our health, our way of life and our economy. Given the centrality of housing to each of these aspects, it is entirely unsurprising that it is also impinging upon the housing market. There is widespread agreement that house prices will fall this year, although estimates of the scale of impact vary widely, with predicted reductions of between 5% and 23%

[1]. The Bank of England has suggested that the figure could be towards the upper end of that scale, at -16%. Such a scale of decline will adversely affect the Gross Development Value (GDV) of new developments and raise questions about the viability of many schemes. This will particularly be the case when set alongside:

- Potentially increased costs (arising from shortages of key materials); and,

- Longer development timescales (arising from lower GDV, supply-chain difficulties, and the need for social distancing on-site reducing output) which will increase finance costs.

Going forward, the issue of development viability will therefore become more acute than it has in a long time.

It is against this context that the judgment of Dove J in

R (Holborn Studios) v London Borough of Hackney (2020) is particularly timely. The application for judicial review was brought on three grounds:

- The failure of the Council to comply with national planning policy in relation to the provision of information in respect of viability assessments;

- The lawfulness of the Council’s guidance for members of the planning committee; and,

- The planning officer’s interpretation of development plan policies in relation to the retention of the existing use as an important component of the creative industries.

Grounds two and three were dismissed, but the claim succeeded on the first ground. The planning permission was consequently quashed (for the second time, having initially been quashed in

2017 for quite separate reasons).

The successful viability ground included a number of connected limbs: that the Council’s had breached “a legitimate expectation in respect of the disclosure of viability information”; that the material on viability that was placed in the public domain was “opaque and unexplained”; and that the evidence did not set out how the benchmark land value was derived. The court found in favour of the claimant in respect of all three of these points.

In respect of these matters, the judgment is important in clarifying the guidance set out in the PPG that:

“Any viability assessment should be prepared on the basis that it will be made publicly available other than in exceptional circumstances. Even in those circumstances an executive summary should be made publicly available.” (Reference ID: 10-021-20190509)

Dove J found that the London Borough of Hackney had failed in this regard. Although some information was included on the public record, this was found to include “differences and inconsistencies” that rendered it incapable of being understood. Such an approach goes against the requirement of the PPG for executive summaries to “set out the gross development value, benchmark land value including landowner premium, costs, as set out in this guidance where applicable, and return to developer.” (Reference ID: 10-021-20190509). The opportunity for the public to engage on the issue of viability on an informed basis was found to have been further compromised by the fact that “no explanation was provided as to how the benchmark land value had been arrived at in terms of establishing an existing use value and identify a premium as was asserted to have been the case.” (Paragraph 71).

In drawing these strands together, Dove J noted that “in following the approach recommended in the Framework and the PPG, standardised inputs should be used” (Paragraph 63). He went on to state in the same paragraph that the PPG “makes clear [that] the preparation of a viability assessment ‘is not usually specific to that developer and thereby need not contain commercially sensitive data’.” Despite the weight that is given the use of standardised inputs (including in NPPF paragraph 57), neither the NPPF nor the PPG provides much by way of guidance on inputs that should be applied.

Lichfields’ research on viability inputs

In response to this, Lichfields has undertaken a review of the viability evidence underpinning 80 recently adopted Local Plans and CIL Charging Schedules

[2]. This research, which will be published in a forthcoming Insight paper, shines a light on the approach taken to key metrics in order to identify commonalities and fill the gap in our understanding of a “standardised” approach.

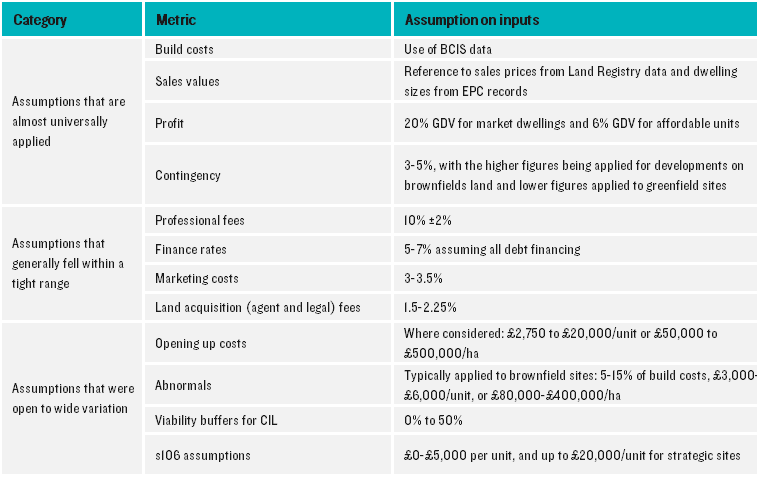

We have found that the key inputs into viability assessments can be categorised as follows:

Categorisation of key inputs into viability assessments

In respect of Benchmark Land Values, our research found that, despite most studies pre-dating publication of the revised NPPF, 60% applied the “Existing Use Value Plus” (EUV+) approach that is now enshrined in policy. Unsurprisingly, the level of uplift was found to vary, with an increase of 20% common for brownfield sites and a multiplier of 15-20 times above EUV or an uplift of 20% plus an additional allowance of between £250,000 and £650,000/ha being applied in respect of greenfield sites. However, quantifying the scale of uplift was important in ensuring that the studies separated the two elements of EUV+ (the existing use value and the uplift) – something that was missing from the viability appraisal prepared in the Holborn Studios case.

The takeaway

This evidence provides a means by which we can begin to move towards a true standardisation of viability assessments. Such an approach cannot account for all eventualities – there will inevitably be specific circumstances that justify the application of alternative inputs. However, it does help to overcome concerns about the publication of commercially sensitive data and thereby allows for a more meaningful debate about development viability, both during the preparation of local plans and as part of the determination of planning applications, where circumstances permit – something that we should expect to become increasingly common during the short to medium term.

[1] Source: https://www.thisismoney.co.uk/money/mortgageshome/article-8312433/House-prices-fall-7-year-lockdown-extended.html Accessed 18 June 2020[2] The evidence base that we have reviewed is dated between January 2016 and September 2019 for CIL Charging Schedules and between January 2018 and September 2019 for Local Plans.