In November 2024, Lichfields published its

Insight into planning applications for co-living schemes in London. The Insight highlighted the opportunities and challenges of this nascent sector in the context of a rapidly growing demand for alternative forms of living in the capital.

Since then, many of the trends identified in our Insight have intensified. Conventional housing delivery in London has continued to slow, with starts at five percent of housing targets for the first nine months of 2025. Meanwhile, as this update sets out, the co-living sector has continued to mature. Twenty-six major co-living applications have been submitted in 2025, totalling over 10,000 co-living homes. Schemes vary in size from c.100 to over 800 units. Reflecting the growing demand for shared living, large developments such as Earls Court and Barking Riverside now include co-living elements in their masterplans, while more Boroughs have developed co-living policies in their emerging Local Plans. The characteristics of these new schemes also reflects a more mature sector with similar characteristics and features becoming more apparent.

Given the fast-evolving nature of London’s co-living sector, this blog provides an update on November 2024’s Insight. It summarises all of the major applications which have been submitted since then, sets out what the average co-living application looks like and how this has changed over the past year.

Since the Insight was published, the GLA has released the ‘Towards a New London Plan’ consultation and we saw the emergency measures to ramp up housebuilding in London published last October. This blog does not cover policy matters in detail, but these new strategic documents form part of the context for the latest generation of co-living schemes.

Definition

For the purposes of this blog, co-living or purpose-built shared living (PBSL) refers to “sui generis non-self-contained market housing”, as per the

London Plan. Co-living units, which contribute towards housing supply at a ratio of 1.8:1, are supplemented with shared spaces for residents such as kitchens and living rooms, to encourage communal living among their residents. A more comprehensive definition is provided in the 2024 Insight.

Number of Applications

This update covers co-living schemes of over 30 units in London with a planning application submitted between 1st July 2024 and 9th January 2026

[1].

Prior to July 2024, 36 planning applications for co-living schemes had been submitted (since 2019). Since July 2024, a further 26 schemes have been submitted. Consequently, more than 40% of the total number of co-living applications in London since 2018 have been submitted in the last 18 months.

Of these 26 more recent schemes, twelve have been approved, while another twelve are awaiting determination and one was refused. Five schemes covered in the last Insight have now received a determination; all of these were approved.

