Today’s

Spring Budget was, very deliberately, intended to be a fairly quiet affair (to the frustration of some Conservative MPs). In Whitehall circles it was already being referred to as the ‘placeholder’ budget – coming in the aftermath of last Autumn’s disastrous mini-Budget which left limited fiscal bandwidth for major new spending decisions, and preceding an Autumn Budget when the Chancellor might be hoping that conditions will have improved sufficiently to allow some pre-election good news announcements.

The Chancellor’s preparations had been prefaced by some brighter economic news, namely that 1) a recession has (so far) been avoided and the latest Office for Budget Responsibility (OBR)

forecast indicates this will continue to be the case for 2023 as a whole, and, 2) the UK government deficit this year proving to be smaller than was originally expected. Jeremy Hunt seized on this news early in his speech to say the economy was

“proving the doubters wrong”.

However, some perspective is needed on both these points. First, in the three months to January, the UK’s monthly GDP figures were +0.15%, -0.55% and +0.28% respectively according to the Office for National Statistics (ONS) – technically avoiding a recession, but the statistical equivalent of not much happening – and the OBR forecast for 2023 still shows the economy shrinking by -0.2% this year (albeit a big upgrade from -1.4% in last November’s forecast) just not necessarily within two consecutive quarters. The OBR then expects GDP growth to pick up to 1.8% in 2024 and 2.5% in 2025 as interest rates start to fall and drops in energy and other prices take inflation below the 2% target, but it has also slightly downgraded the mid-term growth figures for 2025, 2026 and 2027.

Second, while the OBR estimates the budget deficit this year to be £25 billion lower than expected, this is due to a somewhat temporary mix of higher tax receipts and lower spending (mainly reflecting the lower international gas prices and consequent reduced cost of the energy price guarantee scheme). The Chancellor has opted to use about two-thirds of this ‘gain’ to finance the Budget headline measures announced today – namely providing more support with energy bills and business investment, and measures to boost the labour supply. The effect of these will be to see borrowing levels increase again in overall terms mainly during the next three years, but meanwhile making few inroads to reducing government debt levels as a proportion of GDP.

Taken together, there was – perhaps unsurprisingly – a sense of incremental measures to address some of the main short term challenges where the public finances will allow for it, but few expansive interventions or any real sense of a comprehensive long-term plan. Business groups which have been calling for some form of game-changing stimulus measures to level up the UK with what’s being offered by the Inflation Reduction Act in the US or the EU’s Green Industrial Deal Plan, will be left disappointed. However, the full expensing capital allowance for 2023-26 will be welcomed as a means to incentivise firms to bring forward investment and thereby giving a much-needed boost to the level of business investment in the next few years.

Beyond these national measures, the Chancellor was keen to remind us about the government’s commitment to levelling up and promoting local growth and there were some important announcements in this regard.

First, and after much speculation, the government is calling time on the network of Local Enterprise Partnerships (LEPs) that were first introduced in 2011. LEPs have arguably been on borrowed time since the government's LEP Review concluded in March 2022, and government now intends to consult on withdrawing their funding and transferring responsibilities to local government from April 2024. The premise is that putting local economic development policy in the hands of democratically-elected local leaders will mean they can act more flexibly and innovatively, responding to local needs and driving growth for their citizens. That may be all well intended, but the reality is that the resources and budgets available to many local authority economic development teams have been significantly scaled back during the past decade, so significant investment will be required to rebuild capacity. In this context, a third round of the Levelling Up Fund will proceed as planned later in 2023 with a further £1 billion being made available. Alongside this, 20 new ‘Levelling Up Partnerships’ to be created in areas

[1] most in need of levelling up will provide over £400 million of investment for

"bespoke place-based regeneration" running until March 2025. Apportionment of this investment will be made on a case-by-case basis.

Second, Liz Truss’ ill-fated

Investment Zones policy makes a return – even if in name only. While originally ‘hundreds’ of zones were envisaged, today’s Budget confirmed just 12 locations including 4 across Scotland, Wales and Northern Ireland will now be subject to detailed appraisal for new Zones, with a “refocused” policy on productivity, universities and key growth sectors. These will have access to a single 5-year tax offer (matching that in Freeports), consisting of enhanced rates of Capital Allowance, Structures and Buildings Allowance, and relief from Stamp Duty Land Tax, Business Rates and Employer National Insurance Contributions – but notably no mention this time of special planning powers or additional flexibilities. Local partners will be able to choose the number and size of tax sites, within a £80 million envelope, up to a maximum of 3 sites totalling no more than 600 hectares. The locations in England are within the proposed East Midlands Mayoral Combined County Authority, Greater Manchester, Liverpool City Region, the proposed North East Mayoral Combined Authority, South Yorkshire, Tees Valley, West Midlands and West Yorkshire.

