The London Evening Standard reported last week that tourism in the Capital is “roaring back to life” amid a visitor surge this year and could surpass 2019 pre-Covid levels. The article notes that two million more international visitors are forecast to arrive in London in 2023 compared to last year, injecting an extra £674 million in revenue. Analysis by VisitBritain[1] shows that 2022 saw London benefit from a significant tourism bounce back that laid the foundations for this year’s successes, with visitor numbers up 141% last year compared to 2021. But is this recovery in international visitors being experienced in other parts of the UK?

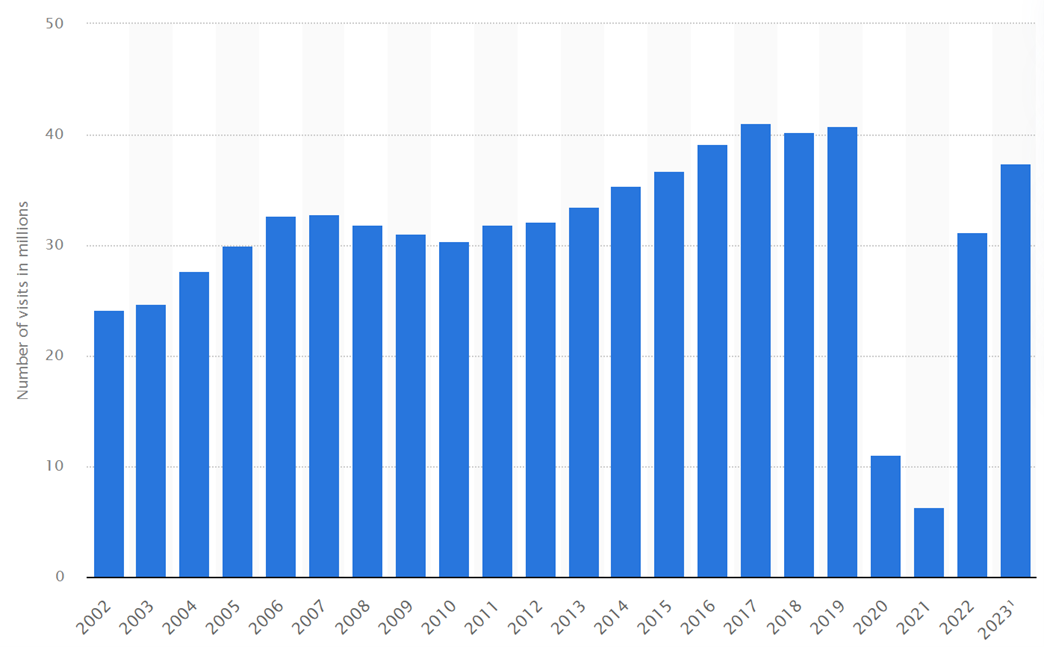

At the macro level, 2022 statistics show the UK welcomed 31.2 million of inbound visits

[2]. This is a significant rebound off the back of two years of extremely low inbound visits caused by COVID-19 restrictions (Figure 1), although is still 24% below 2019 visitor numbers.

Figure 1: Number of Overseas Resident Visits to the UK (2002 to 2022) and the Forecast for 2023

Source: Statistics 2023

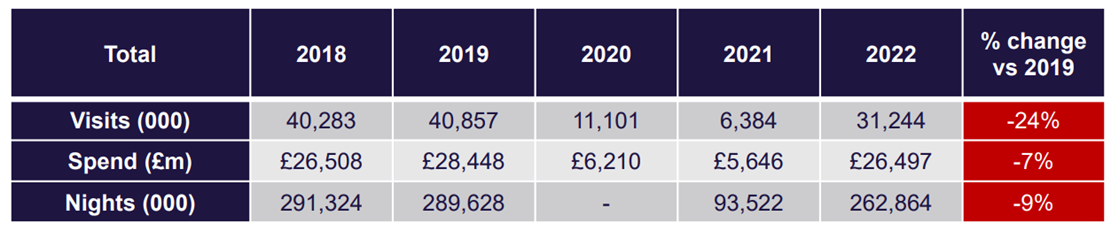

While overall visitor levels were 76% of that reported in 2019, spend has recovered at a faster pace (Figure 2). Inbound visitor nights spent in the UK are also on a steeper upwards curve but still down on pre-Covid 2019 levels. Demand for tourism, like all exports, is impacted by the exchange rate, and a weaker pound last year undoubtedly helped encourage more visitor spending and longer stays.

