This year’s Autumn Statement was promoted by the Chancellor as one of optimism. Less than two months ago, the Chancellor warned that tax cuts would be virtually impossible. However, in the lead up to next year’s election, the Chancellor delivered a highly politically targeted Autumn Statement with the Conservative’s record in power defended and debated from either side of the house, with dividing lines being drawn. The Chancellor claimed that: enabled by the priorities and stability set out a year before, the economy is “back on track” and able to sustain personal and business “tax cuts” before the next election.

The good news - that emerged over the last month - and was celebrated by the Government is that inflation is lower and public sector finances are healthier than expected, providing the Chancellor with £27bn fiscal head room. The Autumn Statement provides a platform for the Government to set out how they plan to spend it.

Progress against the economic priorities

Economic Growth

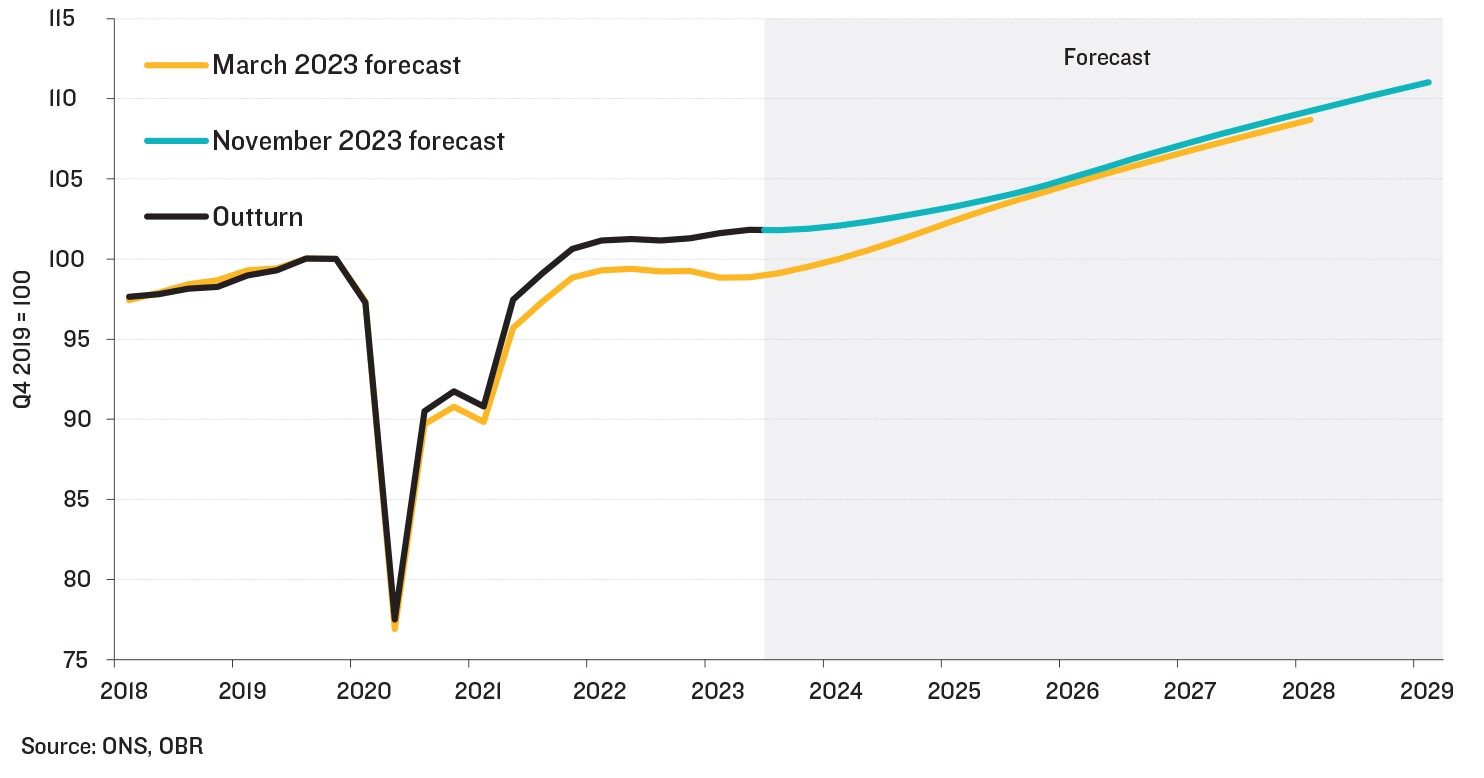

The top priority - agreed by both political parties - for the country’s economy is growth. Although real GDP is set to marginally outperform March’s OBR forecast in the short term (figure 1 ), growth in 2024 is expected to be just 0.7%, compared to 1.8% forecast in March, and in 2025, growth is forecast to be 1.4%, rather than 2.5%. All this means that “Real GDP per person remains 0.6 per cent below its pre-pandemic peak and in the central forecast only recovers that peak at the start of 2025”. This will remain the key long term challenge for the rest of this and the next Parliament.