Third, the Budget confirmed further support to ensure ‘nutrient neutrality’ obligations can be efficiently delivered, thereby reducing the risks facing developers building homes in affected areas. DLUHC will shortly launch a call for evidence from local planning authorities, backed by a commitment to provide funding for high quality, locally-led nutrient mitigation schemes. Where high quality proposals are identified, government has indicated that it will provide funding to support clearer routes for housing developers to deliver ‘nutrient neutral’ sites using ‘credits’. Given the challenges this issue has already created in terms of housing delivery across large parts of the country – see for example our earlier analysis on the

five-year housing land supply and

economic growth implications – definitive solutions can’t come soon enough for the housebuilding industry.

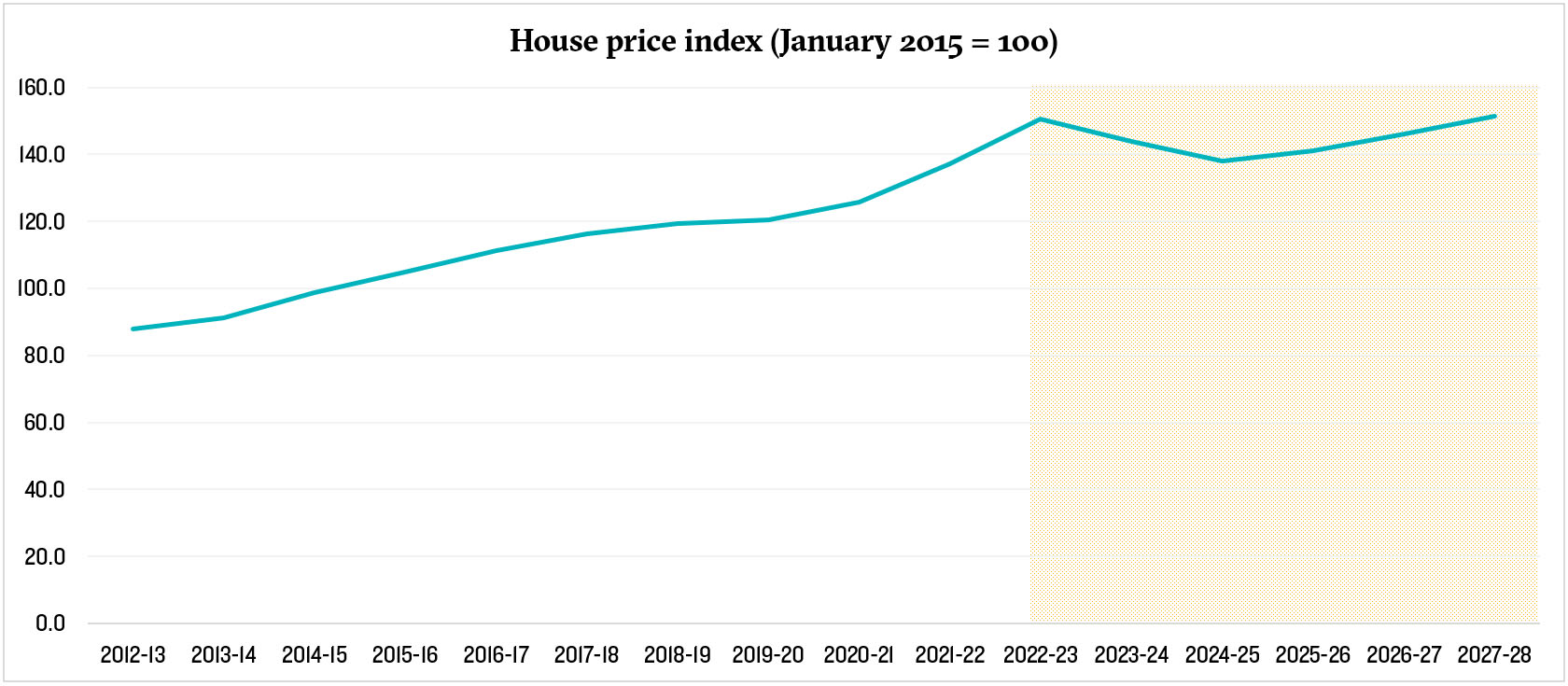

Finally, and on the subject of housing, the OBR forecast shows house prices are forecast to fall (largely driven by higher mortgage rates) and not recover to current levels until 2027/28. This is consistent with the latest indicators from Halifax and Nationwide house price indices which show prices already starting to fall.

