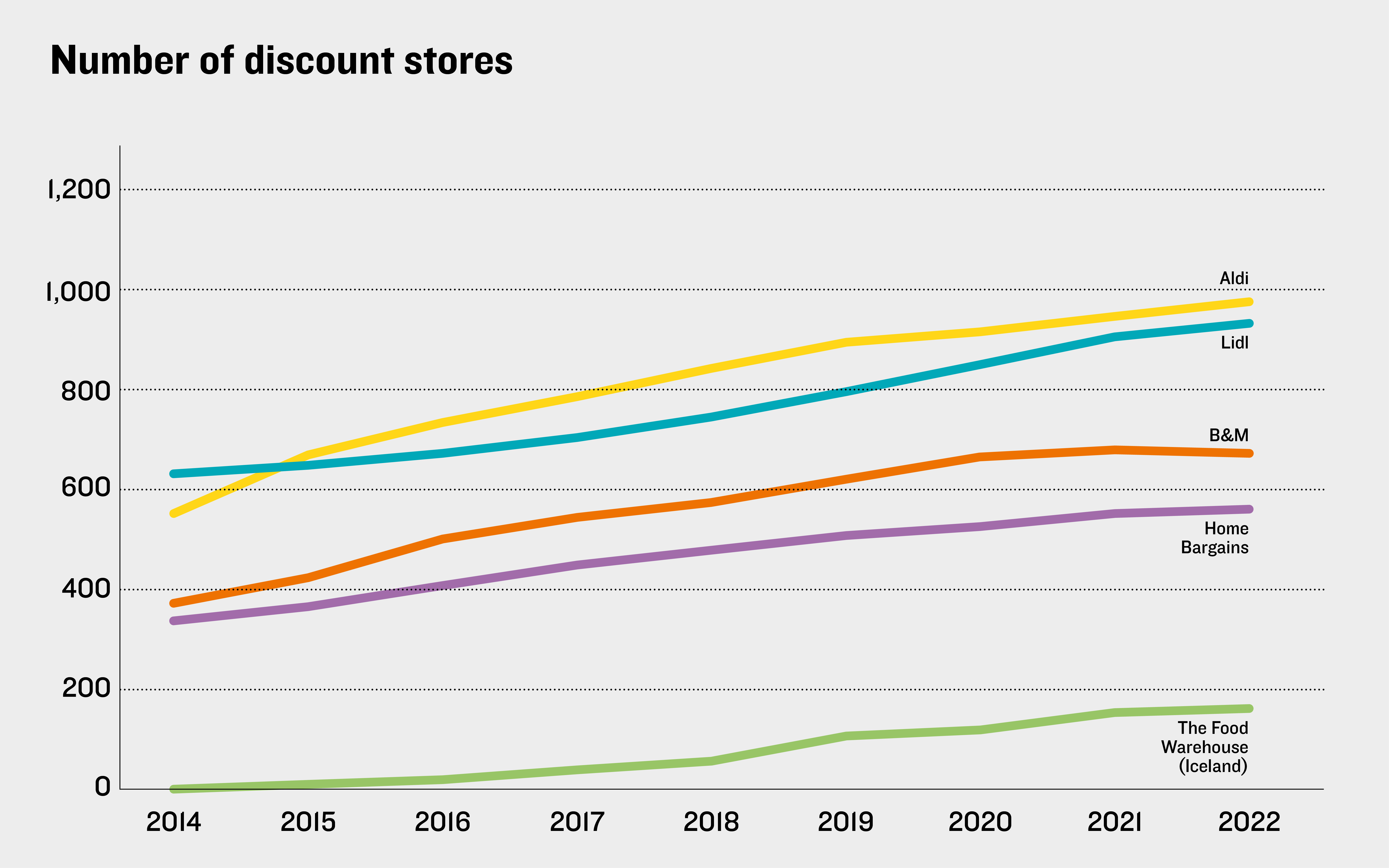

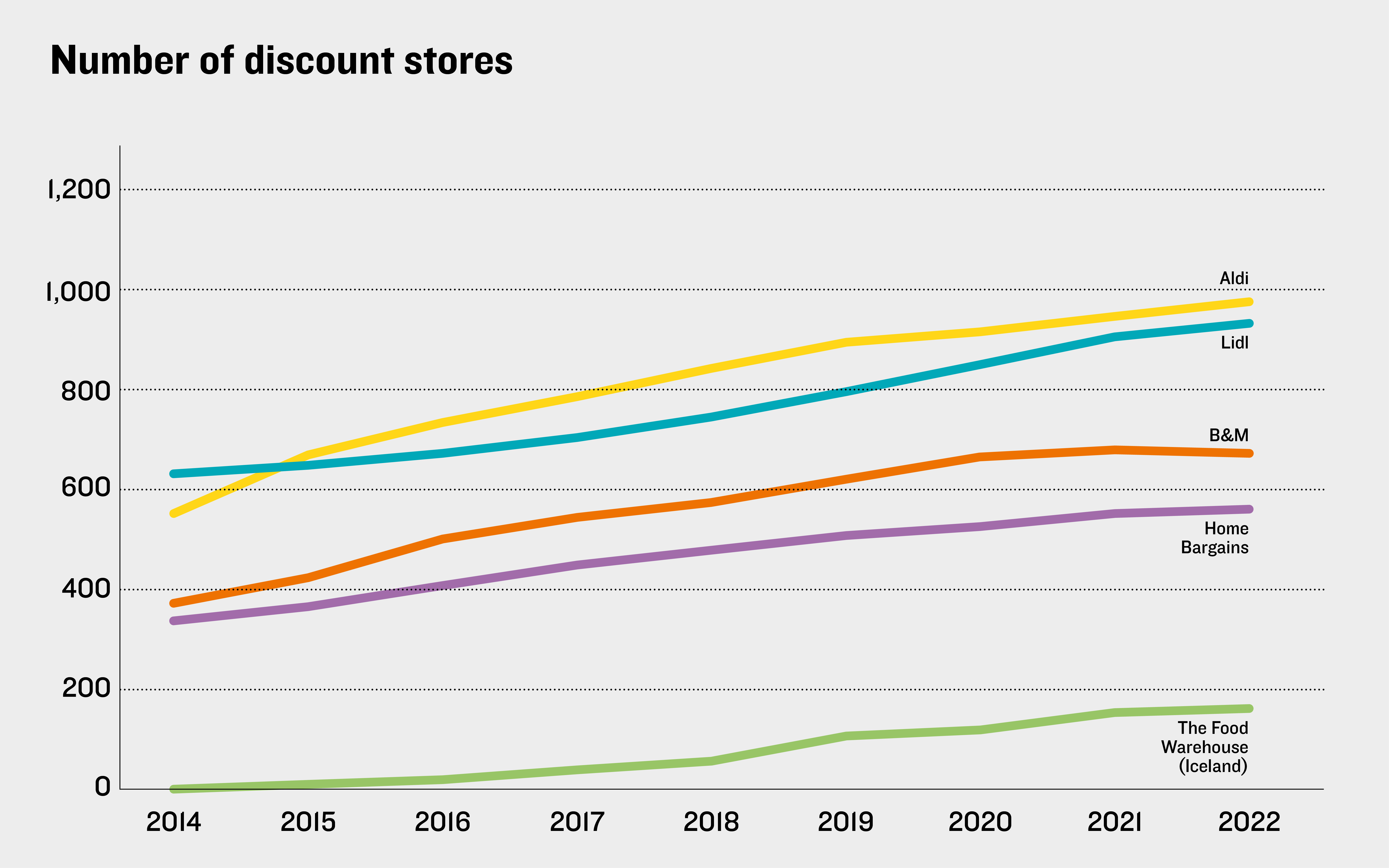

Amongst the doom and gloom in the retail sector, discount operators continue to thrive. Aldi, B&M, Home Bargains, Lidl, and Iceland’s “The Food Warehouse” brand have embarked on rapid store expansion programmes over the last ten years, exponentially increasing their market share of retail sales. This trend has continued during the recent cost of living crisis. Indeed, whilst there are signs of a slowdown in some parts of the country, Aldi has recently announced plans to open at least 60 stores in London.

