I was delighted to have been invited to speak at the North East Shaping the Region event at the end of last year. The event, regularly hosted by Lichfields with other regional partners Turner & Townsend and Muckle LLP, aims to provide insights and stimulate thought across a range of key themes. The most recent event focused on sustainability and regeneration, two topics at the forefront of both regional and national strategy ambitions, reflecting the Net Zero and Levelling Up agendas.

My presentation considered:

-

The regeneration opportunities that can be unlocked through brownfield housing delivery;

-

The role of brownfield housing in supporting housing delivery targets as well as local regeneration and economic ambitions;

-

The challenges facing brownfield development; and

-

The funding opportunities available to accelerate delivery.

The purpose of this blog is to provide insights into the current opportunities that can be unlocked through brownfield housing development and the interventions available for supporting and accelerating brownfield housing delivery. In the weeks since delivering the presentation, there have been several relevant Government announcements, including:

-

The announcement of the opening of the final application period for the Brownfield Land Release Fund Round 2 (BLRF2)

[1];

-

The release of the National Planning Policy Framework (NPPF)

[2]; and

-

Homes England research

[3] into quantifying the social value associated with brownfield development.

National Housing Context

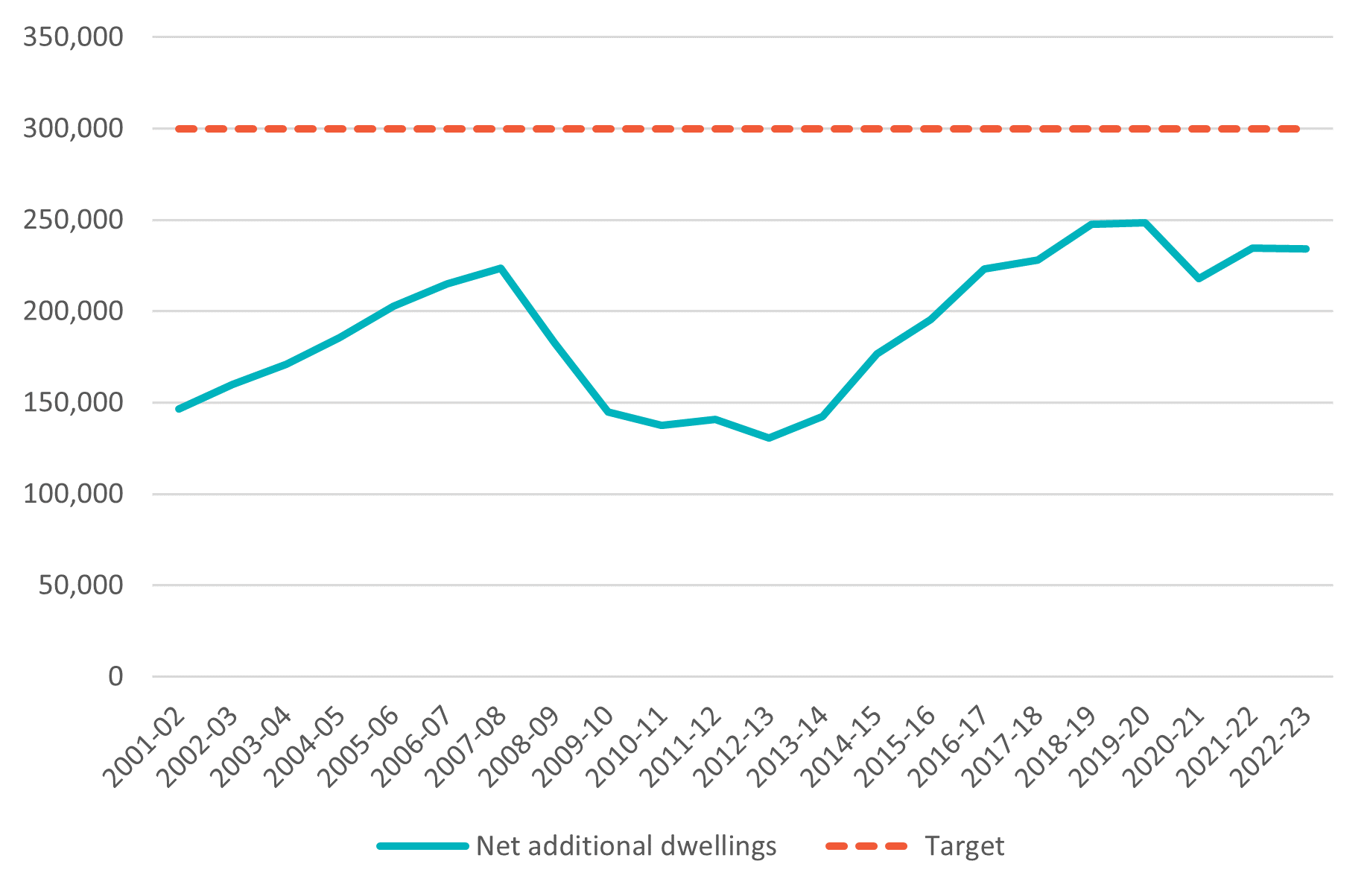

In the 2019 Conservative Manifesto, the Government pledged to deliver 300,000 homes per year by the mid-2020’s. A review of latest housing supply data

[4] shows that housing delivery has consistently fallen short of this target. Emerging Government policy is seeking to focus new housing delivery on urban and brownfield sites.

Figure 1 Trends in net additional dwellings, England, 2001-02 to 2022-23

Source: Net additional housing supply, ONS (2023)