Source: OBR (2023) / Lichfields analysis

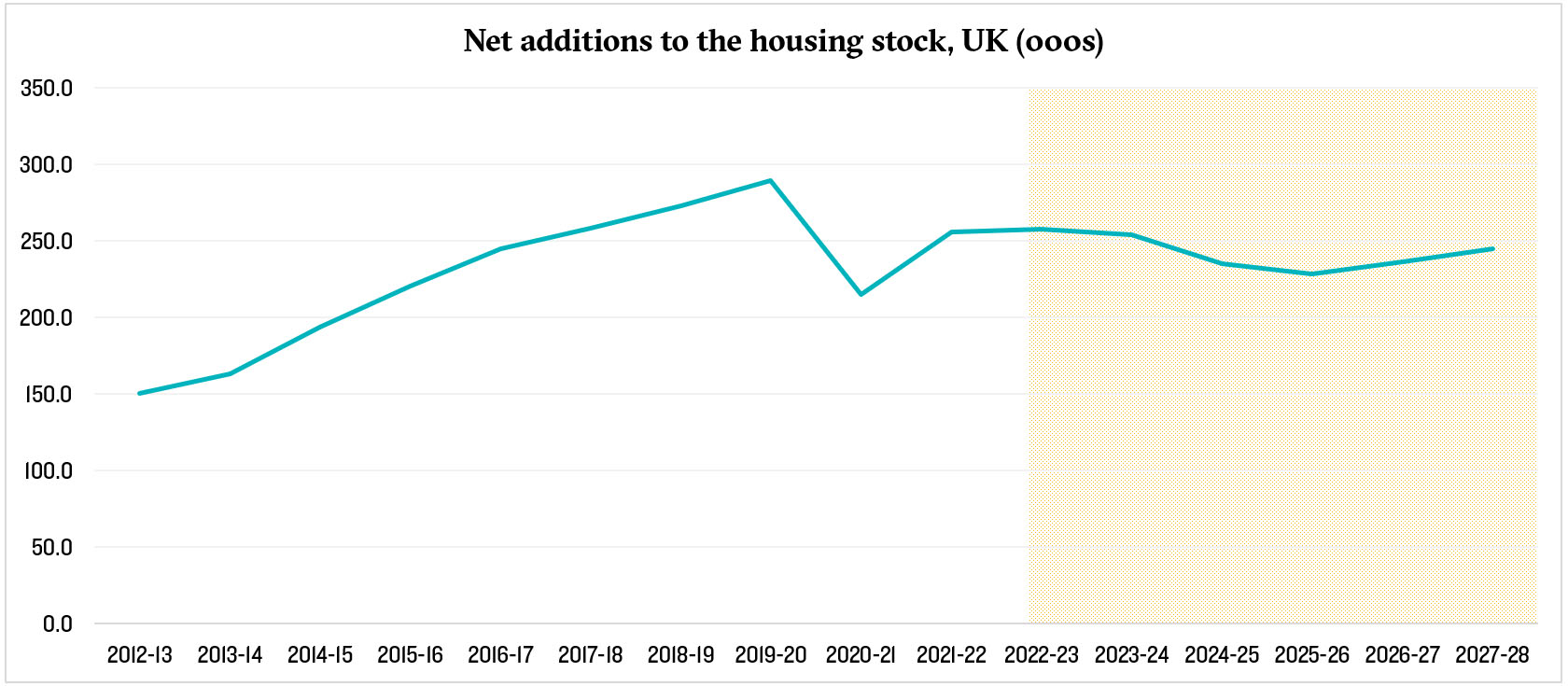

The OBR also expects house building levels to fall, in contrast with the pre-Covid trend growth, the 2026/27 rate is set to be 8% lower than 2022/23 and 18% lower than pre-Covid in 2019/20. The average rate for 2023/24 – 2027/28 is forecast to be 239,700 net additional dwellings a year.

Source: OBR (2023) / Lichfields analysis

Image credit: @hmtreasury via Twitter

[1] Local areas to be invited to form partnerships include: City of Kingston upon Hull, Sandwell, Mansfield, Middlesbrough, Blackburn with Darwen, Hastings, Torbay, Tendring, Stoke-on-Trent, Boston, Redcar and Cleveland, Wakefield, Oldham, Rother, Torridge, Walsall, Doncaster, South Tyneside, Rochdale, and Bassetlaw.