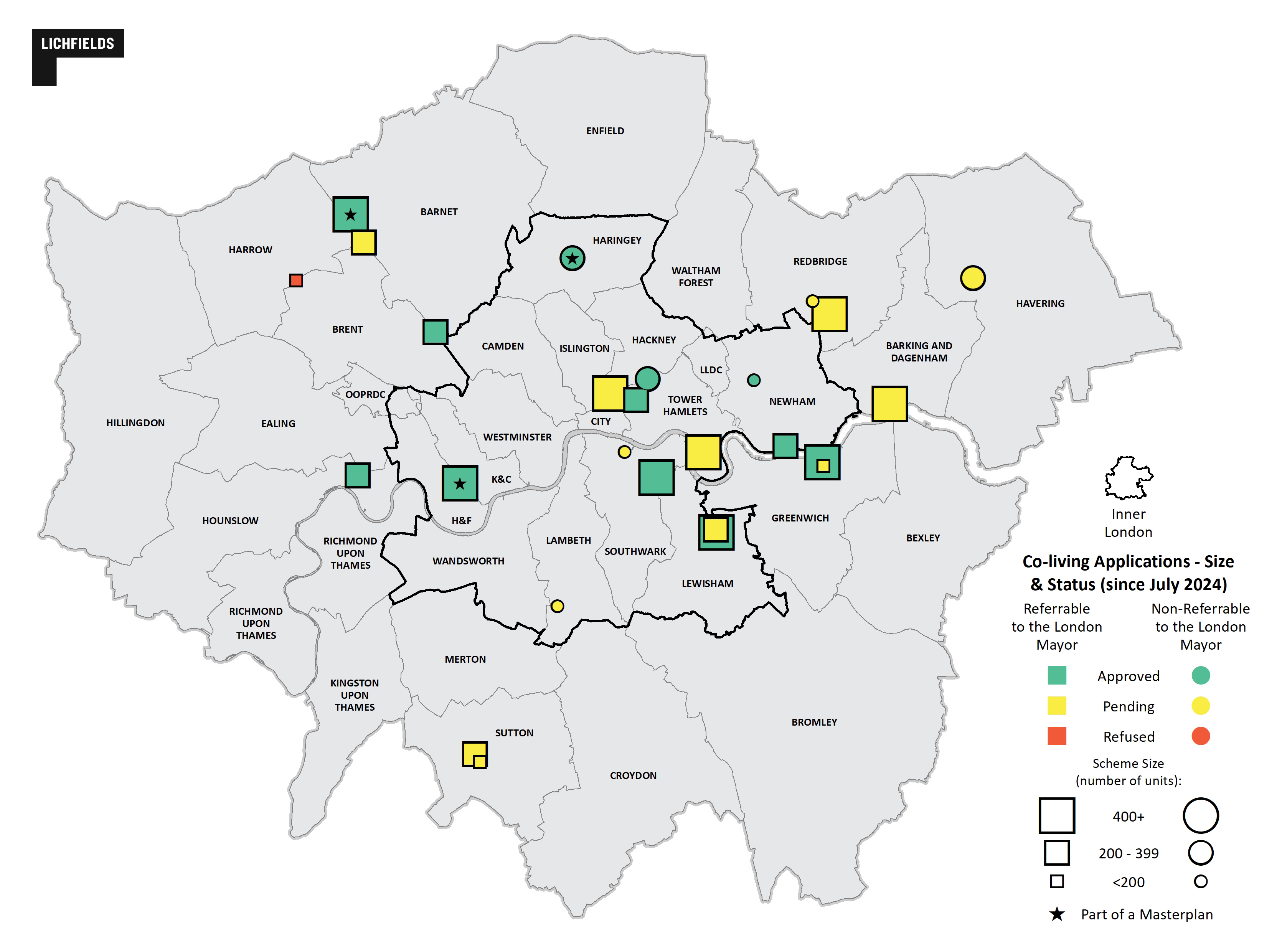

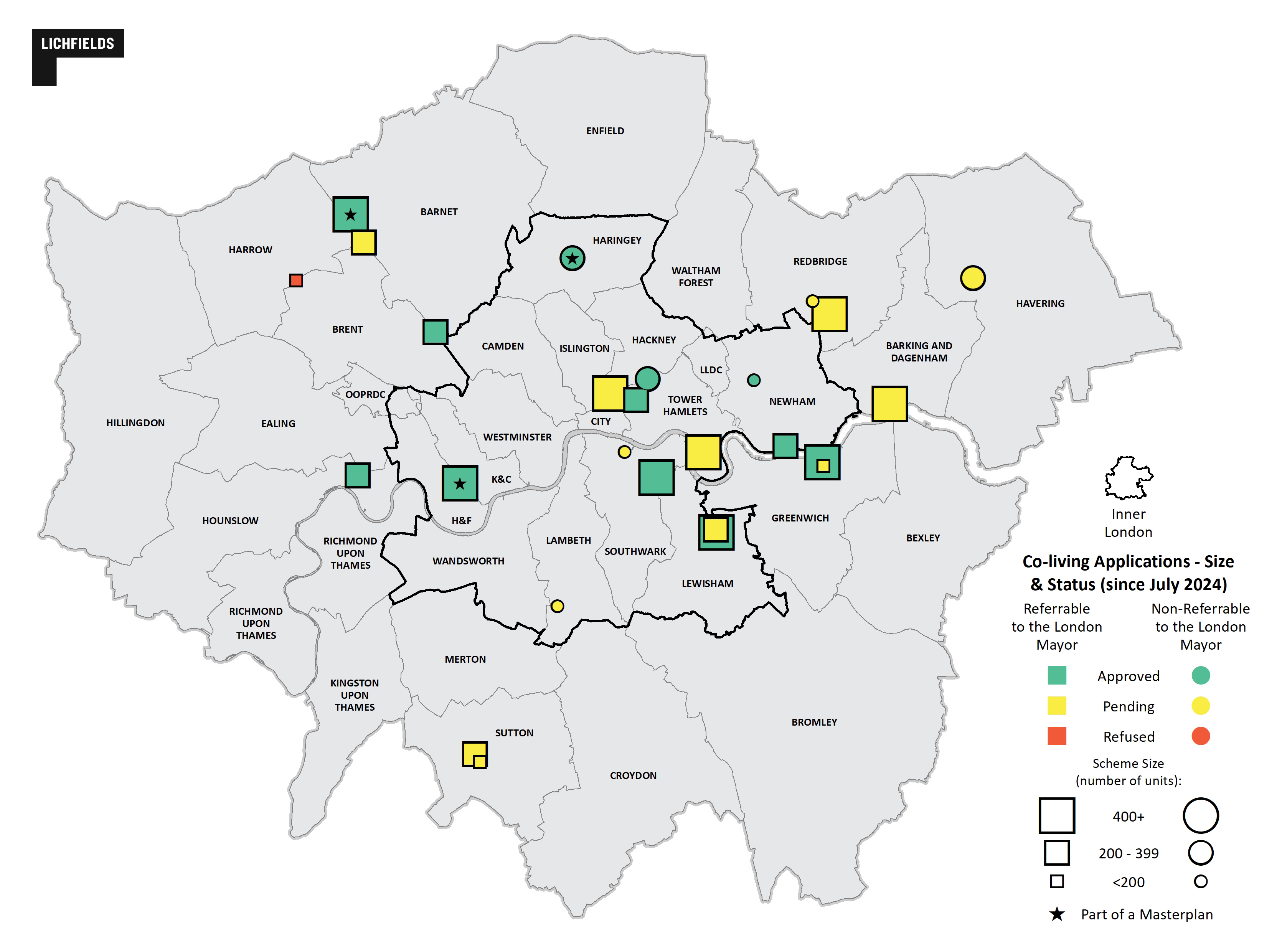

Geographical Spread

As in previous years, the recent co-living applications are spread across the capital but there has been an increase in the number of boroughs which have seen co-living applications. Over 75% of London’s local authorities have now seen a co-living application, up from 50% in June 2024. Among the applications since July 2024, 55% have been in inner London boroughs, slightly higher than the overall 50–50 inner-outer borough split previously identified.

| |

Borough

|

|

Applications

pre-July 2024

|

|

Applications

post-July 2024

|

|

Total Number of Applications

|

|

| |

Southwark |

|

4 |

|

2 |

|

6 |

|

| |

Brent |

|

4 |

|

1 |

|

5 |

|

| |

Ealing |

|

5 |

|

0 |

|

5 |

|

| |

Tower Hamlets |

|

2 |

|

3 |

|

5 |

|

| |

Hackney |

|

3 |

|

1 |

|

4 |

|

| |

Wandsworth |

|

4 |

|

0 |

|

4 |

|

| |

Greenwich |

|

1 |

|

2 |

|

3 |

|

| |

Harrow |

|

2 |

|

1 |

