It has been well documented that the retail and leisure sector in the UK has been through a turbulent period, compounded by Covid-19 and its aftermath. However, what has the impact been upon spending within the sector and what does the future hold?

Spending forecasts sign-post short-term turbulence and a slow recovery

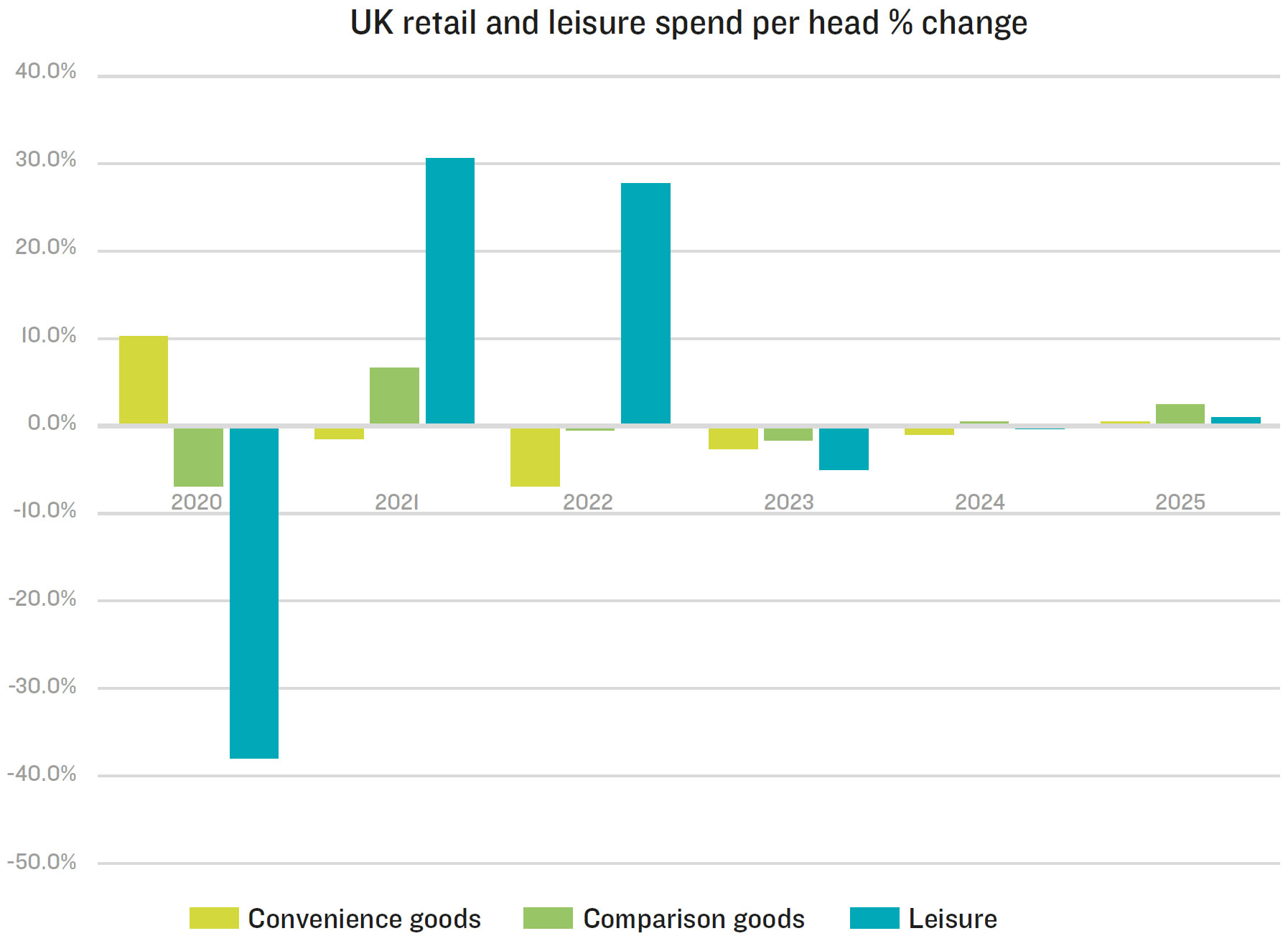

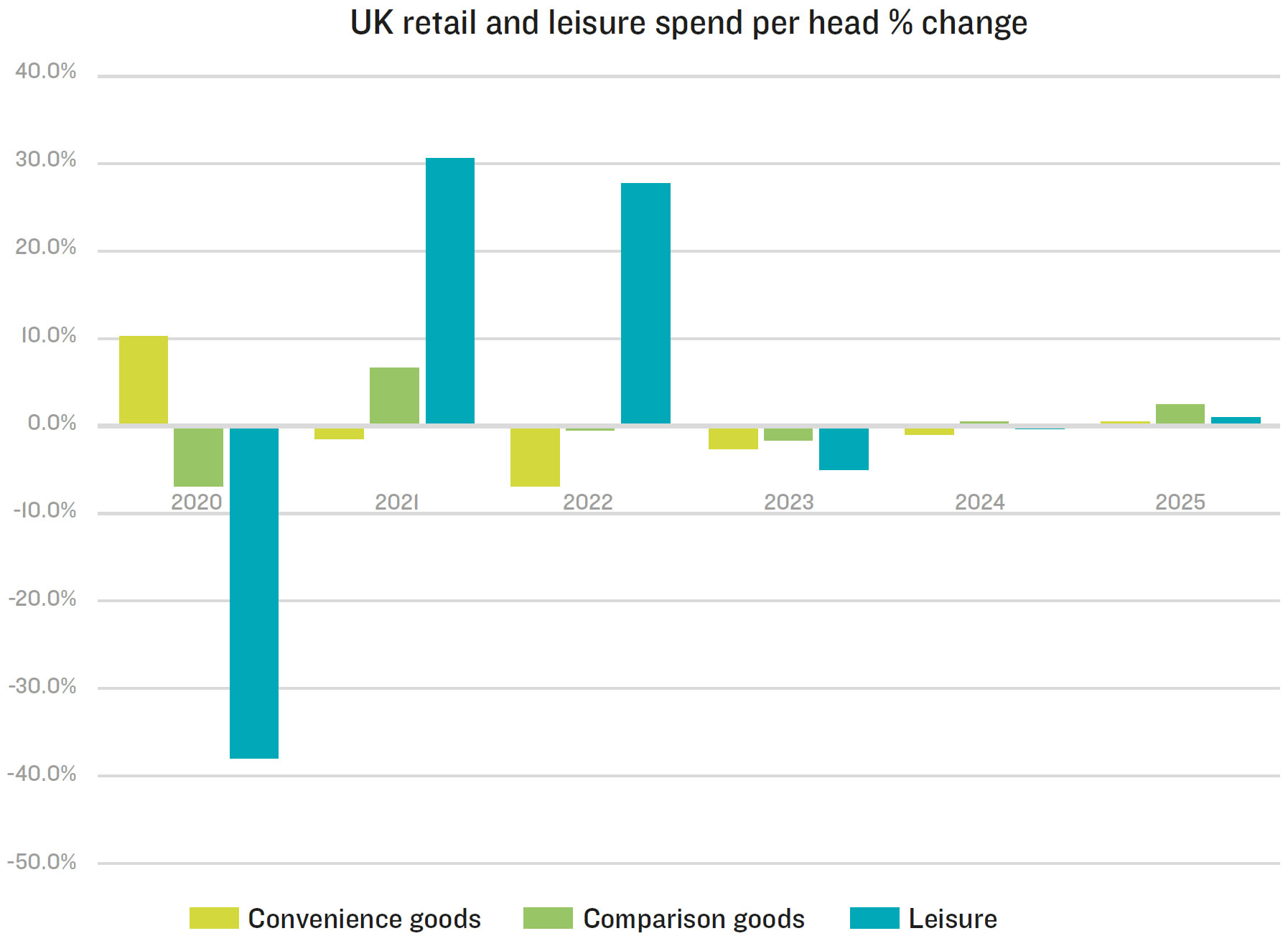

The UK retail and leisure sectors have experienced significant turbulence since the Covid-19 pandemic began in early 2020. The convenience (food grocery) sector benefitted during the lockdowns in 2020 with over 10% growth in expenditure, whilst the comparison goods retail and leisure/hospitality sectors suffered. The average shop vacancy rate in town centres across the country increased from around 12% to almost 15% between 2020 and 2022, with many businesses failing to re-open after the lockdowns.