From niche to mainstream

Once looked down upon, discounters are many people’s favourite stores. Aldi and Lidl first entered the UK market in the early 1990’s and were viewed as value retailers that did not compete directly with the mainstream foodstores. However, with lower prices, derived from limited product ranges and minimalist store designs, they gradually won over customers.

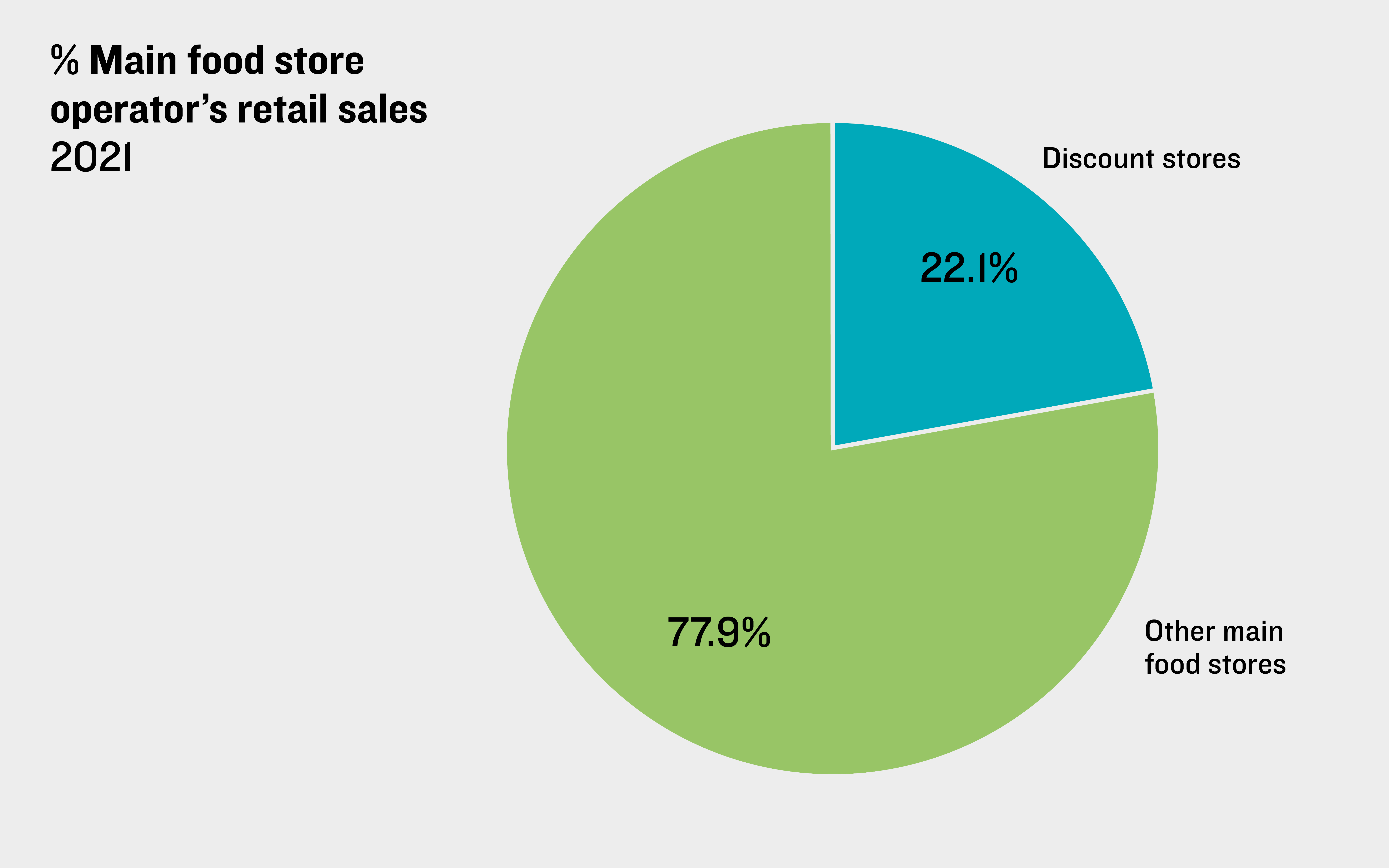

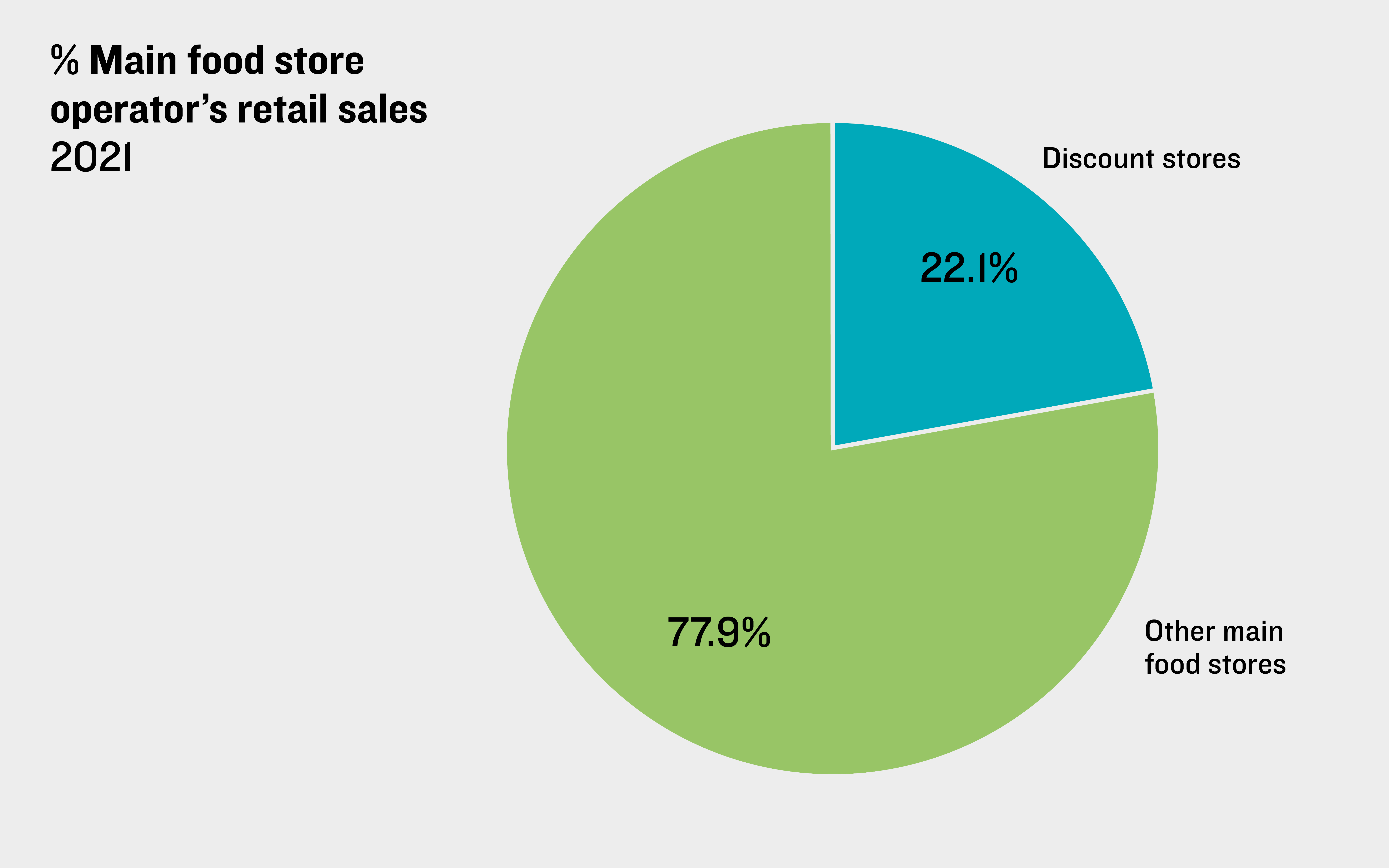

Households moving away from one bulk weekly shop helped them grow, realising that value doesn’t necessarily come without quality. In terms of total retail sales amongst the main food store operators, the market share of these five discounters has increased significantly since 2014 – from around 14% to circa 22%.