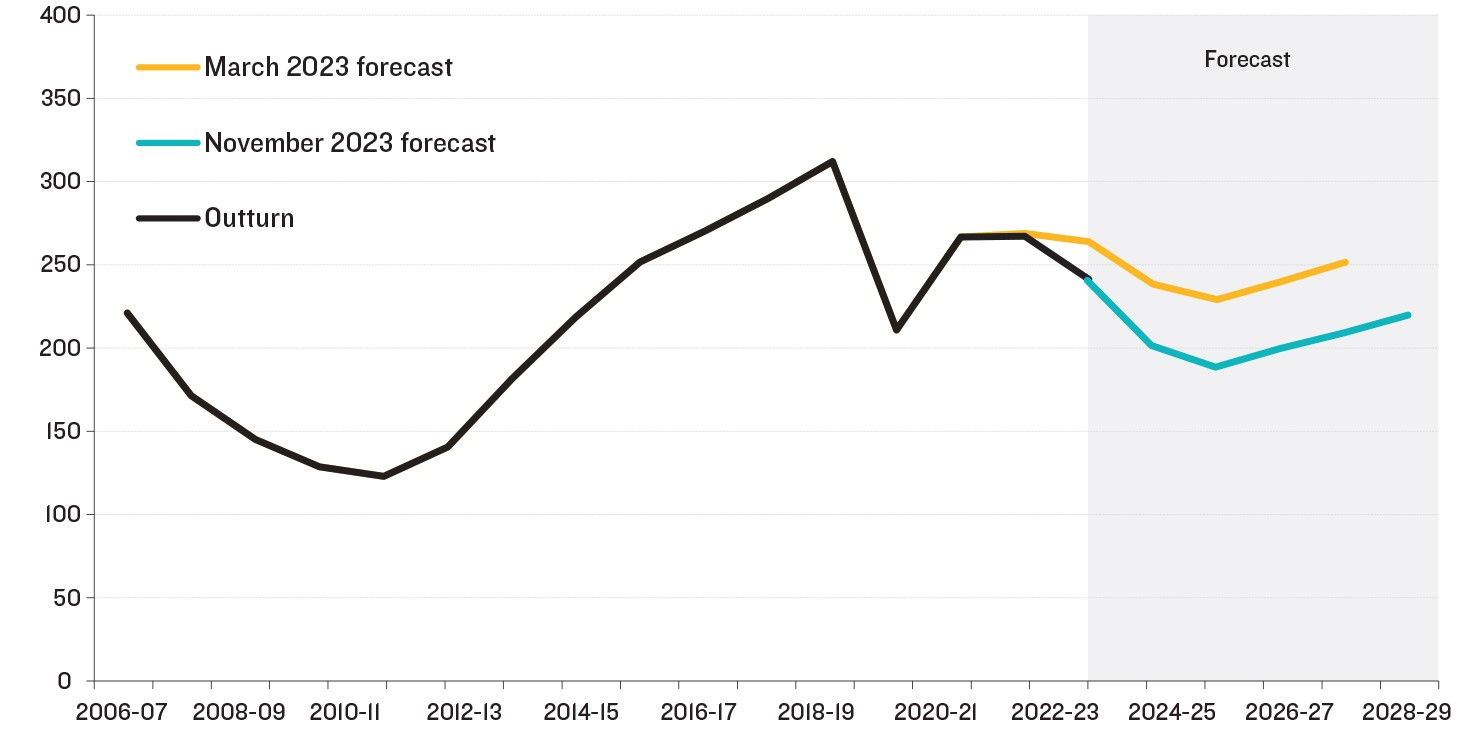

Forecasting, undertaken by the Office for Budget Responsibility (OBR)

[5], indicates that this trend is expected to continue, underpinned by delays to Local Plans, rising construction material costs and high interest rates.

Figure 2 OBR housebuilding forecasts March Vs November

Source: ONS, OBR (2023)

In May 2023, a House of Commons Research Briefing

[6] was published, exploring how the undersupply of housing could be tackled. The findings suggest that whilst it is not possible to solve the housing undersupply crisis with brownfield housing alone, developing brownfield sites can play a significant role in tackling the issue.

This sentiment is echoed within the revised NPPF (December 2023). Chapter 11 sets out the planning policy position, noting:

‘Strategic policies should set out a clear strategy for accommodating objectively assessed needs, in a way that makes as much use as possible of previously-developed or ‘brownfield’ land.’

The NPPF also suggests that planning policies and decisions should:

‘Give substantial weight to the value of using suitable brownfield land within settlements for homes and other identified needs, and support appropriate opportunities to remediate despoiled, degraded, derelict, contaminated or unstable land.’

The National Context

Research undertaken as part of

Lichfields' Banking on Brownfield insight

[7] (2022), reviewed Local Authority Brownfield Land Registers (BLR). It identified that across the UK there were:

-

23,500 brownfield sites;

-

Comprising 36,000 hectares of land; and

-

Maximum net capacity of up to 1.4 million homes, equivalent to 31% of housing need over 15-years.

