The UK is now in the process of gradually easing itself out of the lockdown measures which have dominated our way of life for over two months. The economic costs in the UK and elsewhere have been significant, with indicators suggesting the global economy has plunged into one of the worst recessions since the Great Depression. However, there are some sectors across the economy, notably logistics, that have shown signs of growth due to the “new norms” in our lifestyles. In this blog, I explore the impacts of the pandemic on e-commerce and the implications for the warehousing property market and what this might mean for planning.

Trends in the growth of e-commerce

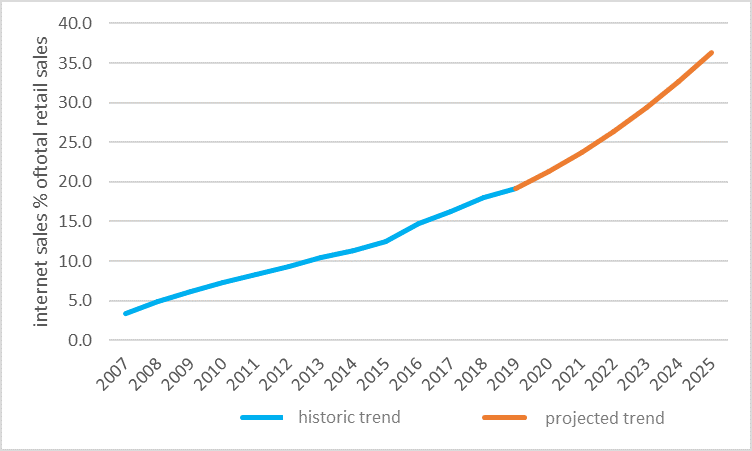

Online sales had been increasing before the pandemic and extrapolating past trends were on course to reach over 30% of total retail sales by 2024, based on ONS records

[1]. However, this level was reached in April. The data reveals that COVID-19 impacted consumer behaviour to drive the e-commerce share much higher to what might typically be experienced during the ‘Black Friday’ and pre-Christmas shopping periods (c.21%).

This increase, however, relates mainly to online food shopping, and that affects the revenues of the various online retailers. Large supermarkets have not avoided incurring costs of reduced merchandise and clothing sales, despite the increased food sales. On the other side, Amazon has announced a boom in its worldwide sales with 26% higher volumes than the same time last year.

Source: ONS (2020), Lichfields analysis

The long-term effect of the pandemic is that considerably more people have now been introduced – by necessity – to online shopping and we can expect a proportion to continue using it regularly after the pandemic. This will accelerate online retail sales growth compared with what we have seen in previous years, which will create additional pressures on the logistics market to fulfil this demand.

A logistics “perfect storm”?

The warehousing market was buoyant even before the public health emergency in Wuhan hit the headlines at the beginning of the year. There has been consistent strong demand over the last few years, but a general undersupply of warehousing property, particularly across popular logistics “hotspots” such as London and the Midlands. From a planning perspective, evidence-base assessments have indicated latent demand for additional warehousing floorspace in these areas.

An unsatisfied short-term appetite for warehousing properties has become even more acute during the lockdown, with commercial agents reporting high levels of enquiries. Investors, particularly those with an acquisition strategy in favour of assets with tenants involved with consumer staples and pharmaceuticals, view warehousing as a safe investment option. In addition, foreign investment has been released into the UK market during the pandemic as a response to the rapid increase in online transactions. Although some second-hand industrial space might be released in the short-term (e.g. due to tenant defaults), this is unlikely to fundamentally improve the demand-supply balance position, particularly for those logistics operators who have bespoke requirements, which cannot be easily fulfilled through refurbishments of older properties.

Well established online retailers, large supermarkets and third-party logistics operators, along with the NHS, have sought to rapidly expand the capacity of their distribution networks. The need for increased supply chain resilience combined with added stockpiling will require additional facilities in response to the growing demand, at the same time as some import activity has been constrained. This is in the context that many operators had already been redesigning their supply chains and increasing reserves in the context of Brexit. The combination of both Brexit and now COVID-19 means the logistics market is rapidly having to adjust its new stockholding strategies. All this activity in logistics, set against the general lack of warehousing supply in critical locations, has created something of a “perfect storm” for the industry.

Planning for a new era of logistics

There is a need for a comprehensive approach to identifying and meeting the needs of the logistics sector. The 2019 National Planning Policy Framework (NPPF) brought a specific recognition of the sector at paragraph 82, which states: “planning policies and decisions should recognise and address the specific locational requirements of different sectors…and for storage and distribution operations at a variety of scales and in suitably accessible locations.”

This implies that local planning authorities, particularly those in accessible locations to key routes and networks, should specifically designate employment land for warehousing (B8) uses. However, in practice, this is relatively rare, even when the evidence base indicates that such provision should be made. There can be a tendency to assume that B8 uses can be mixed with other general employment land provision, or that the footloose nature of the requirements means that needs can be accommodated elsewhere in the functional economic market area. This is not helped by some out-dated perceptions of the sector, such as that it only generates limited numbers of low-value jobs and is land-hungry. However, logistics today is a fast-growing sector making increased use of technology and ever more sophisticated systems that generate higher-skilled positions, and which is also moving towards more intensive forms of development as sites become harder to find (particularly close to major urban centres).

Conventional planning approaches to identifying warehousing land needs, particularly for strategic distribution, are also in need of an update. Analysing past completions and employment forecasts now have only limited value as indicators of future logistics demand, and so the planning system needs to move towards a more detailed understanding of the different segments of the market, the variety of operating models and supply chain networks that exist, and what this means in terms of locational requirements. At Lichfields, we have already been exploring new ways of creating better need evidence and planning strategies for logistics.

The COVID-19 pandemic has shown just how critical an efficient logistics network is within all our day-to-day lives, and is only likely to accelerate our reliance on this infrastructure in the future. At a time of wider economic disruption, it remains one of the few sectors that is growing and we can utilise this as part of plans to help the economy bounce back. It is, therefore, time for planning to take a new approach to this vital sector.

[1] ONS (2020) Internet sales as a percentage of total retail sales (ratio) (%), available at: https://www.ons.gov.uk/businessindustryandtrade/retailindustry/timeseries/j4mc/drsi, last visited 11/05/20