|

3 |

|

| |

Hounslow |

|

2 |

|

1 |

|

3 |

|

| |

Barnet |

|

0 |

|

2 |

|

2 |

|

| |

Croydon |

|

2 |

|

0 |

|

2 |

|

| |

Hammersmith and Fulham |

|

1 |

|

0 |

|

1 |

|

| |

Kingston upon Thames |

|

2 |

|

0 |

|

2 |

|

| |

Lambeth |

|

1 |

|

1 |

|

2 |

|

| |

Lewisham |

|

0 |

|

2 |

|

2 |

|

| |

Newham |

|

0 |

|

2 |

|

2 |

|

| |

Redbridge |

|

0 |

|

2 |

|

2 |

|

| |

Sutton |

|

0 |

|

2 |

|

2 |

|

| |

Barking and Dagenham |

|

0 |

|

1 |

|

1 |

|

| |

City of London |

|

1 |

|

0 |

|

1 |

|

| |

Enfield |

|

1 |

|

0 |

|

1 |

|

| |

Haringey |

|

0 |

|

1 |

|

1 |

|

| |

Kensington and Chelsea |

|

0 |

|

1 |

|

1 |

|

| |

Havering |

|

0 |

|

1 |

|

1 |

|

| |

Waltham Forest |

|

1 |

|

0 |

|

1 |

|

| |

Total |

|

36 |

|

26 |

|

62 |

|

The table above shows the number of co-living applications submitted in each London borough. Fifty percent of all co-living schemes can be found in just nine boroughs.