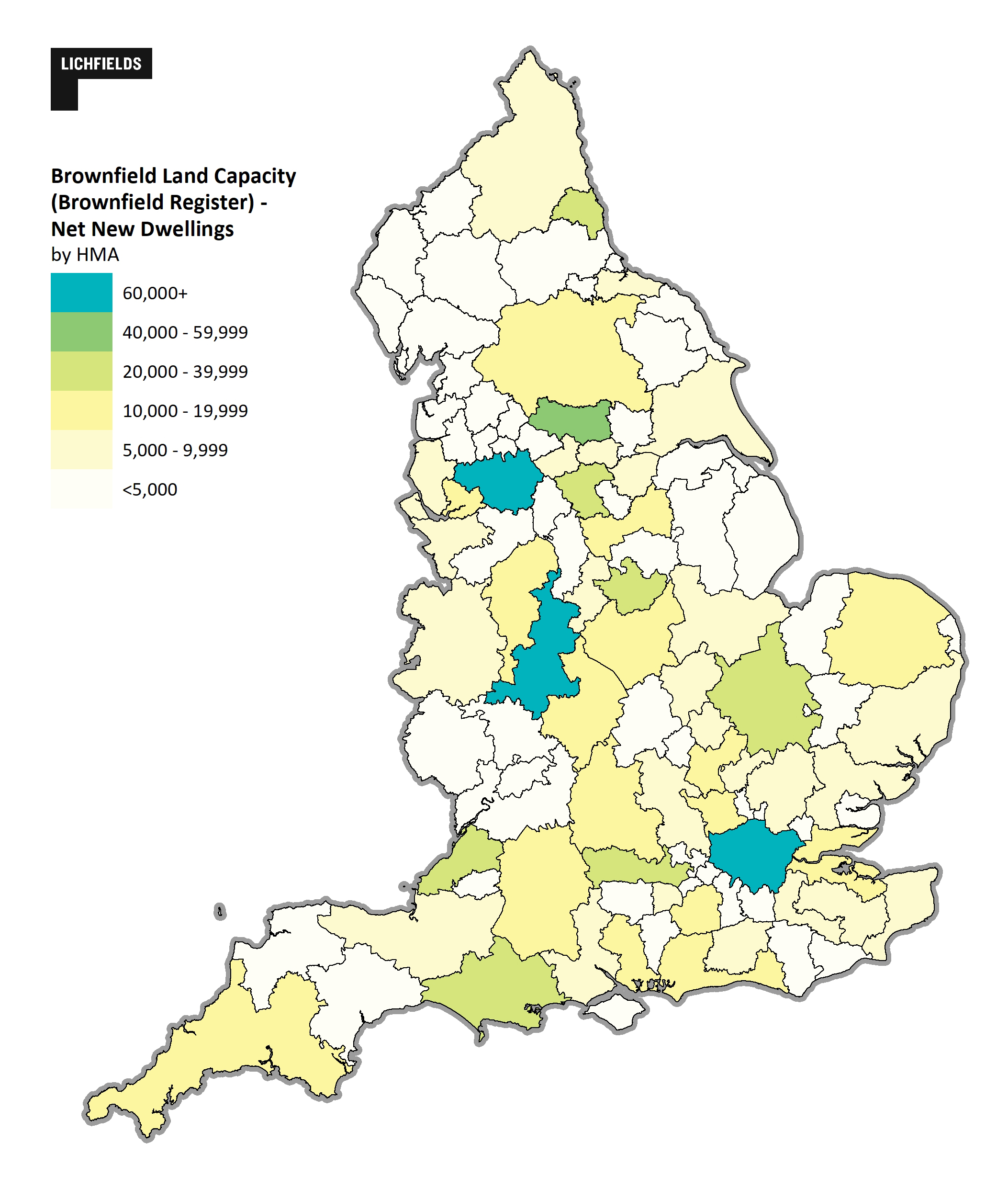

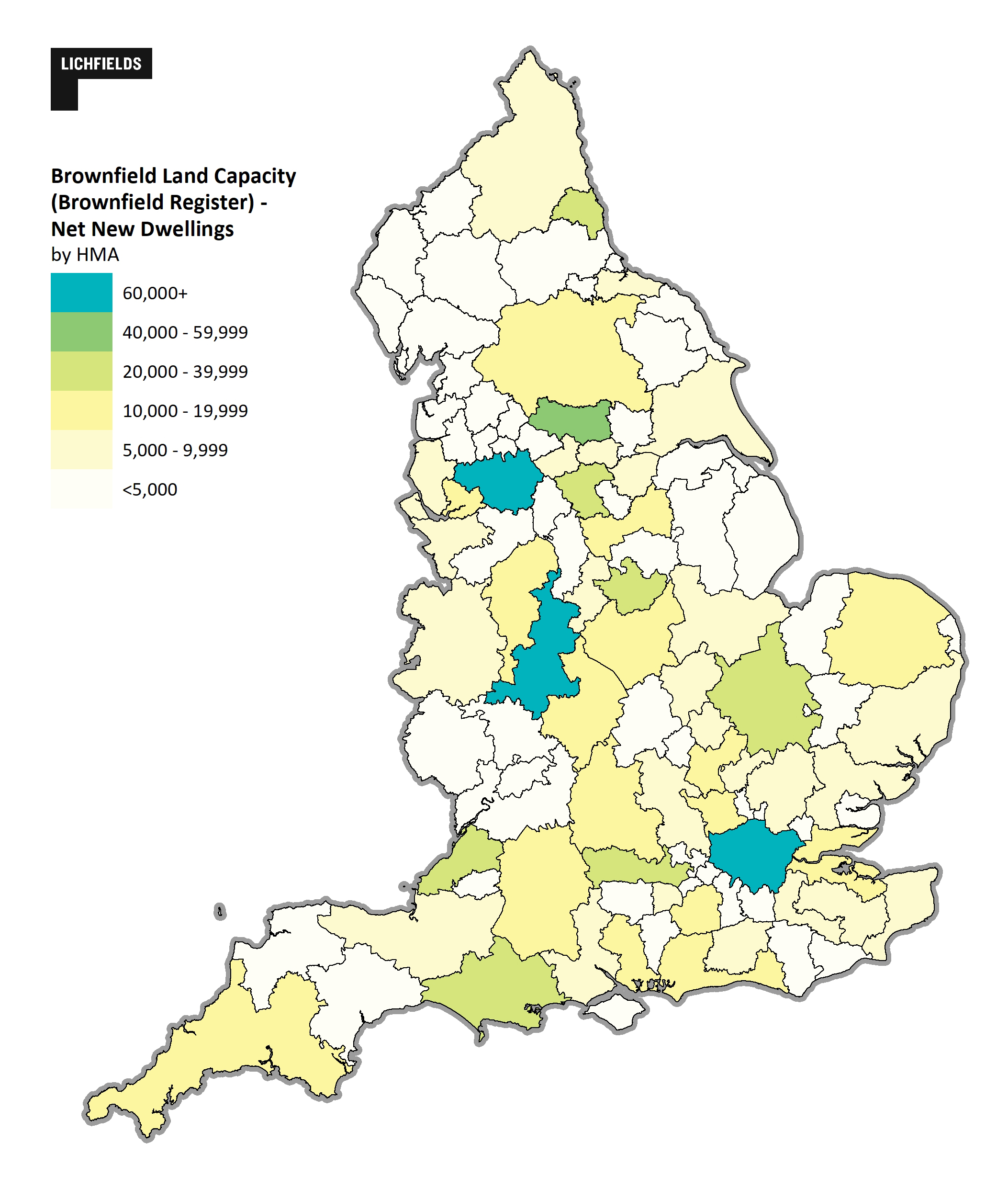

Figure 3 shows the geographical distribution of brownfield capacity by housing market area.

Figure 3 Brownfield land capacity for new homes by Housing Market Area

Source: Lichfields analysis of Brownfield Register, DLUHC (2021)

Figure 3 highlights the spatial distribution and availability of brownfield land as a share of housing need. It can be seen from this that brownfield sites across the North East (and the North generally) have the potential to make a substantial contribution relative to other parts of the Country. This is a function of both the region’s industrial heritage, as well as relatively lower absolute levels of housing need.