During 2021/2022, there was a period of readjustment with expenditure growth in the convenience goods sector reversed. The leisure sector recovered strongly with 66% growth in expenditure per head during 2021/22, as people returned to pubs and restaurants to eat and drink and spent less in supermarkets. Growth in the comparison goods retail sector was more modest – although very welcome - at around 6%.

The latest Retail Planner Briefing Note from Experian sets out their forecasts on future changes in retail spending per person. To help illustrate both the impact of the pandemic upon retail spending and Experian’s views on how personal expenditure is likely to change going forward, their recommended growth rates are shown in the figure below.

Source: Experian – February 2023

The latest forecasts suggest a small reduction in expenditure during 2023 across all three sectors with sluggish growth thereafter in 2024 and 2025. With the continued growth in home shopping, the short-term market outlook for the high street will be challenging. Not least given that the above growth rates are before any allowance is made for continued growth in internet shopping, which will take a significant chunk out of the spending actually available to physical shops.

What does this mean for town centres?

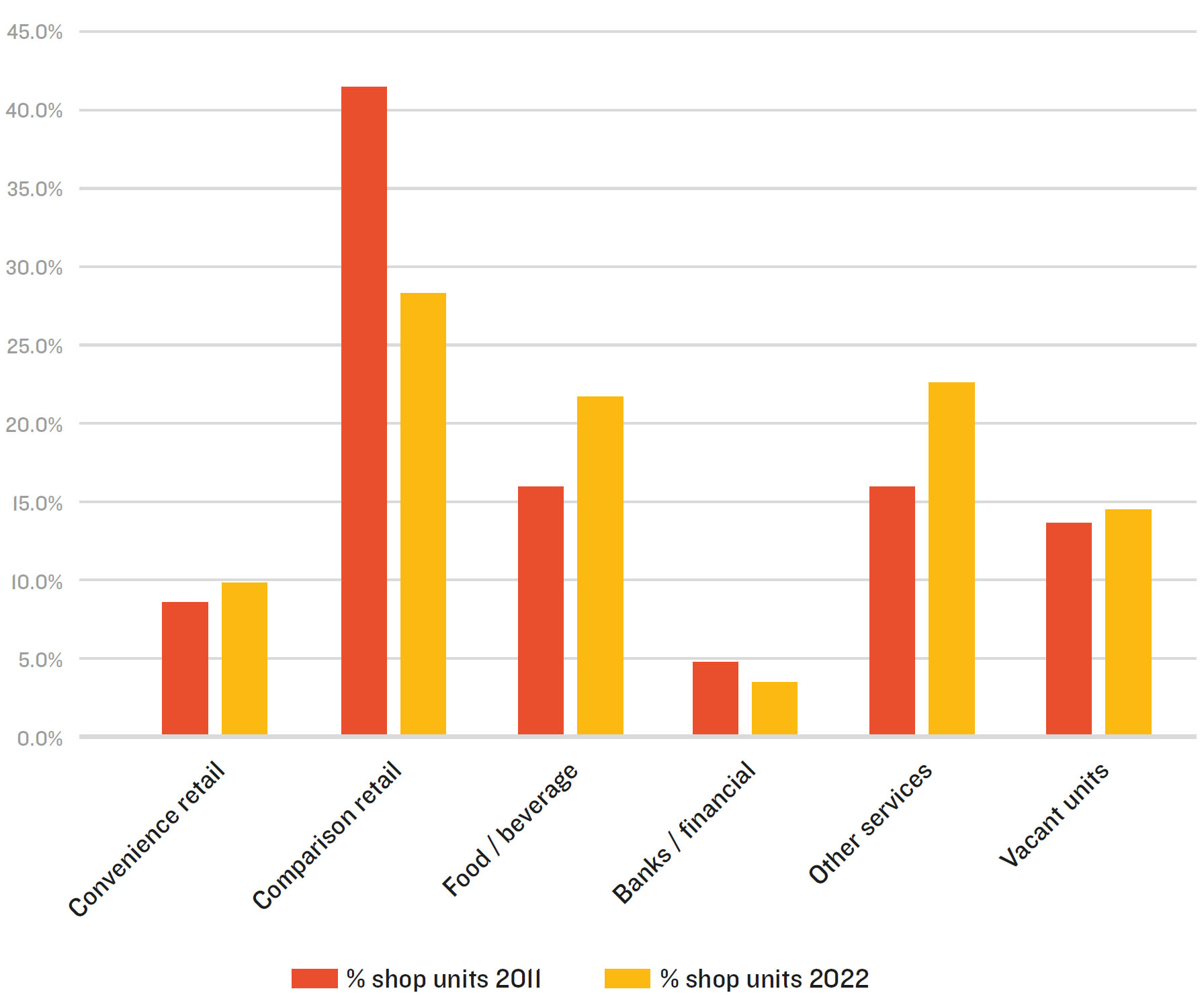

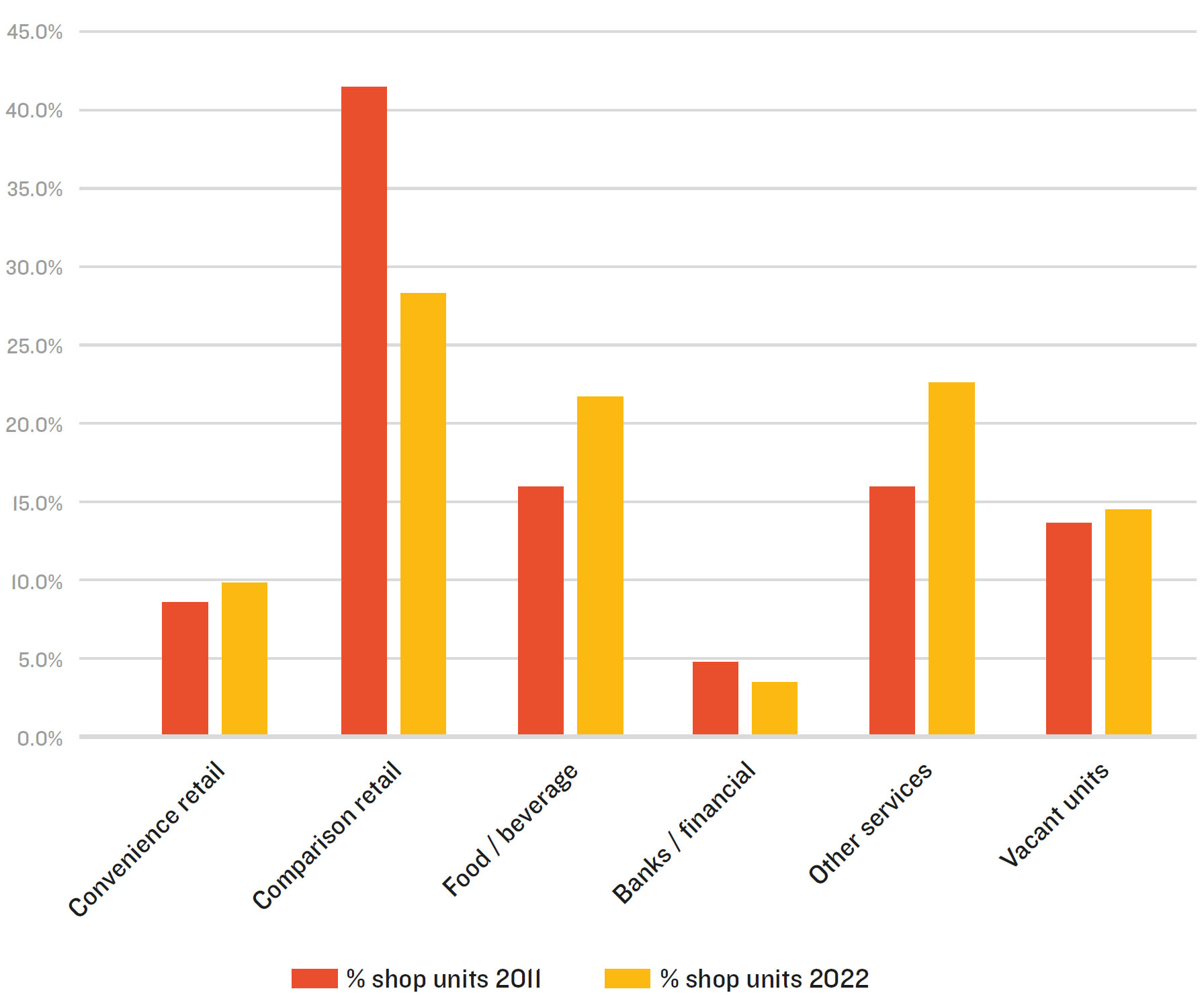

These short-term trends are not entirely new but have been exacerbated by recent circumstances. Although the proportion of convenience goods (i.e. food/grocery) retail uses has increased slightly – buoyed by the number of smaller format stores opened by the large national operators - comparison goods retailing in town centres has declined steadily over the past decade. The proportion of town centre shop premises occupied by comparison goods retail outlets has reduced significantly - from over 41% in 2011 to only 28% in 2022. The banking/financial sector also reduced significantly. Conversely, the proportions of food/beverage and other non-retail services grew during this period.

