The idea of delivering discounted new homes to buy is not new. Six years ago, Starter Homes were making the headlines, but after being plagued with practical difficulties MHCLG’s Starter Homes guidance was shelved last year. Enter First Homes.

The problems faced by first-time buyers getting onto the property ladder is well documented, and no more so than in the past year post lockdown 1.0. The Stamp Duty holiday has pushed sales and house prices to record highs fuelled, as always, by demand far outstripping supply. On paper, First Homes could hold at least some of the answers; strictly only on offer to first-time buyers (helping see off competition from buy-to-let landlords and existing homeowners), they also come with a hefty discount on full market value (30+%) and, unlike other intermediate products like shared ownership, they don’t come with the burden of paying fees, maintenance costs and ground rents to a registered provider or other ‘landlord’. From a buyer’s perspective, it’s almost too good to be true. But what about from a planning perspective? Is it an answer to fixing the broken housing market? What might be the practical issues with its implementation?

Inherent tensions?

Our

previous blog sets out the nuts and bolts of what a First Home is and how it should be planned for and delivered. The key criteria are:

- That the first sale price no higher than £250,000 (or £420,000 in Greater London), after a minimum discount of 30% has been applied;

- That homes reflect the needs of first-time buyers in the local area (for example, they reflect the size of dwelling needed); and

- That First Homes are physically indistinguishable in quality and size from equivalent market homes (inter alia, that they reflect minimum space standards)

