At last week’s Confederation of British Industry (CBI) conference the tourism and hospitality industry was mentioned as having the potential to “light a fire” under the economic revival. Back in May the World Travel & Tourism Council (WTTC) forecast that the UK’s travel and tourism contribution to GDP will grow at an average rate of 3% annually between 2022-2032 equating to a net worth of £286 billion (10.1% of the total economy)

[1], noted as nearly twice the forecast 1.7% annual growth rate of the overall UK economy.

Such is the world we live in at the moment that much has changed since May and current economic volatility means that any industry growth predictions should be treated with caution.

Certainly in the years leading up to the pandemic there was much cause for optimism. Over 2010 to 2019 travel and tourism was the fastest growing sector in the UK in employment terms and its contribution to GDP reached 9.9% (£234.5 billion) in 2019 before collapsing to just 4.3% (£93.8 billion) in 2020

[2] – a huge 60% loss. The rolling back of COVID-19 restrictions in 2021 saw the beginning of the “recovery” for travel and tourism with GDP climbing 40% year on year to reach £131 billion, still significantly below 2019 levels. Oxford Economics has predicted that the UK tourism sector as a whole may not recover to 2019 levels until 2025

[3].

The are many influencing factors that will determine the industry “bounce back” but one aspect that could see sustained growth is domestic tourism, often referred to as “staycations.” Beleaguered airline operators that have had to (and are likely to continue to) reduce overseas flight numbers during peak trading months, rising flight costs, inflation generally and the cost-of-living crisis, changing weather patterns, and a more competitive domestic holiday sector in terms of experience, value and service means there is a significant opportunity for staycations to become more and more popular.

The Government’s Tourism Recovery Plan (2021) highlights that domestic tourism is good for UK businesses and the levelling-up agenda, with domestic visits typically being spread more evenly around the UK compared to inbound international visits that disproportionately benefit London. A survey by Barclays of British holidaymakers and the regions they planned to visit in 2019 demonstrates the wider geographic spread of domestic tourism (Figure 1). One positive of the pandemic has been that it has led to many UK tourists exploring various parts of the UK for the first time so this “spread effect” is likely to have become even more pronounced.

Figure 1 Barclays Survey: UK Regions Holidaymakers Planned to Visit in 2019

Source: 'The Great British Staycations - The growing attraction of the UK for domestic holidaymakers, January 2021

