When the new National Planning Policy Framework (NPPF) was published in July 2018, several notable topics dominated much of the discussion: design policies, viability, the housing delivery test, land assembly and the definition of affordable housing in particular.

But, buried within the new NPPF was one small change – an addition – which could potentially have a significant impact on the Government’s aim of delivering the right homes in the right places. But it has attracted little attention so far. This small change is the introduction of entry-level exception sites – as the name suggests, exception sites providing housing suitable for first-time buyers or renters.

In the draft version of new NPPF, entry-level exception sites were required to comprise a “

high proportion” of entry-level homes for discounted sale or affordable rent. In the final version, “

high proportion” has gone (now implying that the site must be wholly comprise of entry-level homes), and sites can now provide one or more of any of the types of affordable housing set out in the new NPPF. Sites could therefore provide, for example, 100% discounted market housing, 100% affordable rented housing, or a mix of these and/or other types (such as shared ownership, rent-to-buy or starter homes). They should be on unallocated land adjacent to existing settlements, and are subject to a few other criteria, e.g. not being more than 1ha. in size or exceeding 5% of the size of the existing settlement

[1]. It isn’t explicit in the NPPF how ‘

entry-level’ exception sites relate to the Green Belt, but the provision of [limited] affordable housing for local community needs (i.e. ‘

rural’ exception sites) remains an exception to inappropriate development in the Green Belt, and the new definition of ‘affordable housing’ encompasses affordable homes for purchase.

Despite the housing crisis, the great British dream of home ownership remains alive for many young people; 59% of privately renting households expect to buy at some point in the future, but of those who don’t, affordability is by far the main reason

[2]. Yet households increasingly find themselves in expensive rented accommodation, spending just over one-third of their income on rent, which is more than any other tenure, and the private rented sector has become the fastest growing in the last decade

[3]. Unsurprisingly, many first-time buyers increasingly look to family for help when buying a home.

In many areas, particularly the South East, there are significant shortfalls in the income households need in order to move out of the private rented sector and into home ownership. This is likely to be contributing to trends of growth in the private rented sector, given households simply cannot move into home ownership as easily as previous generations. It could also have implications for economic prosperity, given that having affordable housing within reach of employment represents a central facet of any efficiently functioning economy. So, providing affordable homes for purchase on entry-level exception sites (like discounted market housing) in areas where households otherwise could not access market housing could provide a much-needed to home ownership.