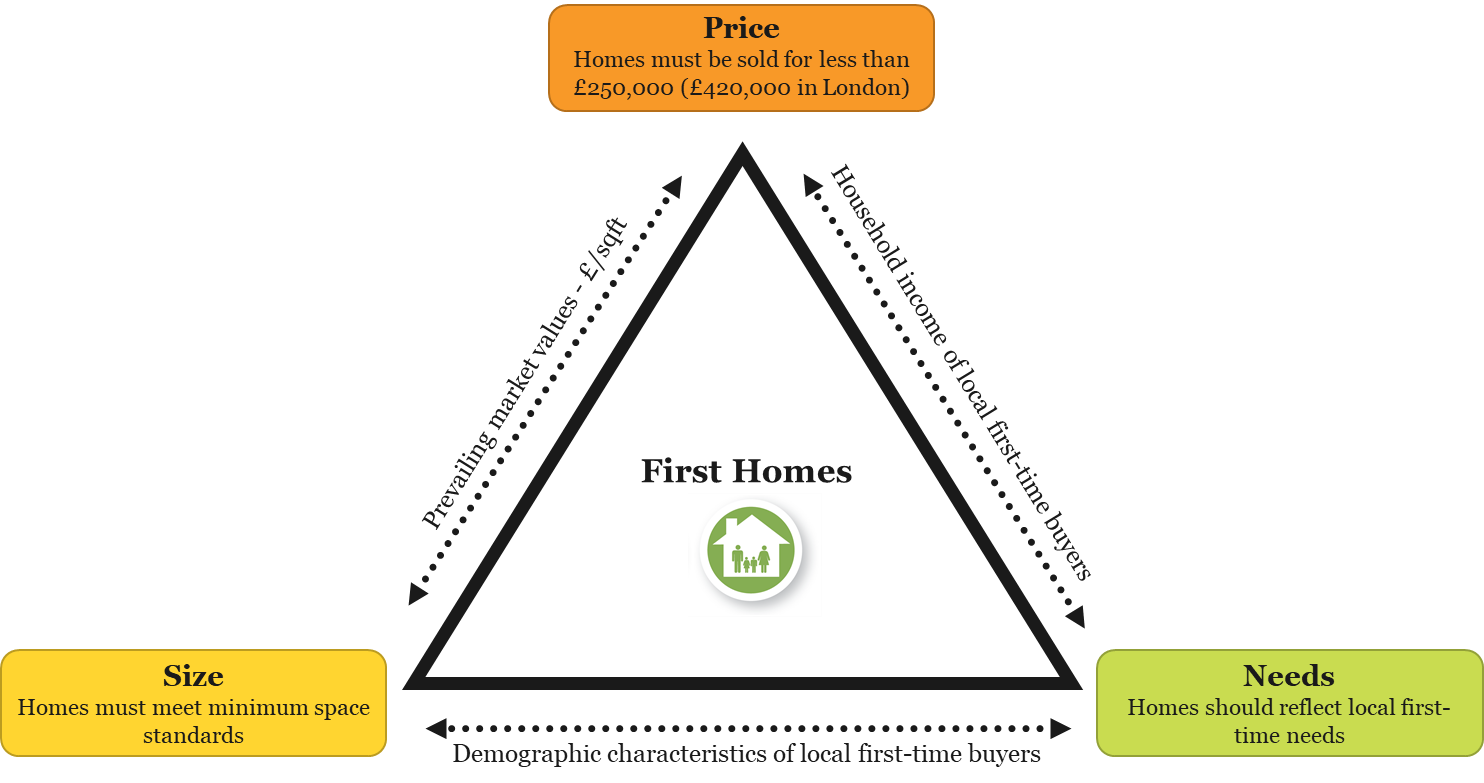

As is so often the case in planning, a one-size-fits-all approach usually has unintended consequences. There are likely to be some areas where all three criteria can be easily satisfied, assuming that these First Homes also do not undermine the overall viability of a scheme. But it is vital to recognise that the criteria are inter-related; if homes must meet the local needs of first-time buyers in the local area, then they need to be sold at a price which reflects local household incomes (which is also no more than £250,000) and be of a size which reflects needs (i.e. demographic characteristics of first-time buyers, such as whether they are couples or families). But price and size are not independent variables. Prevailing market values (£/sqft) will dictate the size of home that can be delivered for a given price, and vice versa, as shown in Figure 1. At the outset, it is important to recognise that the need to meet all three criteria is likely to create tensions in some areas, with one criteria needing to bend to the other two.

Figure 1 – Criteria for First Homes and relationships to each other.

Source: Lichfields

Housing affordability varies hugely across the country meaning First Homes are likely to have a variety of different impacts on first-time buyers and housing markets, depending on the local characteristics. To try and understand the issues different areas might face, we have looked at house prices and affordability in the entry-level

[1] second-hand market across England and compared this with what affordability

could be in those areas with First Homes, based on the price of entry-level new-build homes being discounted by at least 30%. For the purposes of this blog we have assumed first-time buyer households are couples (i.e. dual earner)

[2], and that they can afford housing where prices equate to no more than 4.5x their joint income

[3].

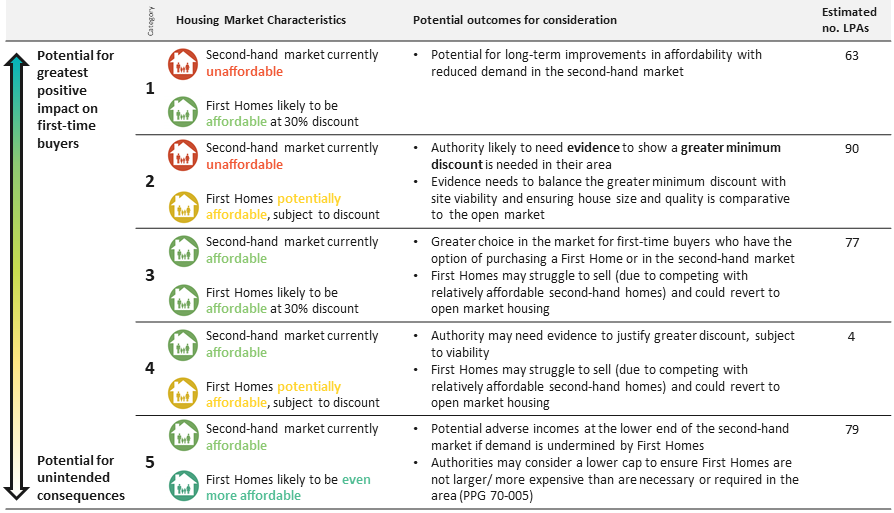

This has led us to five broad outcome typologies as summarised below.

Figure 2 - Typologies based on Housing Market Characteristics and potential outcomes for First Homes.

Source: Lichfields

Where can First Homes potentially have the biggest impact?

First Homes have the potential to have the greatest impact in areas where first-time buyers are currently priced out of the open market (at the entry-level) but where First Homes would be within reach, when the minimum 30% discount is applied. We estimate this represents around one in five authorities in England – around 63 in total.

Will the delivery of First Homes be achievable in the most unaffordable areas?

There are a significant number of authorities where first-time buyers are currently priced out of the local second-hand market and where First Homes – with the 30% minimum discount applied – would still be out of reach. We estimate this represents just under one-third of authorities in England – 90 in total.