The decline in comparison goods retail outlets has been experienced across all retail sub-sectors, but particularly significant for certain sectors, including clothing/footwear and books/stationery. Experian’s latest expenditure projections suggest that these trends are likely to continue. As indicated above, expenditure growth in the leisure sector is expected to be much lower in the next few years and local authorities will need to continually refine their strategies to seek to avoid, and where necessary, respond to further increases in vacancy rates.

Retail is still very much alive

There will be locational differences with areas with high population growth or existing gaps in provision likely to be most resilient. Some sectors, including discount retail (both food and non-food) are continuing to expand, and it is important that local authorities are able to respond positively to these proposals – directing them to the locations which will best support their town centres. Aside from traditional retail, research from LDC confirms that fast food takeaways, beauty salons, nail salons and barbers were all in the top ten fastest growing categories in 2022, based on net change in units. This is not necessarily something to base a strategy around but certainly helpful to smaller centres around the country, in bringing increased diversity of use and new drivers of footfall.

But town centre strategies cannot stand still

Winners and losers will emerge as centres compete for market share. However, those areas which plan pro-actively to deal with the above challenges have the best chances of success. Town centre strategies should continually be revisited, taking into account changes in consumer demand – the need to reduce reliance upon retail is accepted wisdom but it is not enough to rely on traditional leisure activities (and particularly food and beverage uses) either. A more imaginative approach is therefore essential.