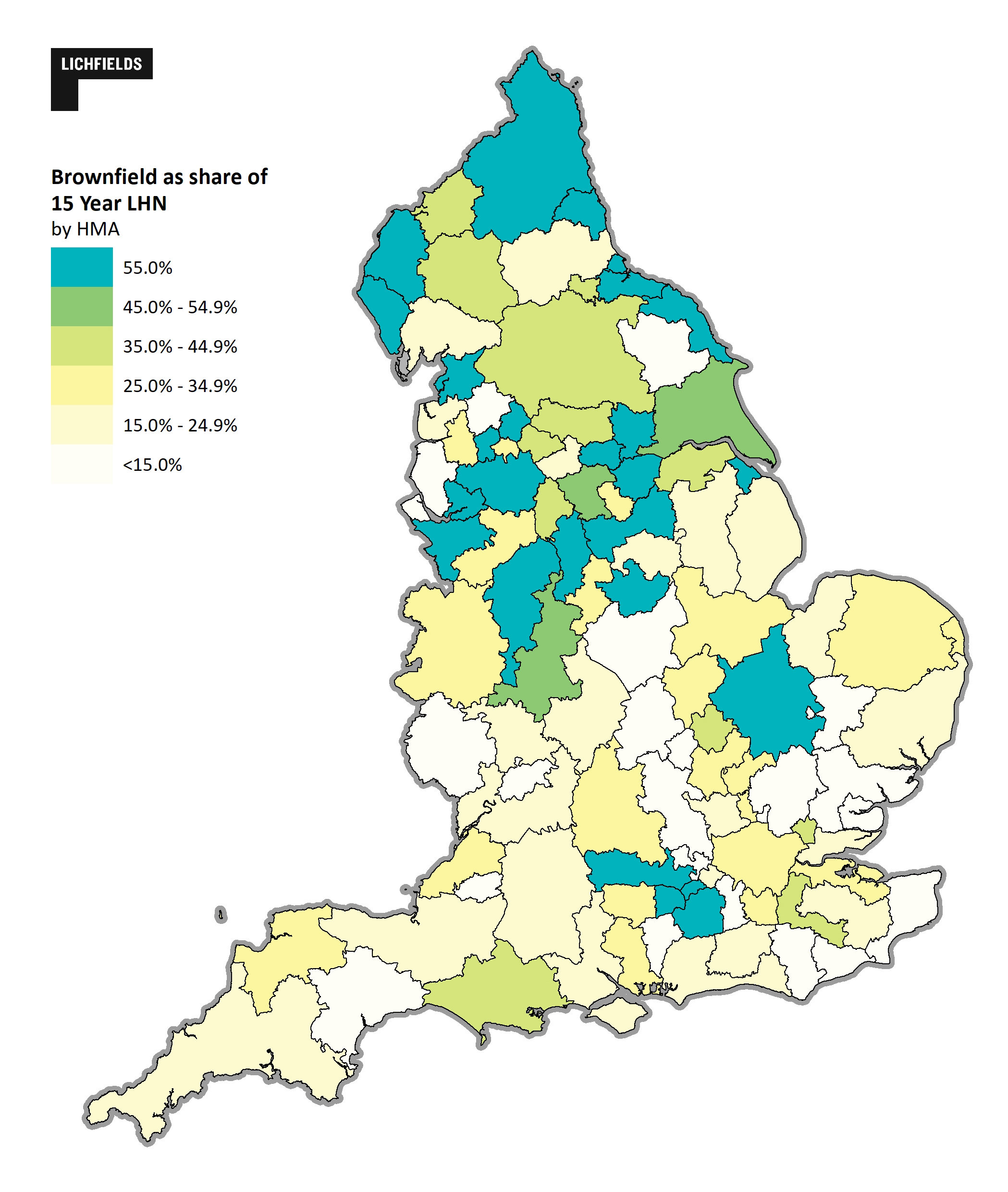

Figure 4 Brownfield land as a share of ‘levelled up’ need, summed to Housing Market Areas