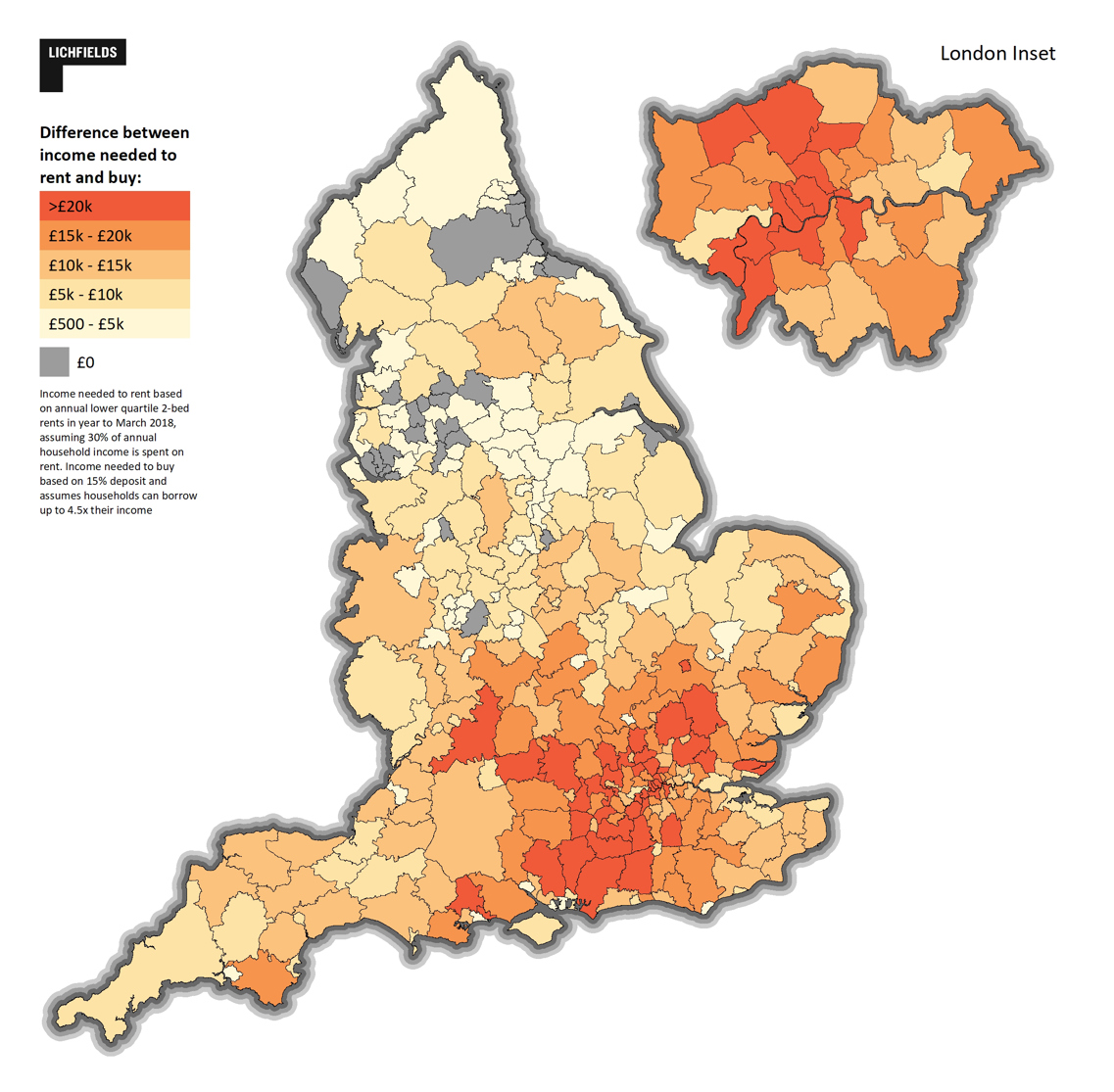

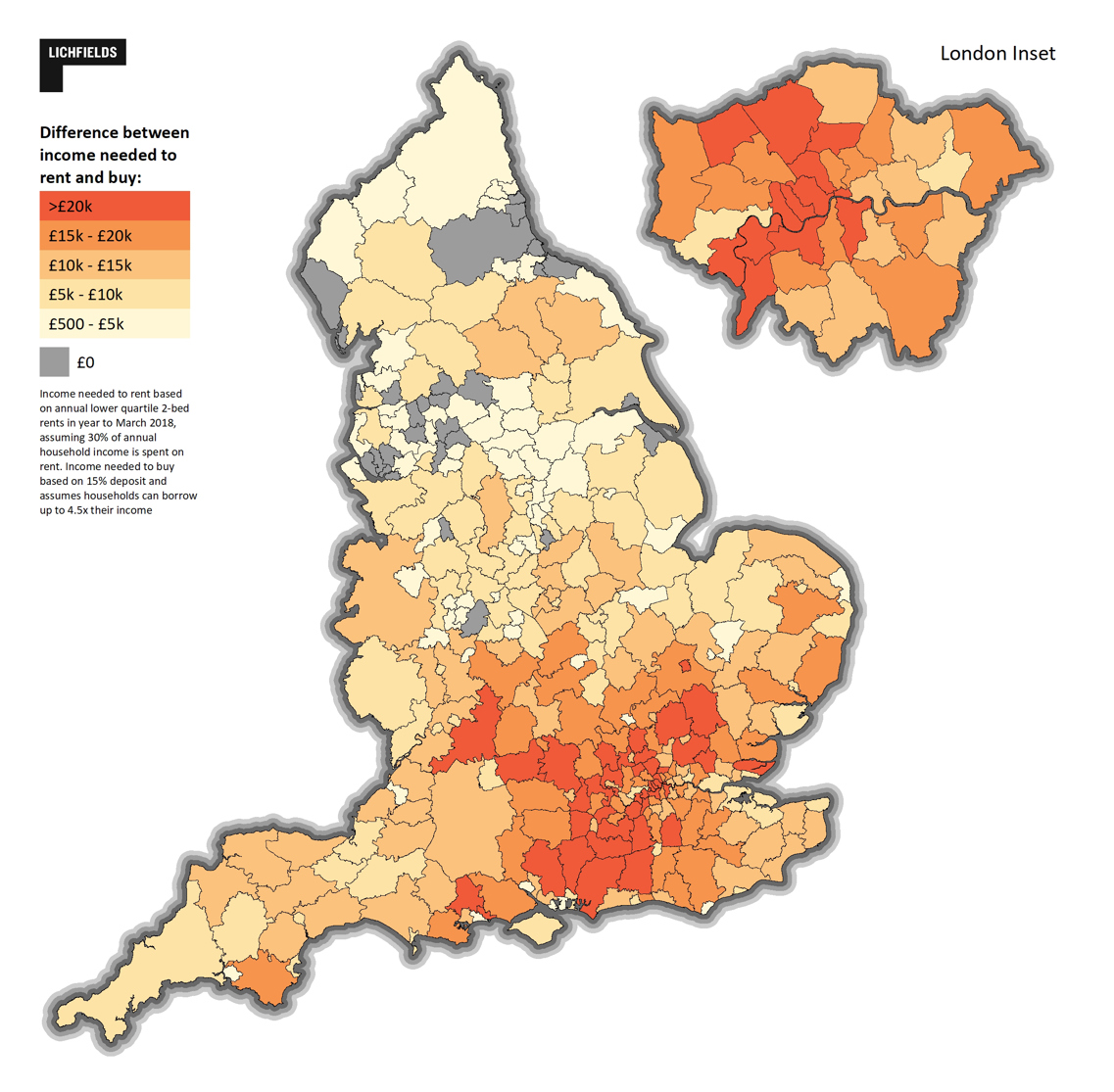

Figure 1 shows the gap in annual household income needed to rent and to buy by local authority in England. It is these households ‘stuck in the gap’ – i.e. those who can afford to rent in the market but can’t afford to buy – that affordable homes for purchase on entry-level exception sites are most likely to help.

Figure 1: Difference between annual household income needed to rent and buy in the market

Source: Lichfields based on ONS/VOA

In locations where the cost of housing is lower, households that can afford to rent an entry-level, 2-bed home in the market are likely to have enough income to buy entry-level housing (subject to having the necessary deposit, etc.). However, in many parts of the country, the cost of even entry-level housing in the market is so high it is out of reach for many living in the private rented sector. Unless these households can raise a substantial deposit (all the more difficult, given the amount of income spent on rent) and/or raise funds from family, the ability to move into home ownership in these areas is limited.

Table 1 shows the top three areas by region with the largest gap in annual household income needed to rent and to buy in the market. As expected, the greatest gaps are in London, but large gaps also exist across the wider South East, particularly in Metropolitan Green Belt areas. Many such areas could benefit from entry-level exception sites providing affordable homes for purchase, particularly where those areas rely on attracting and maintaining a workforce to support a strong economy.