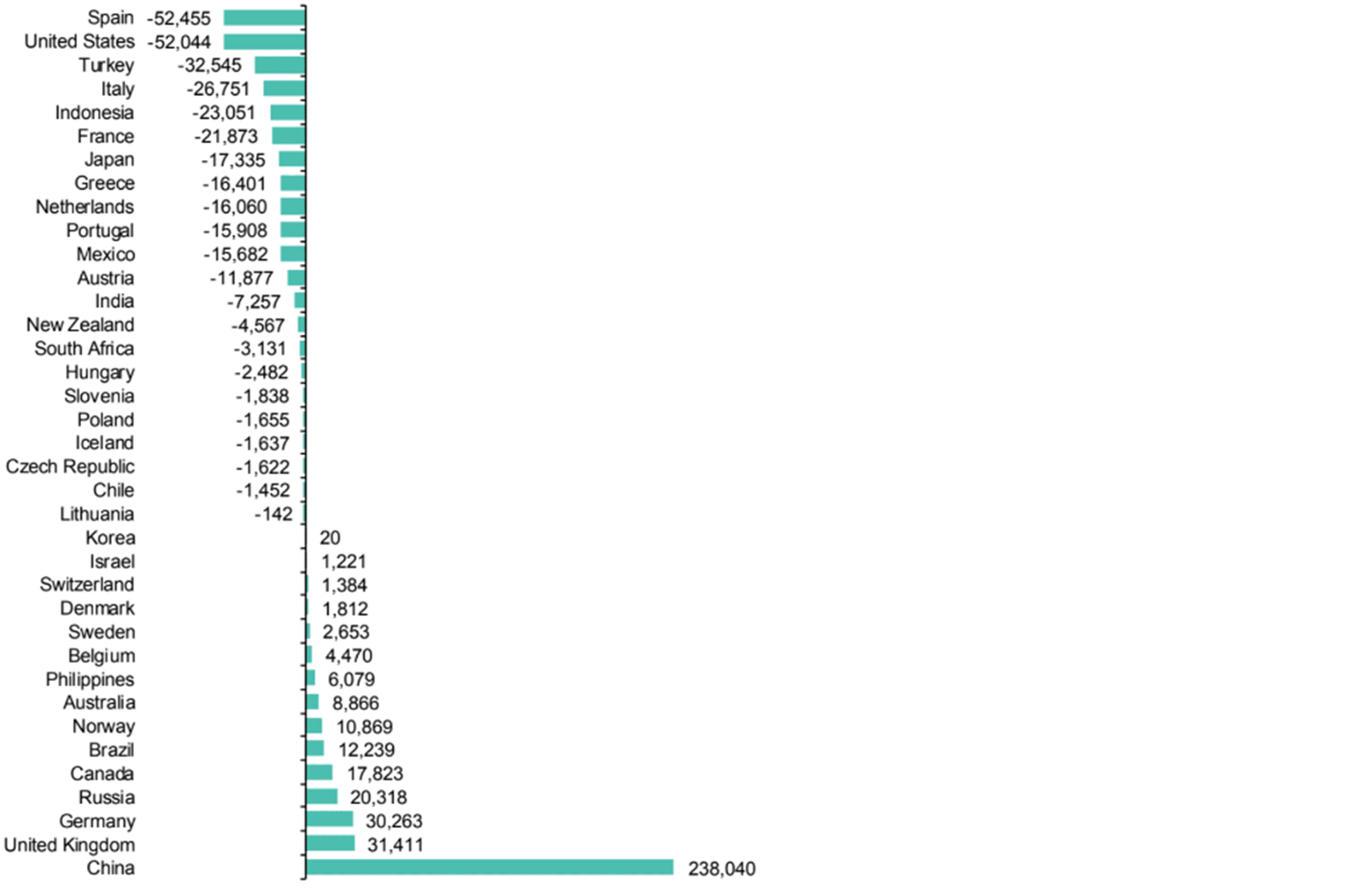

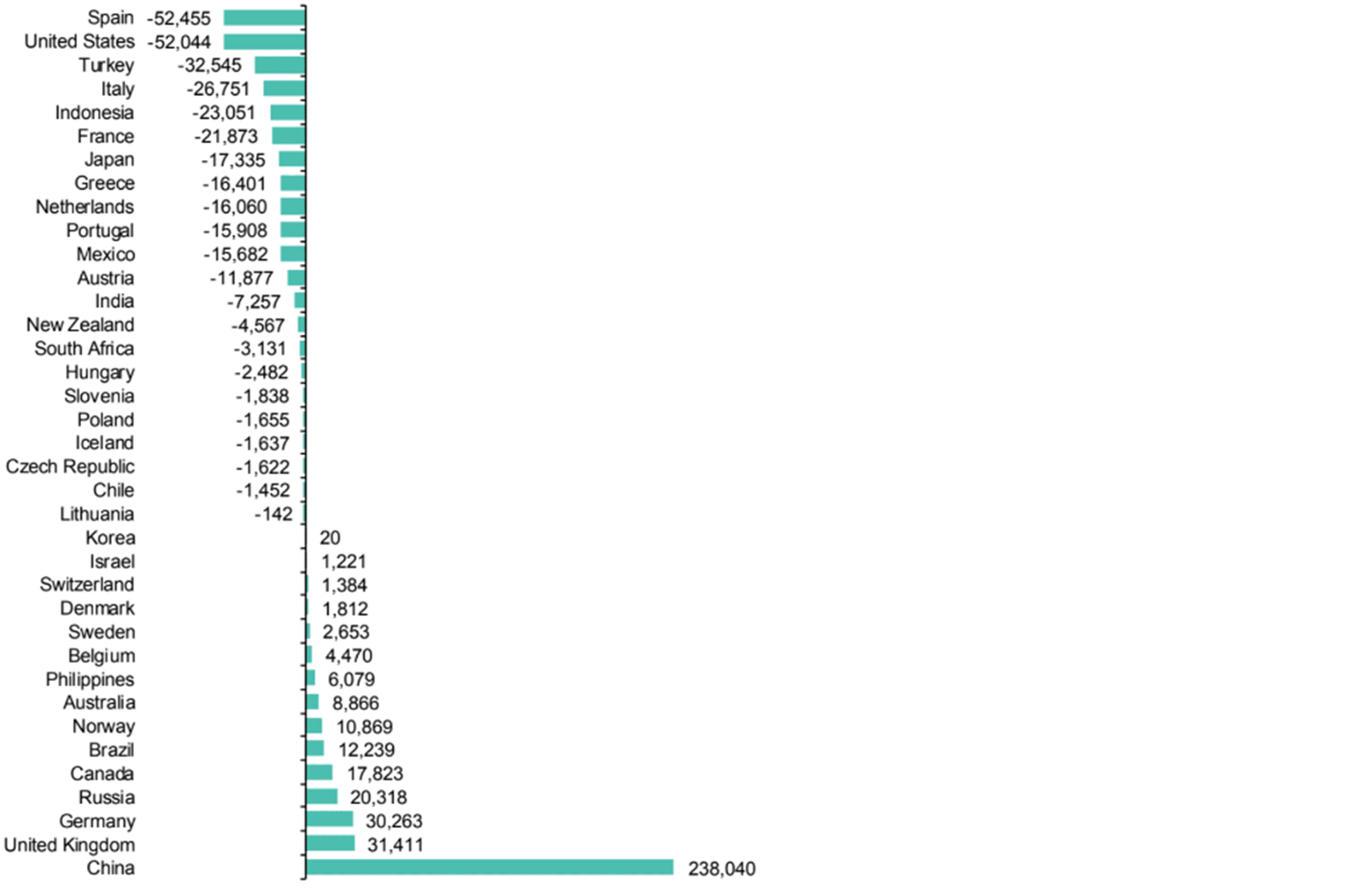

Another really interesting infographic referenced by Skift (below) considered a hypothetical analysis from April 2020 during the pandemic looking at the “winners and losses” from a staycation boom if all international travel demand for a full year was redirected to domestic markets (this considered the current tourism market – domestic travel plus inbound, inbound travel lost and outbound travel gained). Extending the analysis to 37 countries showed that the UK had more to gain than all its overseas competitors, with the exception of China, in converting outbound visitors to domestic visitors.

Figure 2 Total $ gain/loss from all travel going domestic

Source: The Winners & Losers of a Staycation World Ahead (skift.com)

The aim of the Government in its Tourism Recovery Plan is clear – it wants to “build back better” from the pandemic by promoting innovation and creating an “accessible” and “resilient” tourism industry. Domestic tourism can be the kickstart for the wider UK tourism industry recovery that if successful will naturally encourage international visitors to return, and in greater numbers than before. To this end, the Tourism Recovery Plan recognises “…that whilst London is crucial to the fortunes of the UK’s tourism sector overall, we want the recovery to be swift in every nation and region, and in both urban and rural areas.” So what can the planning sector do to help the domestic tourism sector reach its full potential and drive growth across all parts of the UK in the face of continued economic uncertainty?

In my previous tourism research piece in 2020 -

Tourism: Retrench and Rebound - I outlined a number of ways the Government needed to act to address pre-existing issues in the tourism sector at the time. Many of these remain and are relevant to boosting domestic tourism; tellingly quite a few were identified in the more recent de Bois Review in August 2021

[4] along with a range of other recommendations. The following are key to addressing current inadequacies:

- Raise the profile of the visitor economy within national government: the de Bois Review is clear that there is insufficient appreciation of the importance and promise of the visitor economy at the top of government which is undermining the success of the tourism industry. For too long the Government has assumed that the tourism industry is relatively successful and will look after itself which has meant the UK has lost ground to other countries. New funding, policy engagement and delivery is needed.

- Improved partnership working: more coherency and structural reform is needed across central Government, Local Planning Authorities, Local Enterprise Partnerships (LEPs), Destination Management Organisations (‘DMOs’) and other public bodies. This should identify clear lines of responsibility and accountability to ensure the various bodies are clear on their remit and efficient in delivering outputs. Engaging private and public sector investors is also important to ensuring tourism initiatives are workable and meet the needs of the market. Early engagement with investors and developers is key and, in turn, investors and developers need to promote their plans and roles in the area and be a “voice” for tourists.