Source: Lichfields analysis of DLUHC and Building Back Britain Commission

The North East Context

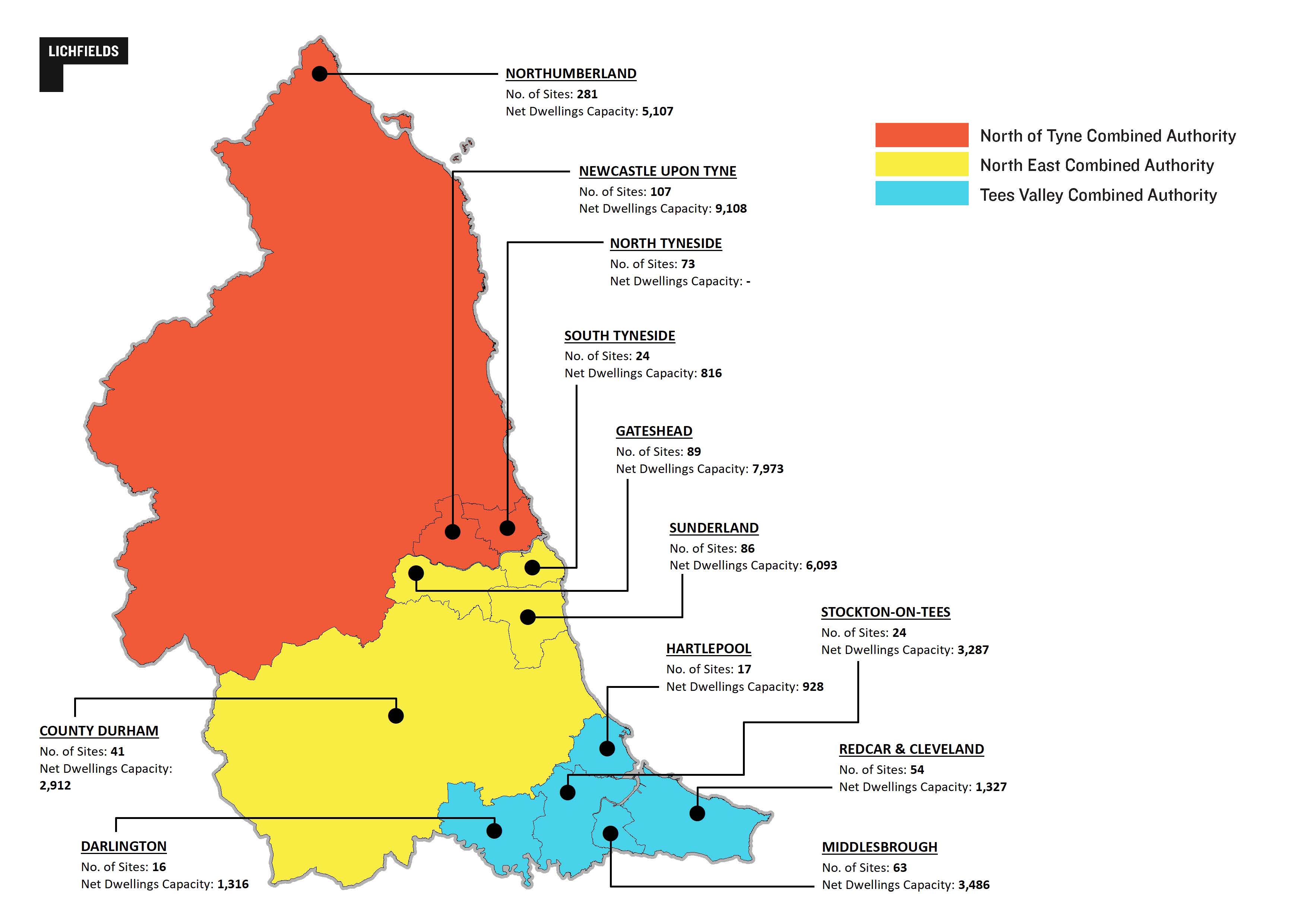

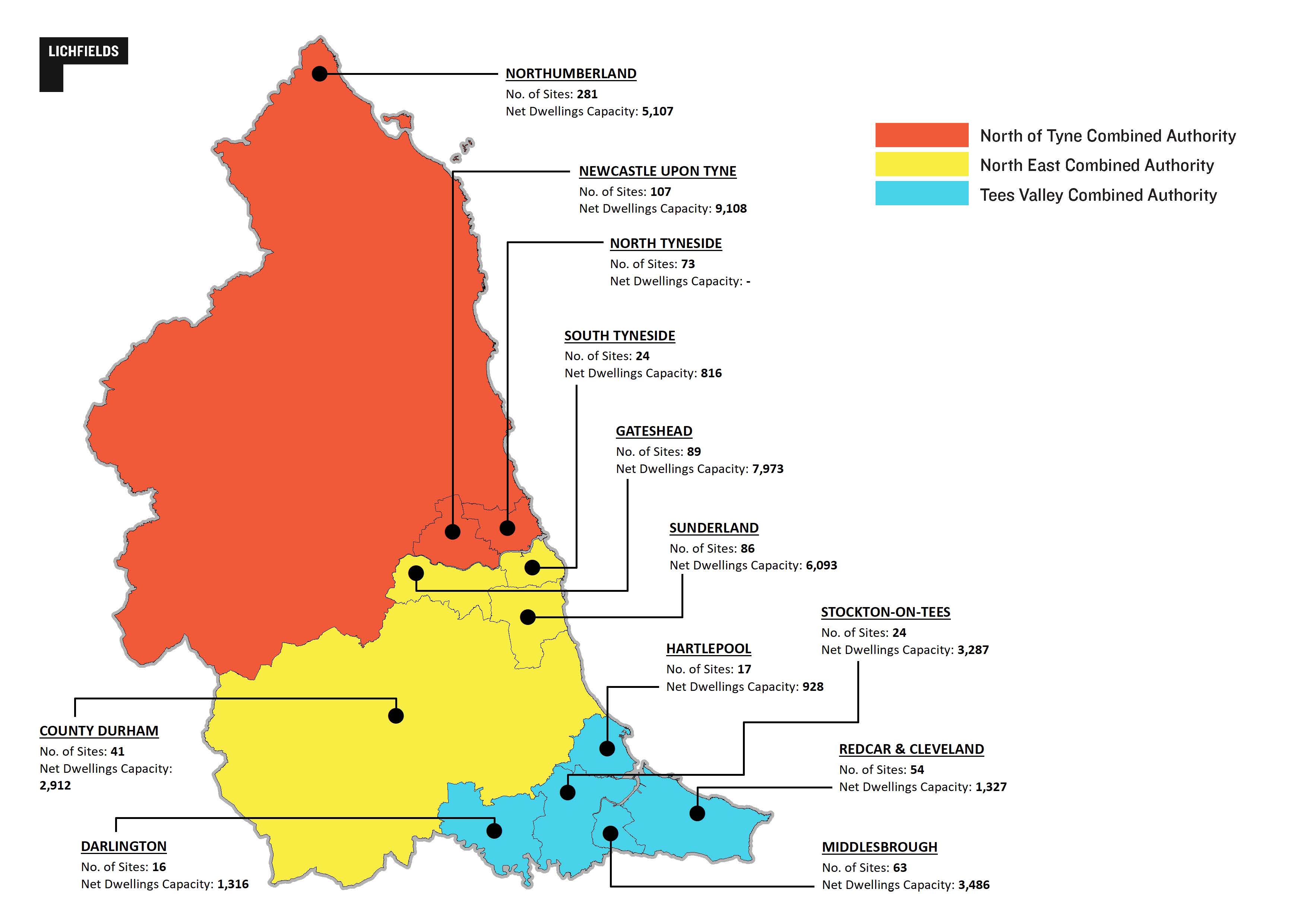

An analysis of updated Brownfield Land Registers across the North East region identifies a total of 875 brownfield sites, totalling 1,690 Ha of land and offering capacity to deliver up to 42,350 net dwellings. Broken down into the individual Combined Authority areas of the North East, this translates to:

Table 1 North East Combined Authority area - Brownfield sites, area and capacity

|

Combined Authority

|

No of

Sites

|

Total Area

(Ha)

|

Net Dwelling Capacity

|

|

Tees Valley Combined Authority

|

174

|

254.2

|

10,345

|

|

North East Combined Authority

|

240

|

526.3

|

17,795

|

|

North of Tyne Combined Authority

|

461

|

908.2

|

14,215

|

|

Total

|

875

|

1,688.6

|

42,355

|

Source: Lichfields analysis of individual Local Authority Brownfield Land Registers (2023)

NB: Tees Valley Combined Authority – Darlington, Hartlepool, Middlesbrough, Redcar & Cleveland, and Stockton

North East Combined Authority – County Durham, Gateshead, South Tyneside, and Sunderland

North of Tyne Combined Authority – Newcastle upon Tyne, North Tyneside, and Northumberland

Figure 5 Brownfield land capacity – North East region

Source: Lichfields analysis of individual Local Authority Brownfield Land Registers (2023)