A new race for space

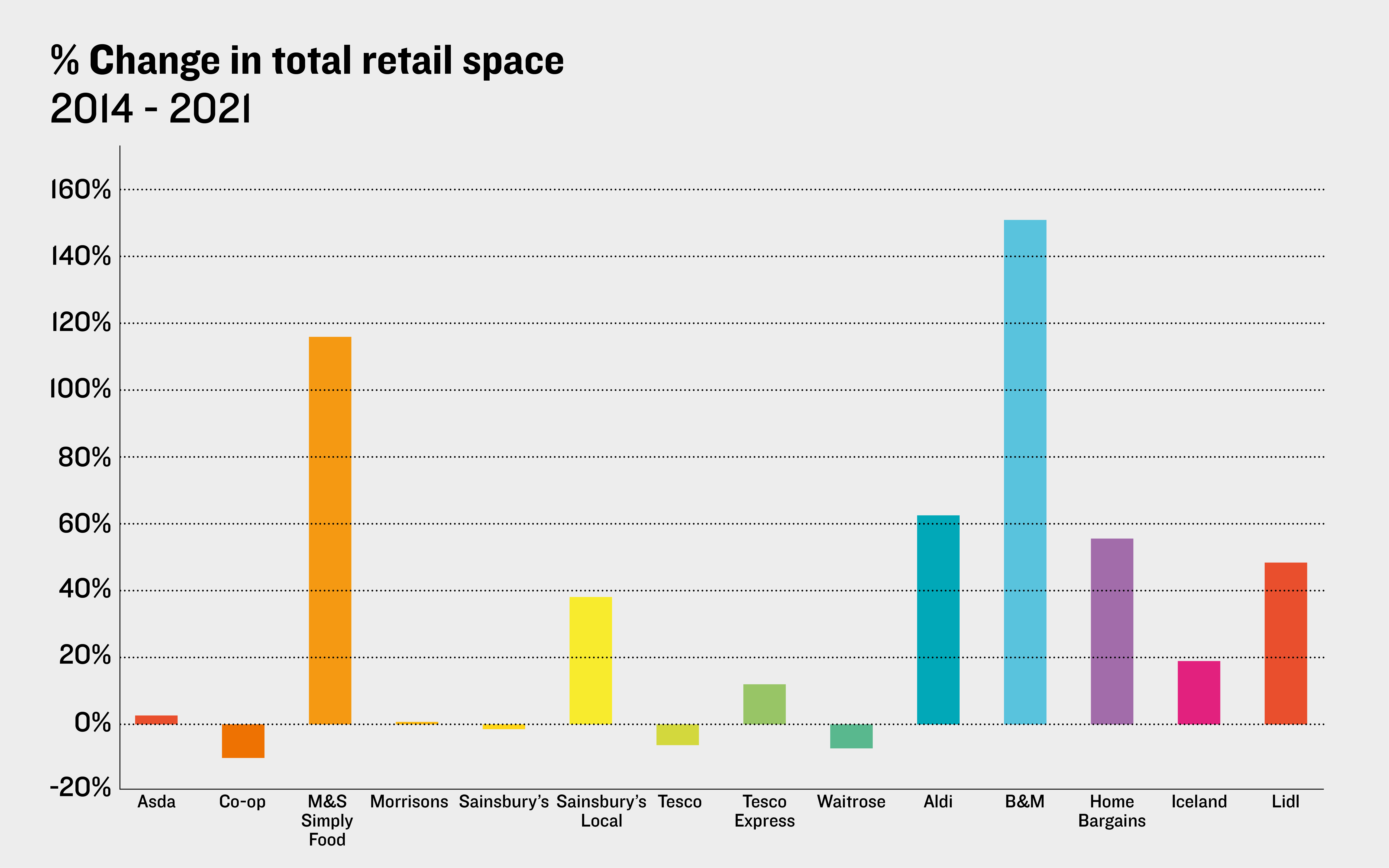

As shown below, the discount sector has thrived, with B&M being the star performer, more than doubling its estate over the period since 2014, and Aldi, Home Bargains and Lidl all increasing their total floorspace by around 50% or more. In contrast, with the exception of M&S and the Sainsbury’s Local format, the other mainstream food retailers have experienced only modest growth, or indeed a slight decline in retail space over this period.

Non-food has joined the party

Whilst much of the growth in the discount sector has been driven by Aldi and Lidl, other chains have emerged with a stronger non-food emphasis. The largest of these – B&M and Home Bargains – operate both in town centres and retail parks, selling a broad range of products. Whilst the non-food offer is the main draw, they also sell ambient food produce, and other items often purchased as part of a weekly (or more occasional) food shop, for example, pharmaceuticals and cleaning materials. Home Bargains currently have around 600 stores but plan to expand to 1,000 outlets, employing over 40,000 staff.

Expansion is continuing

The number of discount stores has nearly doubled overall since 2014. Whilst some areas have now reached saturation point, store expansion plans are likely to continue in under-represented locations. Although the outlook for convenience goods (i.e. food) spending growth in the short term is relatively weak, there will still be a need for new foodstore development in many areas. This could result from geographic deficiencies in provision and/or areas with significant housing growth planned. In such circumstances, there is a decent prospect of demand emerging from discount food retailers.