Figure 2: Inbound Visits, Spend and Nights (2018 to 2022)

![]() Source: VisitBritain

Source: VisitBritain

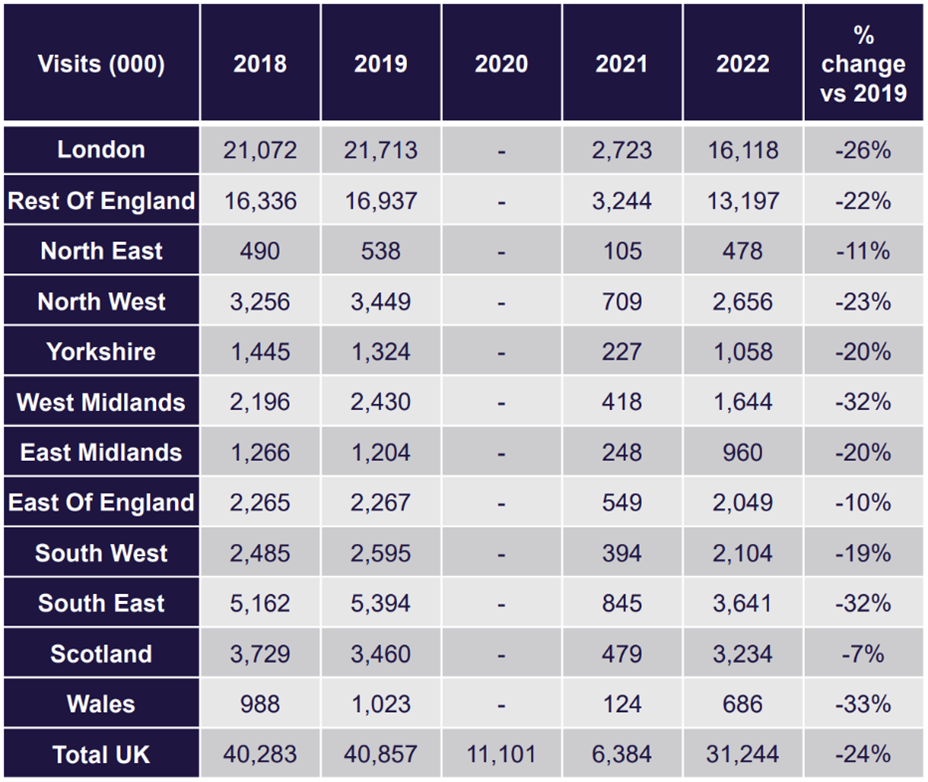

Focussing on the metric of inbound visitor numbers, the evidence shows that visits to all UK nations and regions did not quite recover to pre-COVID 2019 levels in 2022. Of the 31.2 million inbound visit to the UK in 2022, London received a little over half (52%). This is in line with the proportions of visits received prior to COVID-19. The most visited England regions (excluding numbers for London) in 2022 were the South East (3.6 million visits), the North West (2.7 million visits) and the South West (2.1 million visits). Scotland posted the strongest recovery in 2022, compared to 2019 (though down 7%) at 3.2 million visits. Wales is bottom of the league, receiving 686,000 visits in 2022 (33% below 2019 levels). In July this year the Welsh Affairs Committee published a report “Wales as a global tourist destination” highlighting that the country is underperforming in attracting international visitors compared to the rest of the UK and calling on UK Government bodies to do more to promote Wales abroad.

Figure 3: Inbound Tourist Visits by Region (2018 to 2022)

Source: International Passenger Survey by the ONS. All values and percentage changes in spend are in nominal terms