Housing affordability issues are not limited to London and the South East however, with parts of the Midlands (particularly in Northamptonshire and Warwickshire) seeing gaps of up to £17,000 between income needed to buy, and rent. In the northern regions, the greatest gaps are found in rural areas, which may wish to attract and retain young people and families so as to maintain services.

Table 1: Top 3 LPAs by Region - Gap in annual income needed to buy and rent

Source: Lichfields based on ONS/VOA

If entry-level exception sites do take-off, they have the potential not only to directly assist those looking to buy their first home, but could help with a wider re-balancing of local housing markets. A move of households from the private rented sector into new affordable homes for purchase could moderate growth in the cost of renting, potentially increasing the supply homes for sale in the market and reducing relative price growth.

It’s clear that entry-level exception sites have the potential to provide a discrete but important contribution to achieving the Government’s ambition of planning for the right homes in the right places but the case will not make itself. Lichfields has developed a new framework to help clients and local authorities assess the need and demand for affordable first-time buyer housing and understand what type of housing (e.g. discount market, shared ownership, etc.) could best meet those needs. Our framework can be used to identify opportunities for entry-level exception sites, as well as provide evidence to support applications and appeals. It can also inform local plan policies.

If you would like to speak to someone at Lichfields about entry-level exception sites, including site-finding, development appraisal and evidence preparation, please contact

Martin Taylor or

Bethan Haynes.

[1] As set out in paragraph 71(b) of the new NPPF[2] Source: English Housing Survey 2015/16: Future home owners report[3] Source: English Housing Survey 2016/17