Figure 1: Real GDP forecast

Borrowing less

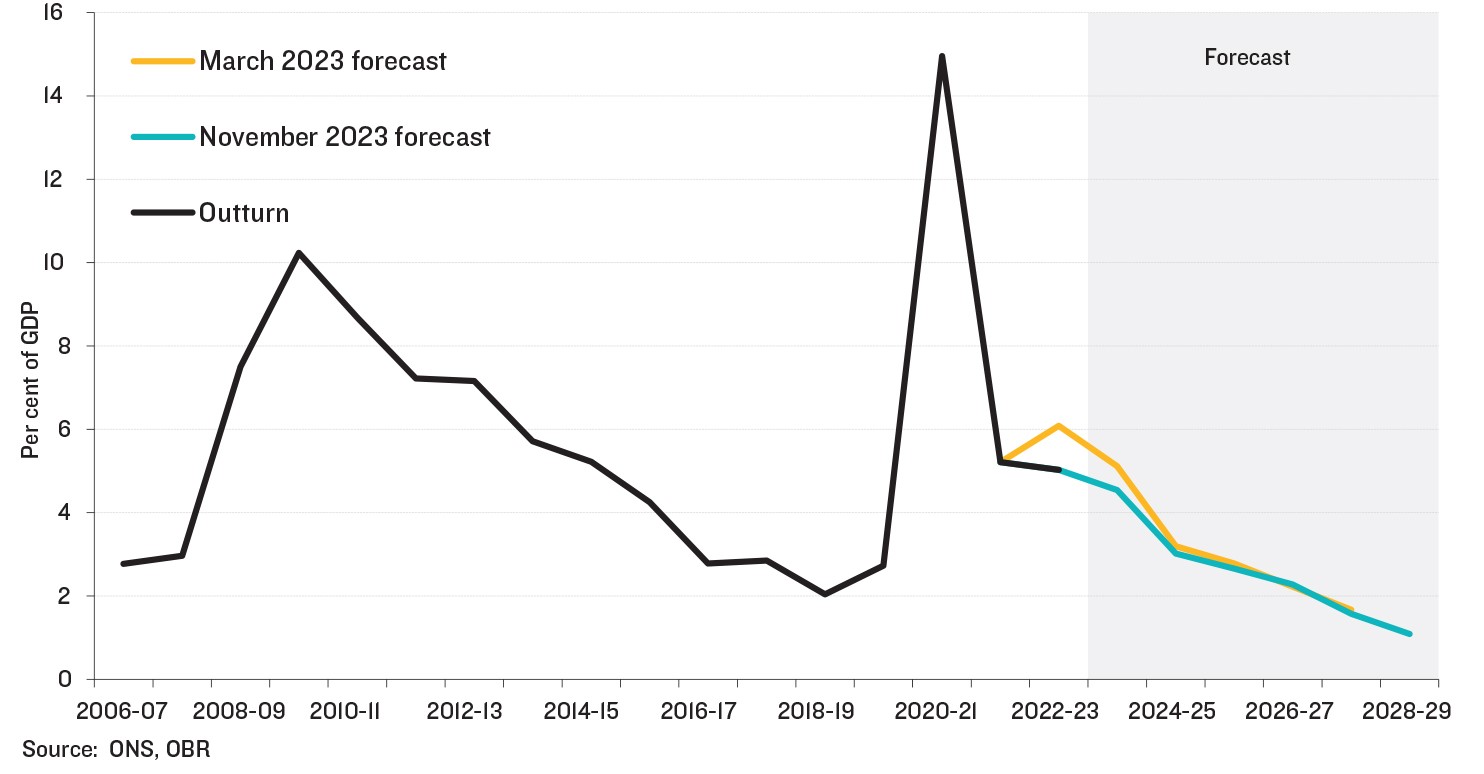

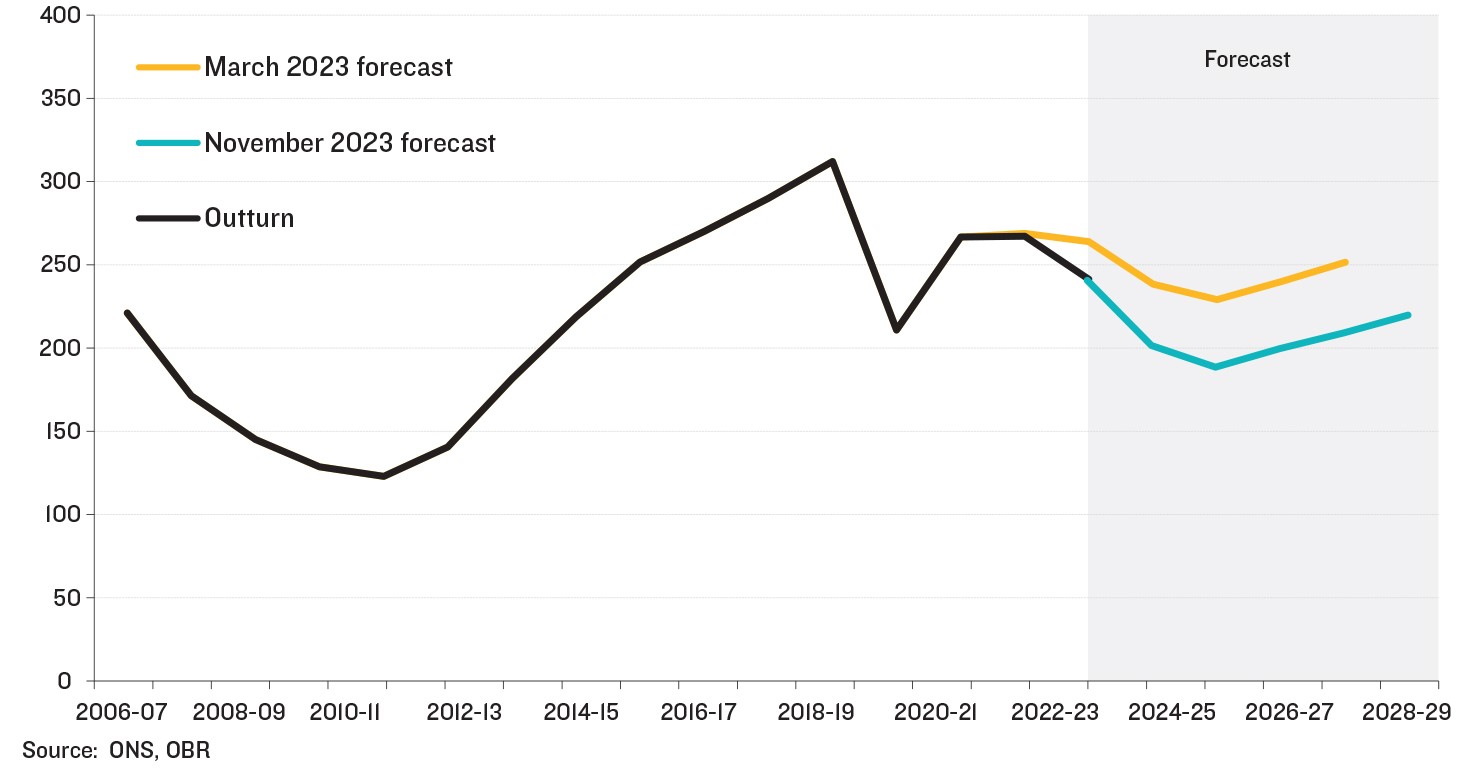

The key fiscal target the Government set itself, is that public sector net debt (excluding the Bank of England i.e. associated quantitative easing measures) will fall in the final year of the forecast (2028-29 in this forecast, figure 2). Using the OBR’s central forecast, this target is met, albeit this is due to underlying forecast changes that reflect lower borrowing in cash terms in 2027-28 rather than policy decisions set out in the Autumn Statement, which instead will offset some of the improvements in headroom. The OBR reports that almost all of the headroom will be spent on National Insurance Contributions, business investment tax reliefs and welfare reforms, “leaving debt falling by a narrow margin in five years” in keeping with the Government’s pledge.