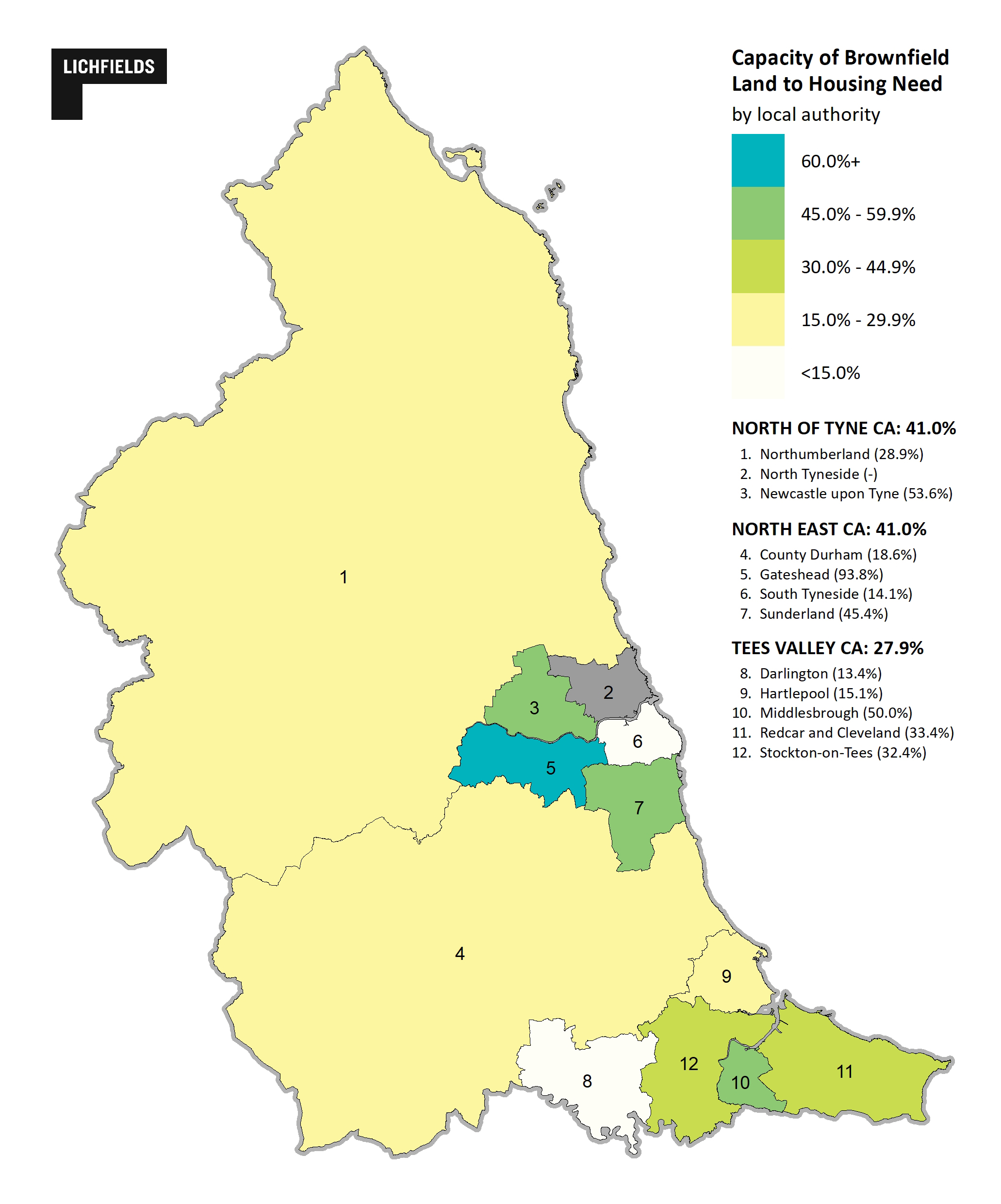

As part of this exercise, local housing needs as set out within Local Plan evidence were also assessed to identify the relative capacity of brownfield land across the North East to meet housing need. The assessment identified that across the North East a maximum net capacity within brownfield sites equivalent to c.37% of regional housing need exists. This exceeds the national capacity of 31%, demonstrating the scale of the opportunity that exists regionally.

Across the individual combined authority areas this breaks down to:

-

27.9% within the Tees Valley;

-

41.0% within the North East Combined Authority; and

-

41.0% within the North of Tyne Combined Authority;

Figure 6 Capacity of Brownfield Land to Housing Need

Source: Lichfields analysis of Brownfield Land Registers and Local Housing Need as set out within Local Plan evidence

Key Challenges – Viability

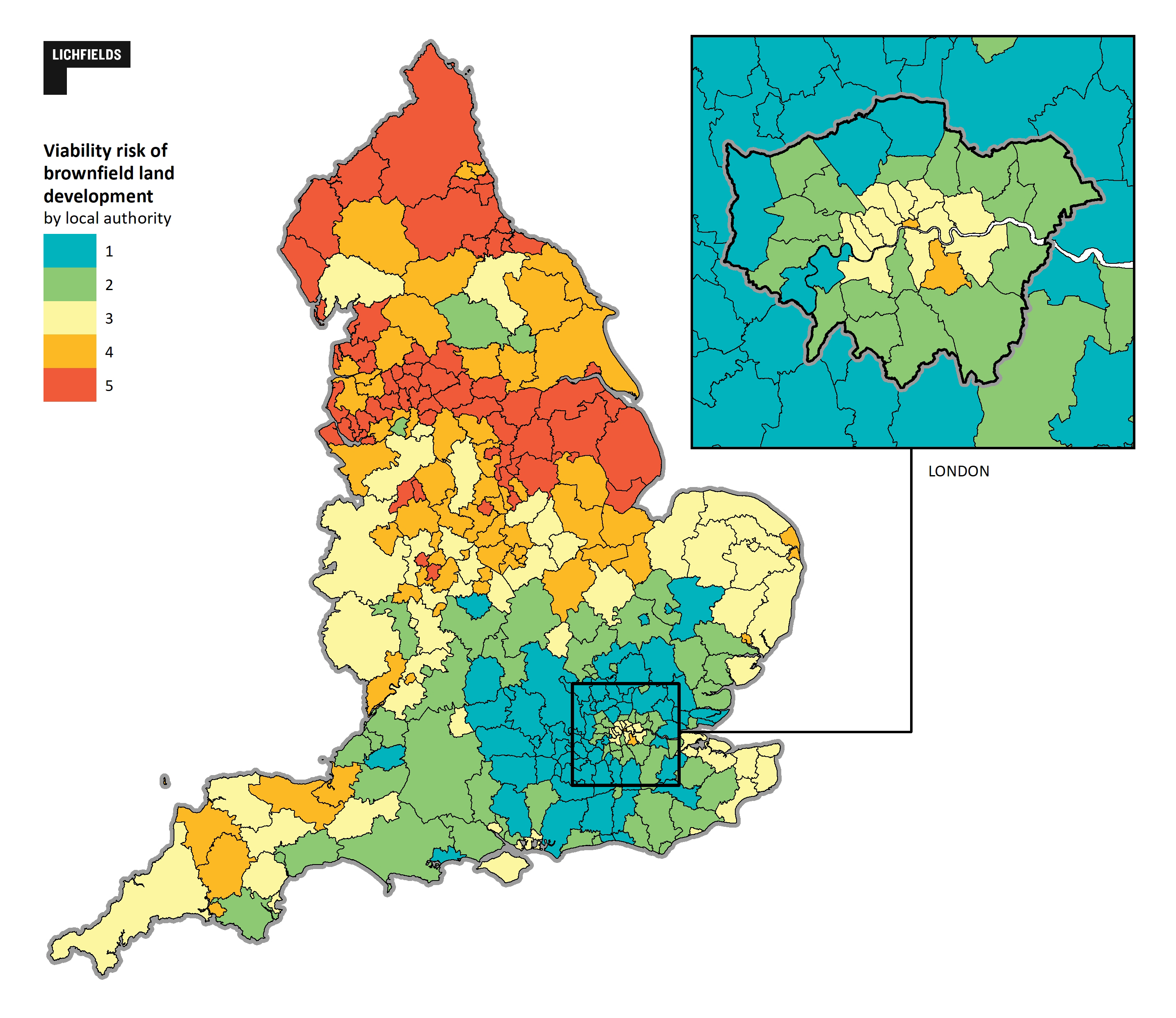

One of the key challenges associated with brownfield development is viability risk. This is due to the high abnormal costs often associated with remediation activity (including engineering and decontamination works) to ensure that sites are suitable for development.