In some areas the severity of affordability issues may lead to tension between the need to deliver homes that are locally affordable, whilst also being of an appropriate size to meet needs. This could leave authorities needing to; a) deliver homes which are smaller than local first-time buyers need in order to achieve a final sale price below the cap; or b) enforce an even greater discount to bring the price of those homes below the cap (which would require evidence and bring further questions around viability).

If size needs to flex, this draws into question whether the demand will be there for such small units. The average age of first-time buyers is now 32 (and higher in London)

[4]; at an age where the buyer may have (or be wanting) a family, would the desire to get on the property ladder be so strong that a potentially very small unit would do? And is there a risk that, in such areas, we could see First Homes built which are ultimately unable to be sold, and which ultimately end up reverting to open market housing?

Alternatively, if size is fixed, and discounts of such significance need to be applied to ensure First Homes are affordable and below the £250,000 cap, this could impact the viability of the scheme more widely. A common point of negotiation concerning viability is the overall quantum of affordable housing provision, and this could see situations where the discounts required to deliver First Homes undermine the overall provision of affordable housing, most notably affordable rent

[5].

What about where the second-hand market already offers affordable options for first-time buyers?

Our research found that a total of 160 authorities have entry-level homes in the second-hand market which are at or below 4.5x earnings (for a dual-earner household). In these areas, it raises the question that if the second-hand market already provides a suitable solution to most first-time buyer needs, then First Homes might not be the best way of meeting overall housing needs, especially if they are displacing other tenures which might be desperately needed, such as affordable rent.

Notwithstanding this, these 160 authorities fell into three distinct categories:

- Authorities where First Homes would be similar in affordability terms to the existing second-hand market, reflecting the premium of new homes. This would increase choice for first-time buyers in the local area, but continues to raise the question of whether it is the most effective way of meeting overall needs if it displaces other tenures which are needed;

- Authorities where, although the second-hand market is currently affordable, the cost of a First Home (at the minimum 30%) is potentially unaffordable. Admittedly this is only a handful of authorities but suggests that new build housing in these areas carries a substantial premium over existing housing. In these areas, authorities may need to consider mandating a discount greater than 30%, and developers may find themselves having to offer an even greater discount to this minimum in order to sell the product (and if prices are not brought down to a locally affordable level, this could risk those First Homes being left unsold, and ultimately reverting to open market housing); and

- Authorities where second-hand market housing is already affordable and the introduction of First Homes could potentially be even cheaper than the second-hand market. These areas are potentially at risk from the local second-hand market ‘bottoming out’ if demand dries up, and authorities may need to bring in restrictions to ensure First Homes are not built unnecessarily large or expensive