Figure 2: Public sector net barrowing

Inflation down

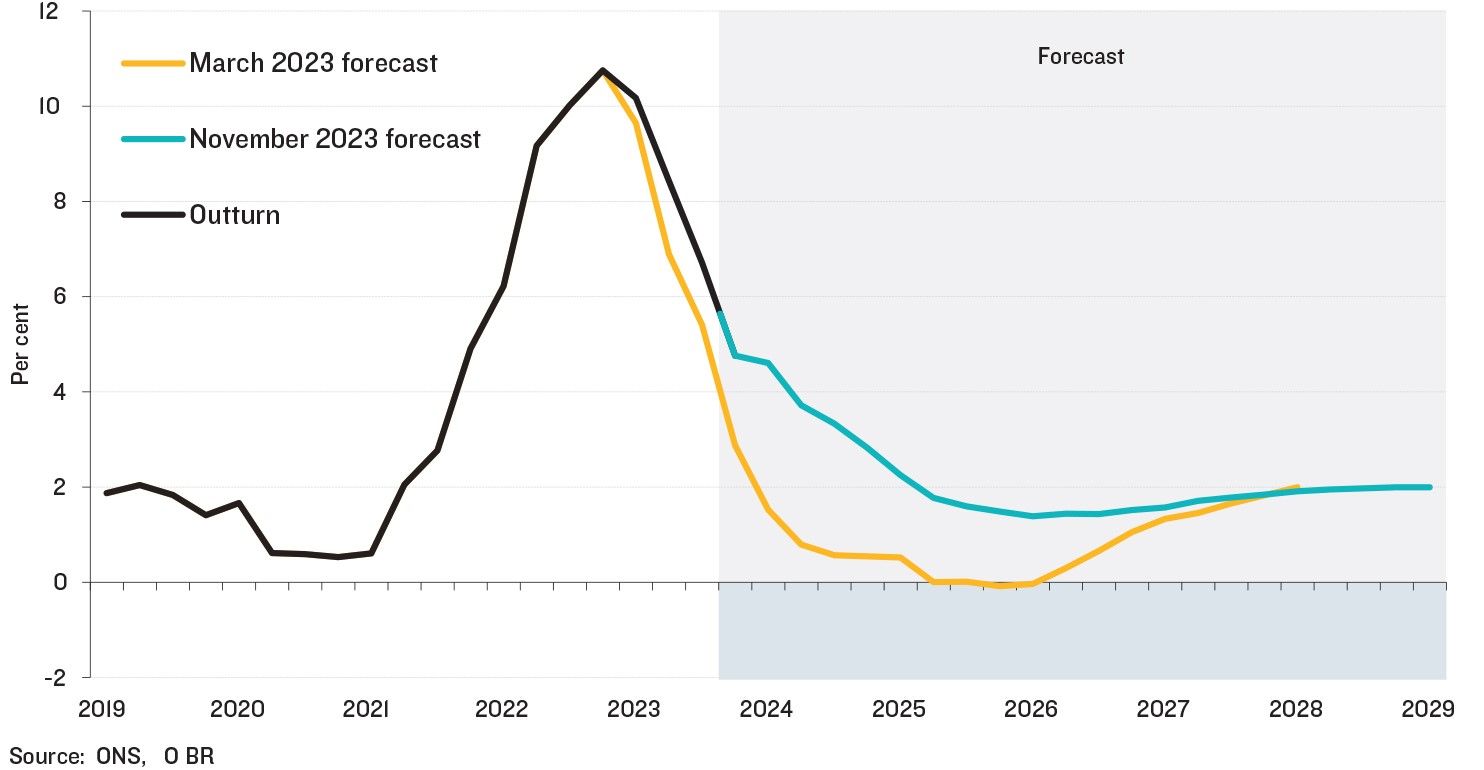

The Government also set itself the target of halving inflation. This is also on course to be met, with the October rate at 4.8%, down from 11.0% a year ago, and with ‘core inflation’ falling. Although others will debate whether Government measures have a significant impact on this, as opposed to the economy more generally and interest rates set by the Bank of England, the OBR do say that measures will reduce inflation further.

However, this good news had sceptics reaching for the OBR’s independent analysis on inflation “We…expect inflation to remain higher for longer, taking until the second quarter of 2025 to return to the 2 per cent target, more than a year later than forecast in March.” Indeed, as figure 3 shows, the OBR forecast inflation to hit the long term Bank of England 2 per cent target in the second quarter of 2025, about a year later than forecast in the latest Budget (March 2023).

Figure 3: CPI inflation

The Headline Measures

The messaging for the Autumn Statement was clear: “backing business and rewarding workers for growth”. The headline measures therefore were:

- Cuts to National Insurance contributions - the main rate for employees will be cut from 12% to 10% from 6 January 2024.

- Invest for less – businesses will benefit from full expensing (invest for less) becoming permanent.

- Maintaining the triple lock for pensions – meaning the state pension will increase by 8.5% in April 2024.

- Welfare reform launched - benefits to rise but alongside stricter return to work expectations, especially for the hugely increased numbers of people unable to work due to ill health.