Research as part of the Banking on Brownfield insight developed a viability risk index using ONS and BCIS data. This is summarised in the figure below. The North East falls within the highest risk quintile indicating the highest level of viability risk, as a function of:

This results in potentially smaller margins for developer return, particularly for schemes delivering affordable housing. This can present deliverability risks meaning that without intervention some sites are at risk of remaining unattractive, undeveloped, and derelict.

Figure 7 Viability risk of brownfield and development (5 most at risk)

Source: Lichfields analysis of ONS, BCIS data

The Funding Need

Considering the viability challenges outlined above, the figure below demonstrates the logic chain which underpins funding support for brownfield housing delivery.

Figure 8 Funding Framework

Source: Lichfields (2023)

The Funding Solutions – The National Landscape

In recent years the Government has launched a number of funding interventions to support brownfield housing delivery and regeneration. These total almost £2bn nationally.

-

Brownfield Land Release Fund (BLRF) – Originally launched in 2021, £68.6m of Round 1 (BLRF1) funding allocated to deliver over 7,000 homes. In July 2022, BLRF Round 2 was launched, committing a further £180m of funding to deliver a further 17,000 homes;

-

Brownfield Housing Fund (BHF) – £400m issued to individual Combined Authorities to support brownfield housing delivery; and

-

Brownfield, Infrastructure and Land Fund – August 2023, £1bn through Homes England to unlock housing-led development.

On the 12th December 2023, the final application stage for the Brownfield Land Release Fund Round 2 opened to all English councils. The deadline for applications is February 14th 2024.