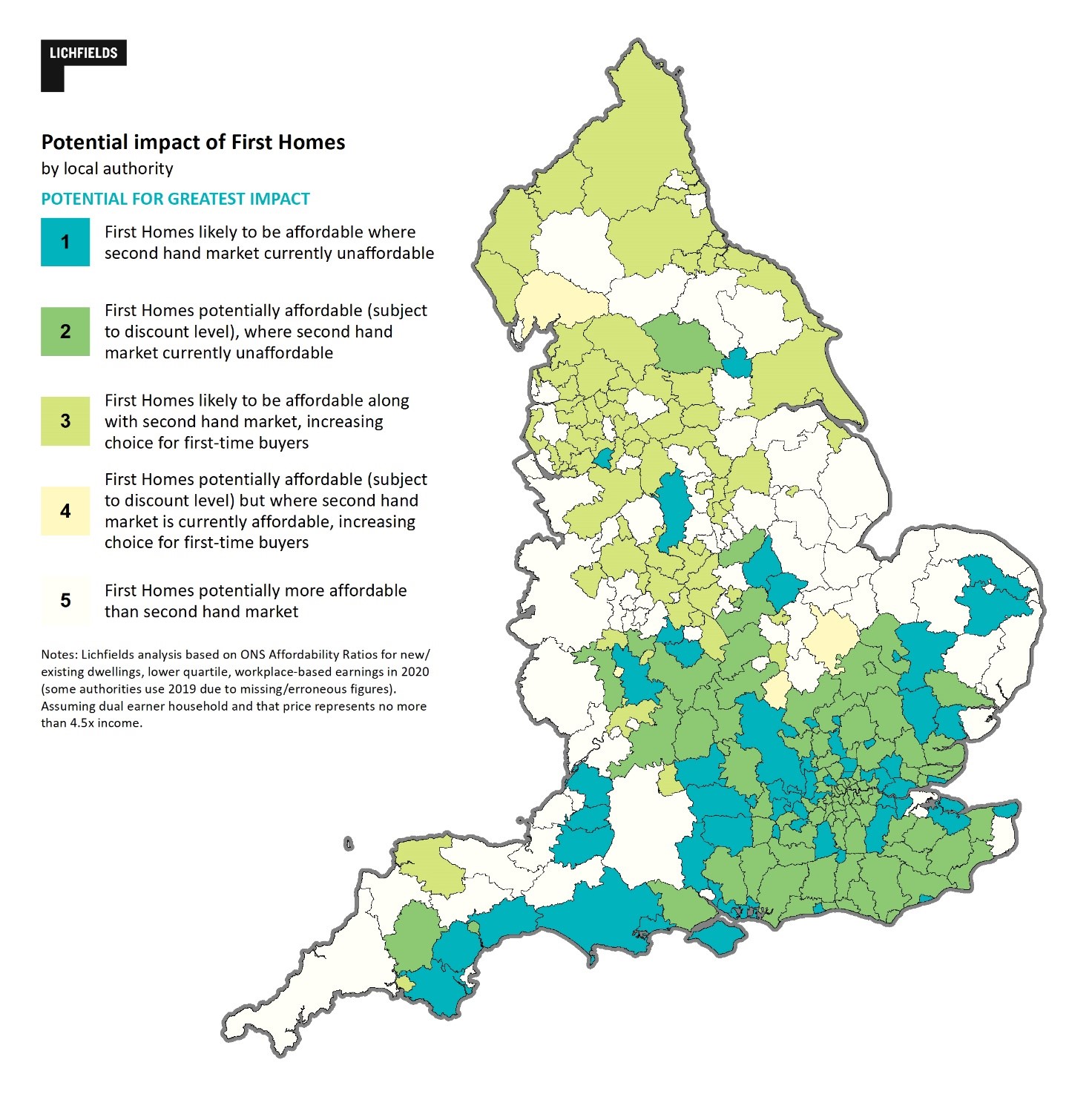

The potential impact of First Homes, based on the five categories of housing market characteristics, are shown in Figure 3 below.

Figure 3 – Authorities by potential impact of First Homes.

Source: Lichfields analysis

Concluding thoughts

For first-time buyers currently priced out of their local market, First Homes may be seen as welcome. And undoubtedly, in some parts of the country, First Homes are likely to be able to be delivered at a price point which is affordable locally, within the price cap, at sizes/types which reflect the needs of local first-time buyers, all without undermining the wider viability of schemes.

But many areas, particularly those at the top end of the market, could face difficulties in balancing the need to deliver First Homes within the prescribed price cap, which are also affordable to local residents, whilst being of an appropriate size to meet local needs, all without undermining viability.

The lower end of the market is equally not immune from potential issues, particularly if First Homes undermine the local second-hand market, and authorities might need to consider an even lower price cap to ensure First Homes are not unnecessarily large or expensive.

Questions also remain as to whether mandating 25% of affordable homes as First Homes represents an appropriate target if it displaces other tenures in favour of simply increasing choice for first-time buyers.

The First Homes policy will undoubtedly bring new challenges for local authorities in the production of evidence for their local area, to not only assess needs, but also to set appropriate discounts triangulating price, need and size.

As ever, when blunt policy concepts meet the reality of local housing markets and the scrutiny of the planning system, complexity and hard work results.

[1] ‘Entry-level’ is taken as lower quartile prices and workplace-based earnings. Based on ONS data for affordability of new-build and existing dwellings for 2020. For Gosport and Portsmouth, 2020 new build price data is missing so earlier data is applied. For Gravesham the new build price for 2020 appeared erroneous and therefore the 2019 figure was used. Data uses overall lower quartile prices for new-build and existing dwellings rather than mix-adjusted prices or prices per sqft (which are not readily available) hence is not a perfect measure of potential First Home affordability.[2] On the basis of the English Housing Survey finding 2019/20 that 76% of first-time buyer households are couples[3] This is broadly consistent with around a 10% deposit and a mortgage which is 4x annual income[4] See English Housing Survey 2019/20[5] Paragraph: 015 Reference ID: 70-015-20210524[6] This could occur, for example in an area where housing is already highly affordable, and the discount placed on First Homes means that larger housing (than is otherwise needed) can be delivered whilst still being affordable to local first-time buyers.Photo by Richard Horne on Unsplash