- Increase in the minimum wage - the national living wage will rise to £11.44 an hour, up from £10.42.

The counter narrative, as the Opposition set out, is that the higher fiscal headroom, that enables tax cuts and the Government to keep to its deficit promises, is predicated on real term cuts of between 2.3% - 4.1% a year after 2025 amongst ‘unprotected departments ’ following the last spending review period (and most probably following a general election).

It is also noted that the drop in National Insurance contribution rates is somewhat tempered by the ‘fiscal drag’ of frozen income tax? brackets that, by 2029, are expected to create 4 million new income tax payers and £45bn in tax receipts.

The outlook for the development industry

Supply Side Reforms

While the headline tax cuts will be welcomed ammunition for Conservative MPs in the run up to the election, the Chancellor will have also been concerned about the risk of re-stoking the temperamental inflation rate by putting more money in peoples’ pockets. To that end, he has looked to target his cuts and spending to promote growth: encouraging investment and expanding the nation’s productive capacity.

Often critiqued as being a break on investment and development, the planning sector was once again the target for a number of these supply side measures, with a particular emphasis on encouraging investment on energy infrastructure, commercial projects and new housing.

New funding was announced for the areas already earmarked for significant housing delivery in DLUHC’s Long-Term Plan for Housing published in July. As part of the proposals, housing delivery in Leeds and East London’s Docklands will be accelerated, while a new ‘urban quarter’ will be delivered in Cambridge.