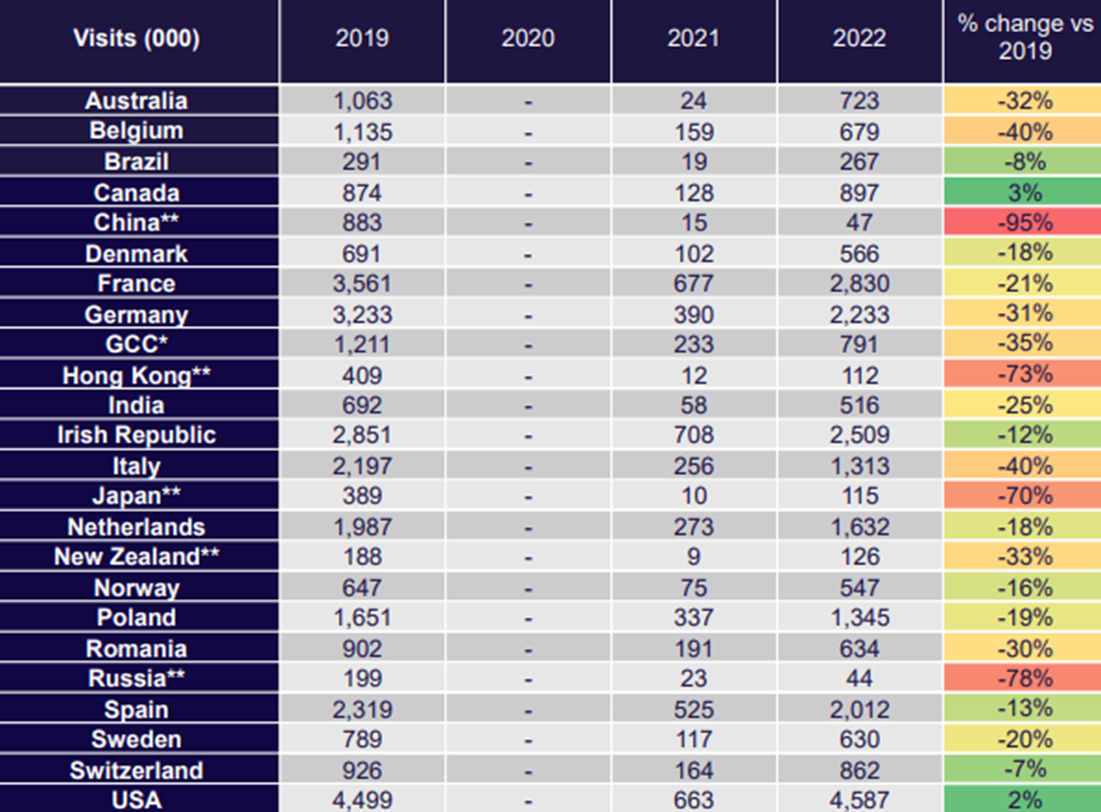

Below is the breakdown of country of origin for visitors to the UK, including the percentage change in visits since 2019. Not too many surprises here although I’m not sure what we’ve done to ‘offend’ the likes of Belgium and Italy. Visitor numbers from the USA last year were comparatively strong, prompted by a weaker pound against the dollar – research has shown that last summer was the first time Americans spent almost as much as Europeans on holidays in the UK

[3].

Figure 4: Inbound Visits to the UK 2019 to 2022

Source: International Passenger Survey by the ONS 2019 & 2022

The latest inbound tourist visitor forecast to the UK for 2023 is 37.5 million visits, 92% of the 2019 level

[4]. Inbound visitors are forecast to spend £30.9 billion, 109% of the 2019 level in nominal terms.

So the country’s tourism recovery is certainly gaining pace and the indications are that we should return to pre-pandemic levels in the not too distant future.

In July 2021 the Government published its Tourism Recovery Plan (TRP) to spur on a return to pre-pandemic trading at the earliest opportunity and set a course for sustained growth in the sector that included addressing pre-existing issues that were prevalent long before COVID struck. The TRP referred to Oxford Economics’ prediction at the time that tourism in the UK would not return to 2019 levels of volume and expenditure until 2025. The TRP was more optimistic, setting a target for recovering inbound visitor numbers by the end of 2023.

In March this year, the Government in its report “The Tourism Recovery Plan: Update on Delivery” reviewed the sector’s performance against all the objectives set by the TRP. For international tourism, it has reassessed the target given the challenges experienced in 2021 and, to an extent, 2022; the Government’s aim is now to recover 2019 levels of inbound visitors and spend by the end of 2024, still a year earlier than Oxford Economics’ prediction. I’m optimistic they’ll achieve that and quite possibly better it.

In my previous blog on “

staycations” I outlined some of the issues preventing the domestic tourism sector from realising its full potential. In its TRP report “

Update on Delivery” the Government identifies that similar issues are impacting international tourism. Key ones include:

|

|

Seasonality: reducing the productivity of tourism businesses outside of peak holiday periods. At Lichfields, our leisure and tourism clients are trying to address this longstanding issue by investing in new visitor accommodation and attractions to encourage short break, multi-day visits spread more across the year, building into the ‘shoulder’ months and increasing guest numbers in the more traditionally ‘off-peak’ periods.

|

|

|

Concentration of tourism “hotspots”: in particular the dominant market in London (referenced earlier) and the South East, hindering the benefits of tourism being spread around the country. Addressing geographic dispersal is vital to levelling up and supporting local communities across the UK, as well as addressing the negatives associated with “over tourism” in some areas.

|

|

|

An overcrowded and disparate landscape of regional tourist boards: their sheer number inhibiting strategic coordination and a joined-up approach.

|

|

|

Increased international competition: reducing the UK’s market share. Pre-pandemic the UK dropped from being the sixth most visited country in the world to 10th in 2019. Marketing and promotion of the UK and ease of access for visitors will be key to helping climb back up the ‘place to visit’ ladder.

|

|

|

Labour shortages: suppressing business’ viability.

|

Overall, there are clearly challenges in the sector still to be overcome, many unrelated to the effects of the pandemic but there is also cause for optimism. International tourism has rebounded quicker than many anticipated and this is making an important contribution to the country’s economic performance at a time of continuing economic uncertainty.

[1] VisitBritain, Visitor Attraction Trends in England 2022, July 2023

[2] VisitBritain, Quarterly Inbound Update & Full Year 2022, May 2023

[3] https://www.investorschronicle.co.uk/news/2023/05/03/will-a-stronger-pound-put-off-foreign-tourists/

[4] VisitBritain: https://www.visitbritain.org/2023-tourism-forecast#:~:text=In%202022%2C%20visitors%20spent%20%C2%A3,data%20please%20visit%20this%20page.

Image credit: Josè Maria Sava on Unsplash