- Establish positive, flexible planning policy: too often at Lichfields we see draft emerging Local Plans or newly adopted Local Plans where the basis of economic growth is disproportionately reliant on more traditional forms of business development (e.g. office and industrial). Often tourism is seen as a secondary source or in some cases is not mentioned at all. It is essential that emerging planning policy and guidance at national and local levels provides a firm and clear basis for the industry to flourish. This should recognise (and support) that more and more tourist destinations, Resorts and Parks are investing to encourage visits spread across the year, building into the “shoulder” months and increasing guest numbers in the more traditionally “off-peak” periods, to make them more attractive throughout the year. This is critical to remaining competitive. Also, a concerted effort is needed to create more bespoke Destination Management Plans (DMPs), establishing current and future priorities for tourism in areas and clear actions to achieve them.

The success of regular investment in tourism is evidential in our planning work with Bourne Leisure and Merlin Entertainments, where regular and new investment in facilities, accommodation and in the case of Merlin, new rides and attractions has allowed sites to flourish and encourage visitors to return.

- Spread the opportunities: government support (policy, financial etc.) should be common across all areas of the UK where tourism can make a contribution. This will assist the “levelling up” agenda and play an important role in placemaking and economic regeneration.

- Improve data: to assist decisions on how best to develop the visitor economy in local areas, the Government should improve access to quality data. In this regard, the de Bois Review suggests introducing the proposed Tourism Data Hub as a matter of urgency.

Opportunities provided by the domestic tourism industry are vast and if managed correctly these have the potential to embed domestic travel as a sustained customer behaviour that drives economic growth across all parts of the UK.

Here’s to the staycation!

[1] News Article | World Travel & Tourism Council (WTTC)

[2] Travel & tourism's total GDP contribution UK 2021 | Statista

[3] Oxford Economics ‘UK Tourism Scenario Forecasts – A report prepared by Tourism Economics for the Department for Digital, Culture, Media and Sport (DCMS), March 2021

[4] The de Boise Review: an independent review of Destination Management Organisations in England, Nick de Bois for the Department for Digital, Culture, Media & Sport, August 2021