Lichfields has helped a number of authorities develop strategies to deal with the challenges facing their centres. In Stockton-on-Tees, we have secured outline planning permission for the redevelopment of a former shopping centre – acquired by the Council to address a longstanding vacancy problem – to provide a new urban park and mixed use development, connecting the wider town centre with the River Tees. Also on Teesside, and after helping secure £25m Town Deal funding for a package of measures in Redcar, Lichfields obtained permission for a new cultural and leisure hub, along with public events space - providing a year-round attraction with spin-off benefits for the wider town centre.

Any new strategies should be bespoke to each town’s needs, also taking into account market demand. Retail may still be part of the solution, not least where there is latent demand in the discount sector, and local authorities must ensure they have the resources to deal with such proposals. However, the latest forecasts from Experian confirm that it can no longer be the central feature. Leisure will play a part, but a simple glance at the definition of ‘Main town centre uses’ in the NPPF Glossary tells us there is a much wider range of uses which should come into the equation.

This includes offices, hotels and conference facilities, theatres, museums and/or concert calls. Whilst not strictly a main town centre use in planning terms, housing will inevitably play a role in most centres, and outdoor space offers the flexibility to perform a range of functions. Up to date evidence on retail and leisure spending will always be important but local authorities must take a much broader outlook to genuinely support their centres.

Image credit: Jonny Gios via Unsplash