Additionally, a new £110 million Local Nutrient Mitigation Fund to help unlock development sites currently constrained by nutrient neutrality rules by offsetting nutrient pollution from housing development. DLUHC estimate that the funding will help to unlock 40,000 homes over the next five years and will be welcomed in areas that have seen stasis since the nutrient neutrality decisions.

A third round of the Local Authority Housing Fund will also begin in 2024, providing £450 million to assist local authorities in obtaining affordable housing for those on resettlement schemes. It is estimated that the fund will help to provide a further 2,400 affordable homes across the UK.

Aside from the promises of new funding were proposals to reform the planning system for commercial and infrastructure projects. At the centre of these plans was the proposal for an Action Plan to halve the time to build new grid infrastructure to seven years and accelerate the UK’s movement towards net zero.

Proposals incentivising households living close to new energy infrastructure to accept developments, by providing money off their energy bills, and reforms to the grid connection process to remove wait times for significant energy infrastructure projects were also introduced.

A new premium planning service for businesses in England will be set up, allowing businesses to pay extra to guarantee accelerated decision dates for major applications and fee refunds wherever these are not met.

The Government are also consulting on introducing a new Permitted Development Right that would allow for the subdivision of houses into two flats without requiring prior approval, to be introduced in 2024.

Levelling up and economic development

The Government announced further support for UK high streets by maintaining a freeze on business rates for small retail, hospitality, and leisure businesses which was introduced in the wake of the pandemic. However, the standard business rate multiplier will be uprated in line with inflation which will hike up rates for almost two-thirds of businesses on the high street.

Earlier this week, the Government announced the award of around £1bn in the third round of its flagship Levelling-Up Fund (LUF). The package was the first of the three rounds to be uncompetitive, with funding distributed to 55 high scoring but unsuccessful bids from Round 2 which concluded in August 2022. The focus of Round 3 has been on regeneration and transport orientated projects, with a further £100m of funding to be subsequently allocated to cultural regeneration projects. However, given the shifts in the macro-economic landscape and the high inflation since the searing heat summer of 2022, there are concerns over the financial viability of projects first put forward in Round 2. The allocation of LUF funding will only be confirmed after consultation with Councils and a re-scoping exercise to ensure the projects remain viable.

An expansion of the Levelling-Up Partnerships programme, which brings together public and private partners to deliver targeted Levelling-Up investment, was also announced. This included an £80 million package to expand the programme to four local authorities in Scotland, as well as a further £50 million to support regeneration in Bolsover, Warrington, Monmouthshire, North Norfolk, Eden, and the Isles of Scilly.

Following the launch of the third of 12 English Investment Zones in West Yorkshire yesterday, the Chancellor launched a further three Investment Zones in the West Midlands, East Midlands and Greater Manchester. The West Yorkshire Investment Zone will be focused around the region’s life sciences cluster while the others are targeted at promoting advanced manufacturing and have already received anchor investment from the private sector. As part of the launch, the Chancellor announced that the Investment Zones programme in England will be extended from five to ten years and that the investment and tax relief offered to each Zone by Central Government will also be doubled from £80 million to £160 million.

Further devolution deals were announced for the West Midlands and Greater Manchester Combined Authorities and include a commitment to implement a single funding settlement for both authorities at the next spending review. Level 3 devolution deals as set out in the devolutionary framework, were agreed with Greater Lincolnshire and Hull and East Yorkshire, while non-mayoral Level 2 deals were agreed for Cornwall and Lancashire.