Scheme Size

Since the 2024 insight, the size of the average co-living scheme in the capital has risen slightly, from 295 to 385 units. This reflects the fact that of a number of very large schemes have been submitted since the 2024 Insight. There remains a wide range of scheme sizes, from under 100 units up to the largest at 865 units.

A notable difference from the 2024 analysis is that co-living units have begun to be included in masterplans for large regeneration schemes. Outline planning applications for the Barking Riverside, Edgeware Town Centre, and Earls Court masterplans all now include a co-living component. The Barking Riverside and Edgware schemes both include up to 500 co-living units whereas the Earls Court masterplan contains 1,000 units.

As expressed in the 2024 Insight, Lichfields’ view is that co-living can make a meaningful contribution towards mixed and balanced communities. The inclusion of co-living within these major London schemes supports this principle. It also speaks to growing developer confidence in the co-living sector, that demand exists for this portion of the market alongside conventional residential units for rental and sale.

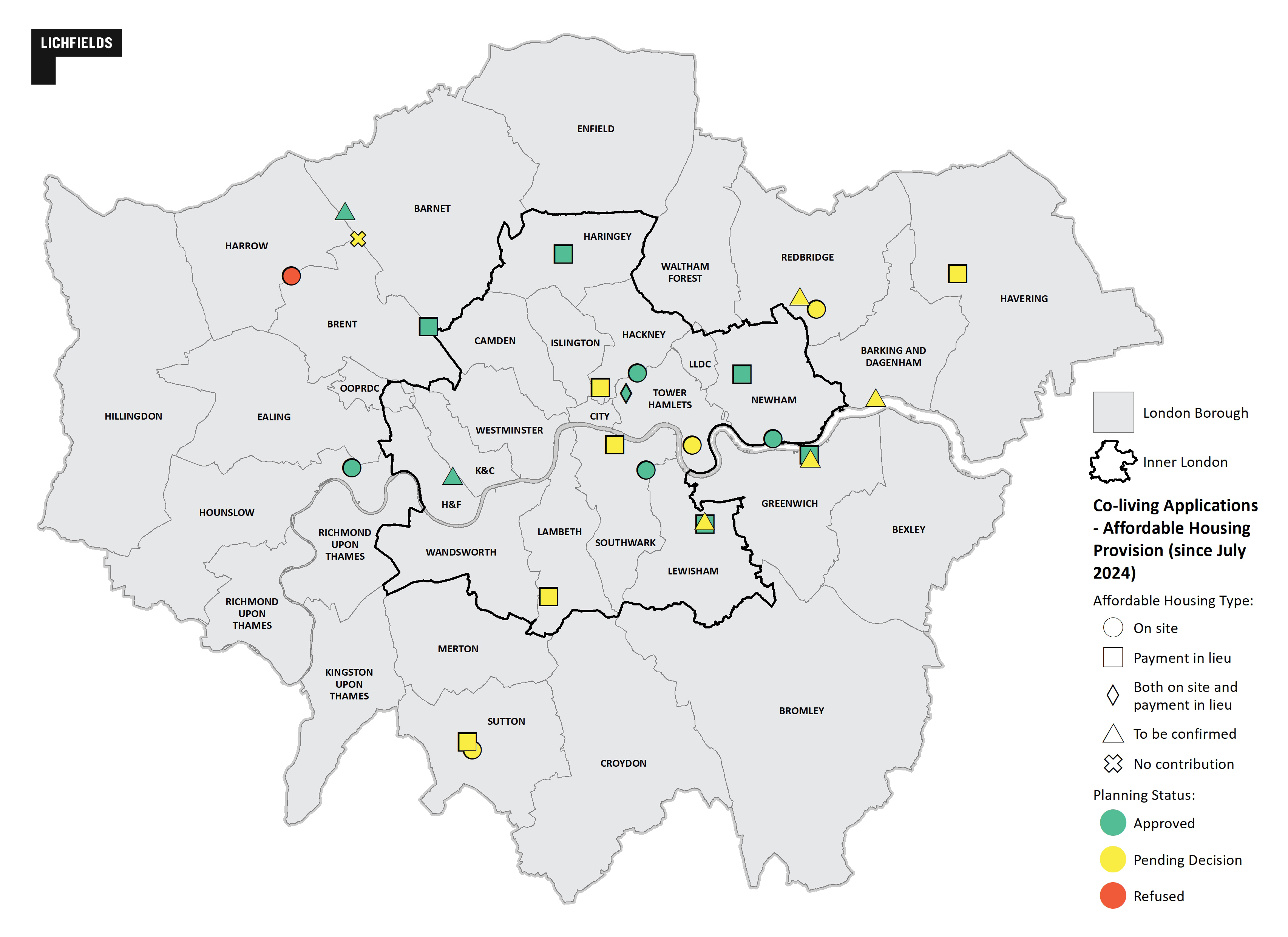

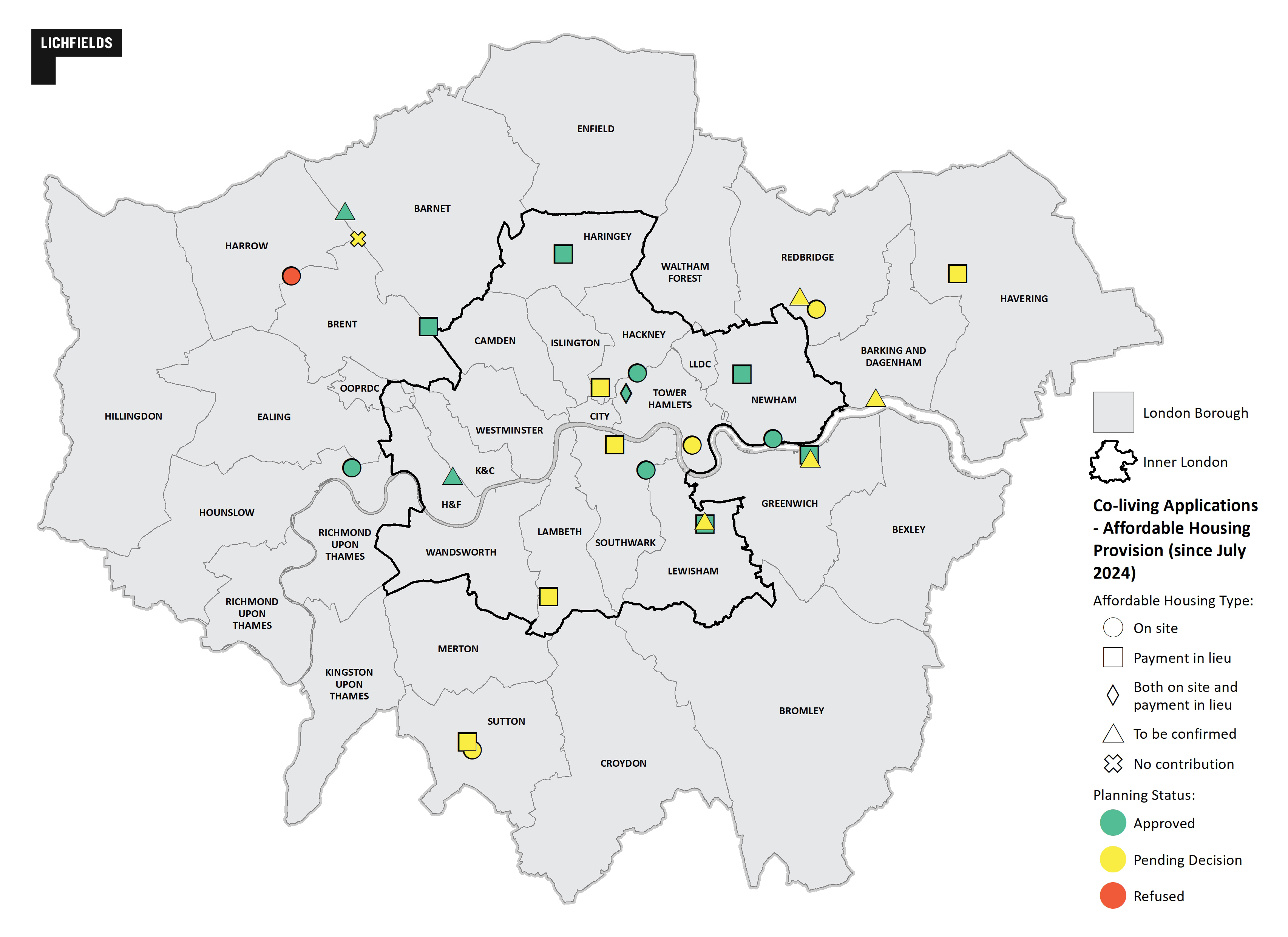

Affordable Housing

Affordable housing delivery and the associated impact on project viability continues to be one of the principal challenges faced by new residential schemes in London. Co-living is no different. London Plan Policy H16 requires developments to make a payment in lieu contribution towards the provision of off-site affordable housing. However, we are seeing an increase in Local Plan policies which require the on-site provision of conventional affordable housing.