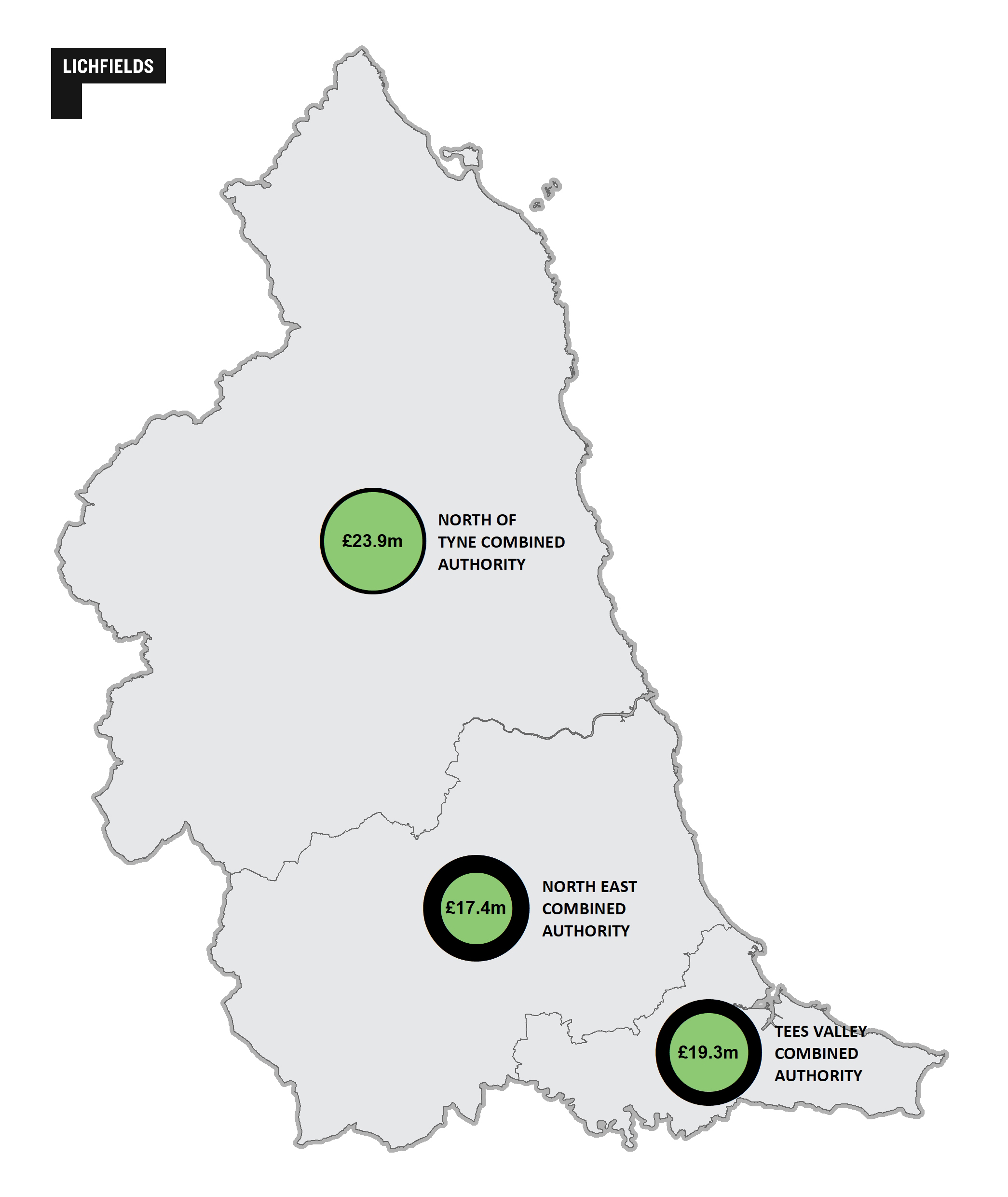

The Funding Solutions – The North East Case Study

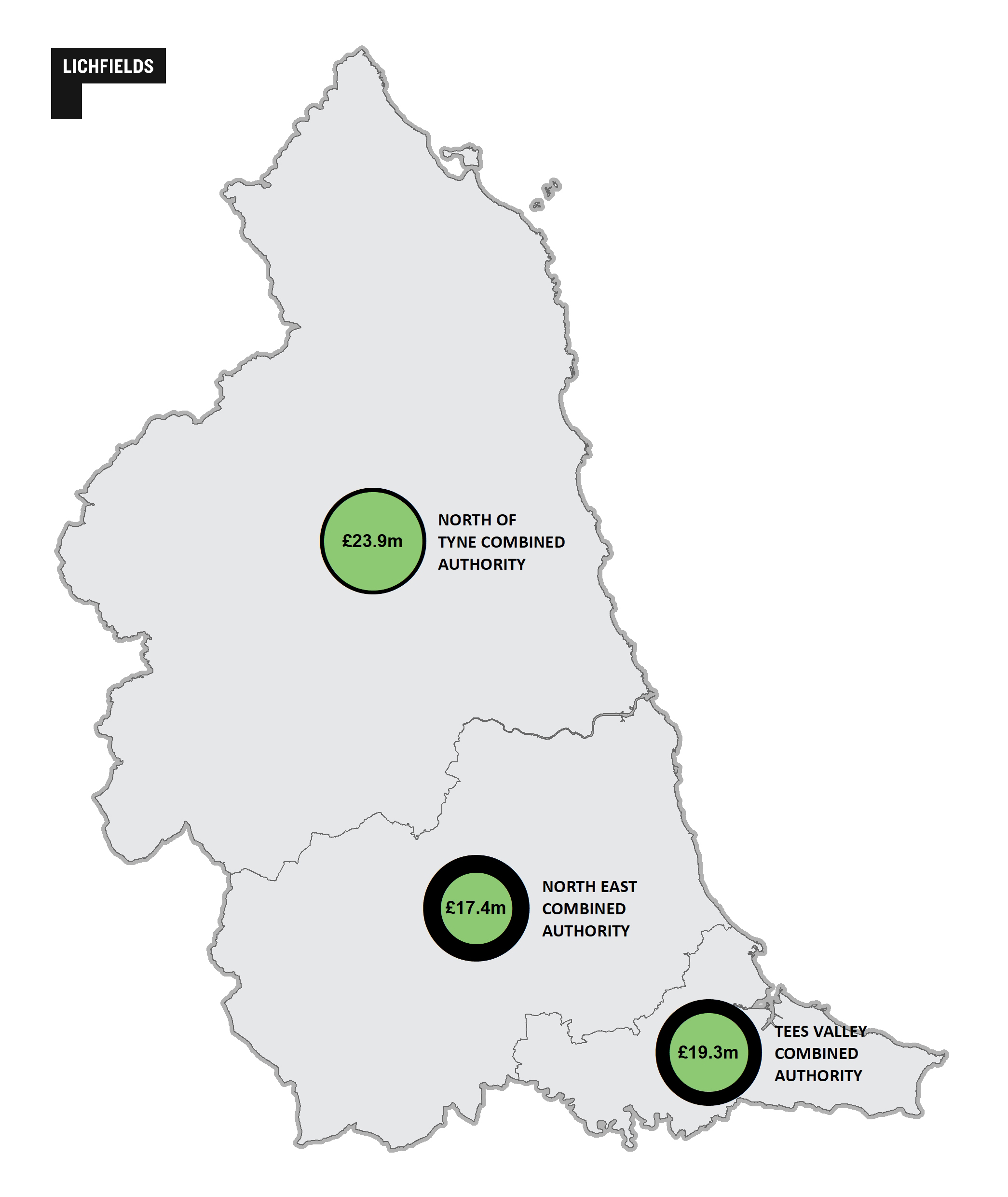

The North East has been successful in accessing £66.1m of funding to deliver brownfield housing. This includes, £5.6m of BRLF funding issued to four schemes and £60.5m of Brownfield Housing Fund, including:

-

£23.9m issued to the North of Tyne Combined Authority;

-

£19.3m issued to the Tees Valley Combined Authority; and

-

£17.4m issued to the North East Combined Authority through the recent devolution deal.

Figure 9 Brownfield housing funding allocations within the North East – Broken into Combined Authority area

Source: Lichfields analysis of BLRF and individual Combined Authority BHF allocations monitoring data (2023)

The Opportunities – The North East Case Study

Housing Delivery and Economic Contribution

An assessment of allocations data across the funds indicates that the committed funding is expected to support the delivery of 5,600 new homes including 650 affordable homes. This funding will:

-

Positively contribute towards achieving local housing delivery targets;

-

Bring forward schemes that may have otherwise remained undeveloped and derelict;

-

Support policy-compliant affordable housing ambitions, ensuring housing is accessible; and

-

Generate significant economic benefits (See below)

Figure 10 Economic Impacts associated with North East funding commitments and anticipated delivery

Source: Lichfields analysis

Wider Impacts

Schemes that Lichfields have been involved in developing business cases for have identified significant wider potential impacts:

-

Supporting wider regeneration ambition through public realm improvements, estate renewal, and delivering public amenity and community infrastructure;

-

Contributing towards the net zero agenda and environmental sustainability ambitions through developing houses which utilise energy reducing technologies such as Air Source Heat Pumps and Solar PV;

-

Support reduced instances of crime and anti-social behaviour;

-

Support improved public health outcomes through delivery of open space and infrastructure, promoting increased participation in physical activity; and

-

Provide wider benefits through positive impacts on the value of surrounding housing stock associated with placemaking and reducing the negative externality disbenefit associated with derelict sites.

Summary

There are clear benefits of brownfield housing development, both in terms of contributing towards achieving housing delivery targets but also economic and regeneration outcomes. A key barrier for delivery is presented by the viability risk associated with site remediation meaning that some schemes can stall and remain undeveloped. In response to this, the Government has committed significant funding to support with overcoming viability issues to prioritise the delivery of housing on brownfield land.

Lichfields has an excellent track record of developing business case and funding application submissions, helping clients to access gap funding to deliver much needed housing on brownfield sites. If you require any support in identifying and applying for potential funding opportunities, please get in touch with James on

james.robertson@lichfields.uk

About the author

James Robertson – James joined Lichfields in 2022 and has over six years’ experience as an economist. James offers applied experience in quantitative and qualitative research methods across a range of economic and social research services on behalf of private and public sector clients.

James’s experience covers business case development, economic impact assessment, evaluation of social policy interventions, delivering ex-ante appraisals and cost-benefit analysis, in line with HM Treasury Green Book Guidance.

James has led on the preparation of several full business cases for Brownfield Housing Fund applications, helping to unlock over £6.0 million of funding. James is currently advising a number of public and private clients in support of grant funding applications to Government grant funding opportunities to bring forward brownfield housing development.

[1] – One Public Estate: Brownfield Land Release Fund (BLRF2) Round 3 – December 2023, Local Government Association (2023)

[2] – National Planning Policy Framework (publishing.service.gov.uk), DLUHC (2023)

[3] – Brownfield Development Values - GOV.UK (www.gov.uk), Homes England (2023)

[4] – Housing supply: net additional dwellings, England: 2022 to 2023, DLUHC (2023)

[5] – Economic and fiscal outlook – November 2023, OBR (2023)

[6] – Tackling the under-supply of housing in England, House of Commons Library (2023)

[7] – Banking on Brownfield, Lichfields (2022)