Housebuilding

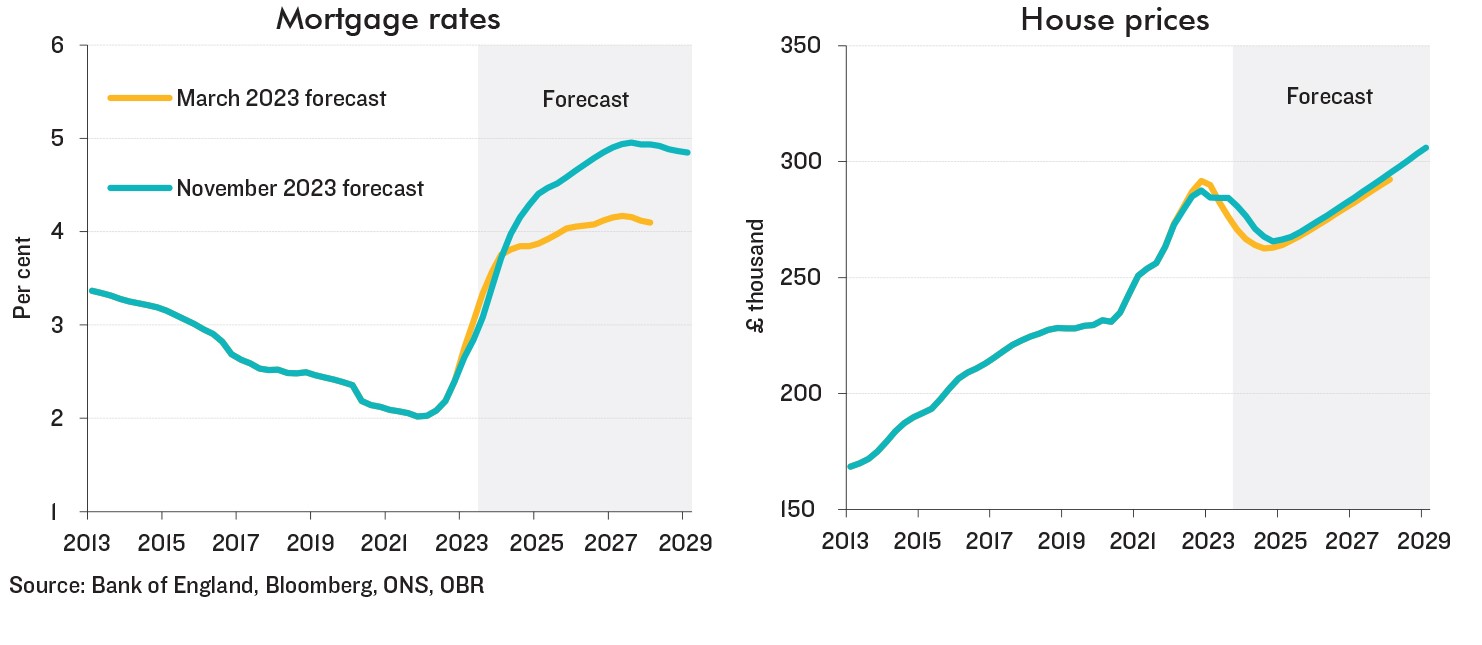

With the LURA recently passed offering new planning ‘hardware’ for change, and the upcoming NPPF update providing new policy ’software’, it is also notable that the OBR’s forecast for mortgage rates and house prices were also updated. The longer tail of high mortgage rates (figure 4) will be a significant concern to the industry and a reflection of the persistent inflationary forecast.

Figure 4: Mortgage rates and house prices

The combined effect for the development industry is acutely concerning, the OBR housebuilding forecast shows a significant drop in housebuilding both from today’s already low rates and March’s forecast. The result is that housebuilding is set to drop to 199,100 in 2025/26, almost 30,000 down on March’s forecast and just two thirds of the Government’s target (figure 5).

Figure 5: OBR housebuilding forecasts March vs. November

Conclusions

The Chancellor took the opportunity today to celebrate that the economy is primed for growth and used the resultant headroom to offer pro-growth tax cuts and investment boosting measures. This seemingly positive news however was cast against a troubling economic outlook in the OBR’s forecasts; together, persistent low economic growth, low productivity and lingering inflation will bring serious challenges for the remainder of this and the next Parliament.

This economic outlook and the drop in housebuilding shows the importance of the upcoming policy and legal changes to the planning system, through the NPPF and LURA, both to the development industry and as part of the Government’s push for economic growth more widely.