Of the twenty applications submitted since July 2024 with a committed approach to affordable housing provision, nine propose on-site affordable housing, typically through delivery of conventional C3 affordable homes. Forty percent of the recent applications deliver a cash in lieu payment, while one scheme includes both on-site provision and a payment in lieu. All three pathways deliver similar levels of affordable housing, equivalent to 33–37% of habitable rooms. One of the recent applications does not propose a contribution towards affordable housing because of viability constraints.

Neither the Government’s emergency measures or Towards a New London Plan seek to vary the established strategic policy approach to affordable housing within co-living schemes. Indeed co-living was explicitly excluded from the emergency measures. However, Towards a New London Plan does seek consultation responses on the approach to affordable housing both for conventional housing development and co-living. We therefore expect the policy position to change in the coming years.

Unit Sizes

The recent applications for co-living include an increase in the average unit size, which has slightly increased to 21sqm. Reflecting the

PBSL London Plan Guidance (LPG) from February 2024, the smallest unit size was 18sqm, up from 16sqm in the 2024 Insight. Several schemes are also now offering a range of unit sizes, from 18sqm to the policy maximum of 27sqm, to cater for different segments of the co-living market within an individual development.

Almost all schemes now include 10% accessible units, as per the LPG, at an average size of 30sqm.

Amenity Space

In the last year, the average internal communal space within London’s co-living schemes has been reduced slightly to 3.5sqm per unit, compared to 5.5sqm per unit in 2024’s Insight. This change likely reflects the impact of the adopted LPG, which replaced the previous requirements for 5sqm per unit and introduced a tiered approach to internal amenity space, stepping down from 4sqm per unit for the first 100 residents to 3sqm then 2sqm per unit in the largest schemes.

The LPG also encouraged flexibility in the application of these benchmarks, prioritising “qualitatively good design outcomes” over a blanket approach to amenity space, a measure which was widely welcomed by the industry. Some of the applications submitted since 2024 have directly addressed the new flexibility in the guidance, delivering under 4sqm of amenity space but in the form of large, easily accessible spaces with good outdoor access and public realm benefits.

As the sector matures and planning authorities become more experienced dealing with co-living schemes, we are seeing a shift in focus from mechanistic application of quantitative policy standards towards qualitative considerations in terms of amenity space and other facets of co-living development. This pragmatism and emphasis on quality is to be welcomed.

Cycle and Car Parking

Among the recent schemes delivering only co-living units, cycle parking provision ranges considerably from 0.3 to 1 spaces per unit, with an average of 0.75 spaces per unit. All schemes delivering only co-living units are car free except for accessible car parking spaces.

Summary

The graphic below shows provides a summary of the co-living applications submitted since July 2024.

Conclusion

2024's Insight identified that “the appetite for co-living amongst prospective tenants, developers and investors is growing”. A year on, and the data demonstrates that this appetite has continued to strengthen in London in the context of a very challenging residential market.

The number of co-living applications has significantly increased and the characteristics of these proposals reflect a more mature sector backed by clearer policy and guidance. Lichfields’ experience is that more London authorities have a better understanding of the sector and are engaging constructively with applicants on prospective co-living schemes.

Co-living remains a relatively small proportion of the overall London housing market, and this blog has not covered the number of these applications that have actually been delivered. It will be interesting to see how the sector continues to develop as the broader residential market improves. What is clear, however, is that co-living has established itself as an important component of London’s housing market, one that will continue to evolve and expand in the coming years.

Footnote

[1] Excluding EIA scoping applications. The previous Insight covered schemes up to July 2024.

Image credit: Folk at Sunday Mills, Halcyon Development Partners