The potential for further expansion is highlighted in the latest information from Kantar – a leading data analyst – which indicates that the market shares of both Aldi and Lidl have continued to increase over the last year. That of Aldi has increased from 14.1%, when measured over the twelve weeks to 17 April 2022, to 10.1% over the twelve weeks to 16 April 2023, with that of Lidl increasing from 6.6% to 7.6% over the same period. According to Kantar, total sales have increased by around 25% (in absolute terms) for both retailers.

Retail planning skills remain important

Local authorities need to direct any future demand to the most sustainable locations, in line with the sequential test, and ensure that there would be no significant adverse impacts, as required by the National Planning Policy Framework (NPPF). Any sequential and impact assessments need to be carefully considered by Councils, before it can be concluded that these tests are satisfied. Given our expertise in both preparing and reviewing such assessments, Lichfields are well placed to assist with this.

As well as filling gaps in provision, new discount retail stores can also deliver significant socio-economic benefits. By way of example, a typical Lidl store will generate up to 40 FTE (full time equivalent) jobs, with staff being drawn from their local community, with a new Home Bargains creating around 60 FTE jobs. These jobs will be in a variety of positions, including management, customer service, restocking, sales and cleaning, providing opportunities at a variety of skill levels.

Although store expansion programmes are not immune to the current economic headwinds, discount operators remain a shining light in an increasingly challenging retail sector. Having been embraced by the general public, they are certainly here to stay, and their continued expansion provides a valuable opportunity to help meet future needs.

Image credit: Gustavo Fring via Pexels